King Washington Release of Lien for Property is a legal document used to officially remove a lien from a property in the state of Washington, USA. When a property owner has outstanding debts or obligations, a lien can be placed on the property, which acts as a legal claim by a creditor to seize the property if the debts remain unpaid. The Release of Lien for Property is filed once the debts have been settled, allowing the property owner to regain full ownership rights. The King Washington Release of Lien for Property is a crucial document that protects both the property owner and potential buyers. Without a released lien, any future property transactions may be hindered, as the lien holder can claim the property's value to settle the outstanding debts. Therefore, the Release of Lien ensures a clean title, giving the property owner the ability to freely sell, refinance, or pass on the property without any legal hindrance. Different types of King Washington Release of Lien for Property may include: 1. Mortgagor's Release of Lien: This type of release is typically used when a property owner has satisfied the mortgage loan on their property. Once the final payment has been made, the lender issues a Mortgage Release of Lien, acknowledging that the property is no longer held as collateral. 2. Contractor's Release of Lien: This release is utilized when a property owner hires a contractor or subcontractor for repairs, renovations, or construction work on their property. Once the contractor has been paid in full for their services, they release their lien, providing proof that all financial obligations have been met. 3. Mechanic's Release of Lien: This type of release is specific to construction projects. It is used when a contractor, subcontractor, or supplier has filed a lien against a property due to non-payment for labor or materials used in the project. Once payment has been received, the lien is released, ensuring that the property owner is no longer encumbered by financial liabilities. In conclusion, the King Washington Release of Lien for Property is a vital legal document that ensures the removal of a lien, enabling property owners to freely manage their property and engage in future transactions. Whether it is a Mortgagor's, Contractor's, or Mechanic's Release of Lien, each type serves a unique purpose in safeguarding the rights and interests of property owners in Washington state.

