Collin Texas Release of Lien for Property is a legal document that declares the release of a lien placed on a property located within Collin County, Texas. This document serves as proof that a lien holder, typically a lender or creditor, has received full payment for their services or loan, and therefore releases any claim they may have had on the property. A Release of Lien for Property in Collin Texas is an essential document for property owners, as it provides them with tangible evidence that they are no longer encumbered by any financial obligations towards the lien holder. This release is crucial when selling or refinancing the property, as it demonstrates to potential buyers or lenders that the property is free and clear of any liens. There are various types of Collin Texas Release of Lien for Property depending on the circumstances: 1. Collin Texas Mechanics' Lien Release: This release is used when the lien holder has placed a mechanics' lien on the property due to unpaid services or materials provided for construction or repairs. Once the debt is settled, the lien holder must sign a release of lien to remove the encumbrance from the property title. 2. Collin Texas Judgment Lien Release: This release is applicable when a court has issued a judgment lien against the property for unpaid debts or legal obligations. Once the judgment is satisfied, the creditor must file a release of lien to lift the encumbrance. 3. Collin Texas Property Tax Lien Release: Property tax liens can be placed on a property by the tax authorities if the owner fails to pay their property taxes. Once the tax debt is resolved and paid in full, the tax collector's office will issue a release of lien, releasing the property from the tax lien. 4. Collin Texas Mortgage Lien Release: Mortgage lenders hold a lien on a property until the mortgage is fully repaid. When the mortgage is paid off, the lender will prepare a release of lien, officially releasing their claim on the property. 5. Collin Texas Judgment of Foreclosure Lien Release: In cases of foreclosure, where the property is repossessed by the lender due to non-payment, a judgment of foreclosure lien may be placed on the property. Once the foreclosure process is complete, and any outstanding debts are settled, the lender will provide a release of lien to clear the property title. In conclusion, a Collin Texas Release of Lien for Property is an important document that releases any claims or encumbrances on a property. Whether it's a mechanics' lien, judgment lien, property tax lien, mortgage lien, or judgment of foreclosure lien, obtaining a proper release of lien is crucial for property owners to ensure a clean title and facilitate real estate transactions.

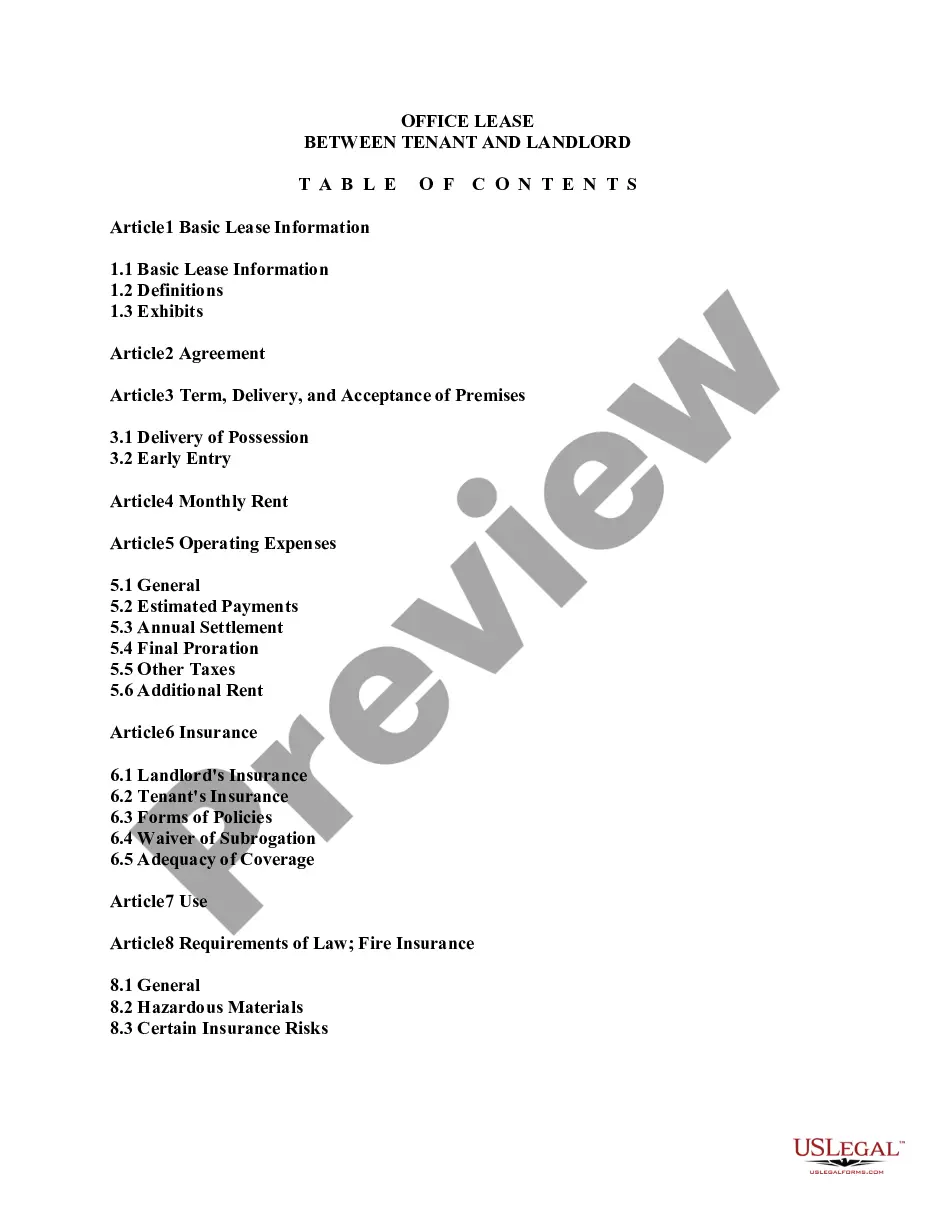

Collin Texas Release of Lien for Property

Description

How to fill out Collin Texas Release Of Lien For Property?

Preparing documents for the business or personal demands is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state regulations of the particular area. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it burdensome and time-consuming to create Collin Release of Lien for Property without expert assistance.

It's possible to avoid spending money on lawyers drafting your paperwork and create a legally valid Collin Release of Lien for Property by yourself, using the US Legal Forms web library. It is the largest online catalog of state-specific legal templates that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the necessary form.

In case you still don't have a subscription, adhere to the step-by-step guideline below to get the Collin Release of Lien for Property:

- Examine the page you've opened and verify if it has the document you need.

- To accomplish this, use the form description and preview if these options are available.

- To locate the one that satisfies your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal forms for any use case with just a couple of clicks!