King Washington Release of Lien for Property

Description

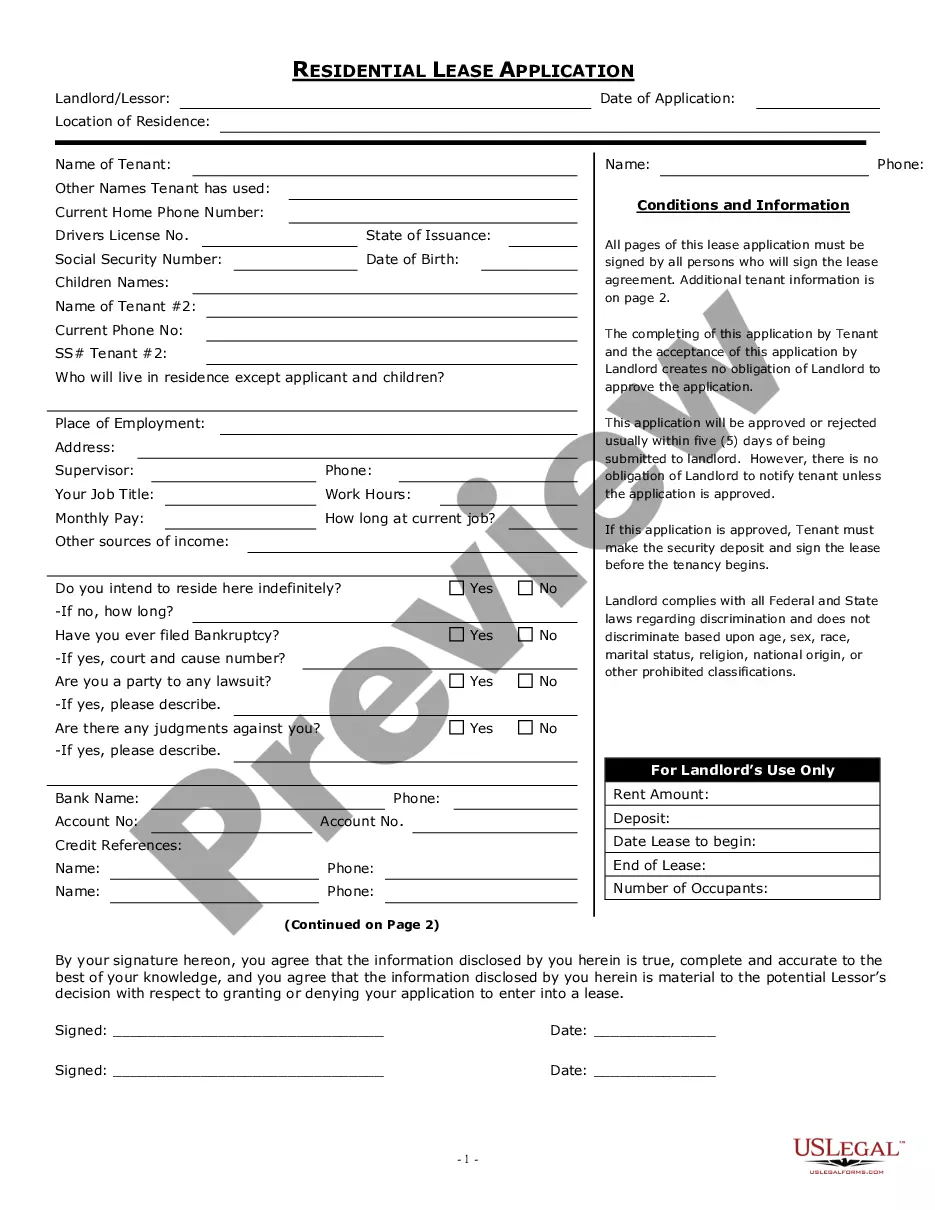

How to fill out King Washington Release Of Lien For Property?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring ownership, and lots of other life scenarios demand you prepare formal paperwork that differs throughout the country. That's why having it all collected in one place is so beneficial.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal forms. Here, you can easily find and download a document for any individual or business objective utilized in your region, including the King Release of Lien for Property.

Locating samples on the platform is amazingly simple. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. Following that, the King Release of Lien for Property will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guide to get the King Release of Lien for Property:

- Make sure you have opened the proper page with your localised form.

- Make use of the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form satisfies your requirements.

- Look for another document using the search option in case the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Select the suitable subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the King Release of Lien for Property on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

Time to Enforce a Judgment Judgments are good for at least 10 years in Washington. If a creditor sues you for money owed, or if the court awards a money judgment against you for any other reason, the judgment holder has this long to enforce it.

A lien on real property in Texas is evidence of a debt, and payment of that debt extinguishes, or releases, the lien. When the underlying debt is paid, the lien holder prepares, signs and certifies a written release that is recorded with the county clerk in the county where the property is located.

According to this law, a debtor must file an affidavit with the county to secure the release of a judgment lien against a primary residence. The debtor must first provide a 30-day notice letter to the creator of the judgment, containing a copy of the affidavit the debtor intends to file.

How long does a judgment lien last in Washington? A judgment lien in Washington will remain attached to the debtor's property (even if the property changes hands) for ten years.

A lien against a consumer must be filed within 90 days of work stoppage, or delivery of materials. Additional information regarding the timeline for filing liens may be found in RCW 60.04. 091.

How long does a judgment lien last in Washington? A judgment lien in Washington will remain attached to the debtor's property (even if the property changes hands) for ten years.

In case you borrow a loan from a bank in order to buy a house, a lien is placed on the house by the bank until you pay off the mortgage. If you fail to repay the mortgage the bank has the legal rights to seal your property. Tax liens Tax liens are the liens created by law.

In Texas, a release must be filed to clear a deed of trust from title to real property after a loan has been repaid or otherwise satisfied. The payment or other satisfaction of the debt extinguishes the encumbrance, but a recorded release is required to remove the lien as a cloud on title (Ellis v. Waldrop, 656 S.W.

How to Obtain a Lien Release Satisfy the terms of the loan by paying the balance of the loan back to the lender, including any interest incurred.If you don't receive the lien release, submit a request to your lender for proof that the loan has been satisfied.

Under RCW 60.04. 181, the property owner has the right to take the case to court to compel deliverance of the lien release, i.e., demand that the satisfied lien be released and wiped off the record. Lawsuits can be expensive and stressful, so it's best practice to avoid court appearances altogether if you can.