A San Diego California Release of Lien for Property is a legal document that officially removes any claims or encumbrances on a property. It is important for property owners, buyers, and lenders as it ensures that the property is free from any outstanding debts or liabilities. This document typically indicates that a lien holder or creditor has agreed to release their lien on the property, giving the owner full ownership rights without any obligations. The lien holder acknowledges that they have been paid in full or have otherwise resolved the debt, allowing for a clean transfer of title or ownership. The San Diego California Release of Lien for Property serves as proof that the property is no longer encumbered and can be bought, sold, or refinanced without any legal obstacles. The document must be filed with the appropriate county office to ensure its validity. Different types of San Diego California Release of Lien for Property may include: 1. Mortgage Lien Release: When a homeowner pays off the full mortgage loan amount, the mortgage lender provides a release of lien to clear the property title. 2. Mechanics Lien Release: This type of lien is placed by contractors, subcontractors, or material suppliers who have not been paid for their services. Once the debt is settled, the lien holder issues a lien release to clear the property from any further claims. 3. Tax Lien Release: If a property owner was unable to pay their property taxes, the county or state government entity may place a tax lien on the property. Once the outstanding taxes are cleared, a tax lien release is issued, removing the encumbrance. 4. Judgment Lien Release: In the event of a court judgment against a property owner, a judgment lien may be placed on the property to ensure payment. When the judgment is satisfied, a lien release is provided, releasing the property from the legal claim. It is crucial to consult with a qualified attorney or a title company when dealing with a San Diego California Release of Lien for Property to ensure compliance with state laws and a seamless transfer of ownership.

San Diego California Release of Lien for Property

Description

How to fill out San Diego California Release Of Lien For Property?

Creating legal forms is a necessity in today's world. However, you don't always need to look for qualified assistance to create some of them from scratch, including San Diego Release of Lien for Property, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to choose from in various categories varying from living wills to real estate paperwork to divorce documents. All forms are arranged based on their valid state, making the searching process less frustrating. You can also find detailed resources and guides on the website to make any activities associated with document execution simple.

Here's how you can purchase and download San Diego Release of Lien for Property.

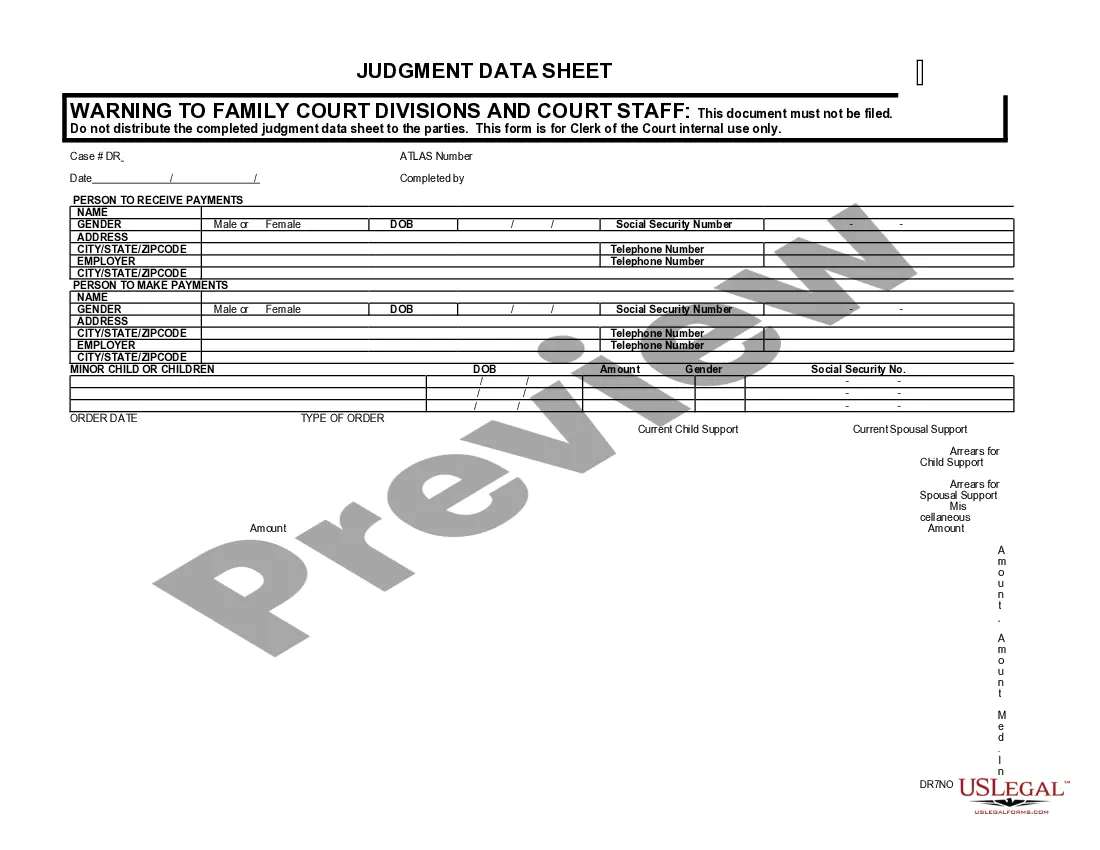

- Take a look at the document's preview and outline (if provided) to get a general information on what you’ll get after getting the document.

- Ensure that the template of your choosing is specific to your state/county/area since state laws can affect the legality of some documents.

- Check the similar document templates or start the search over to locate the correct file.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a suitable payment gateway, and buy San Diego Release of Lien for Property.

- Select to save the form template in any offered file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed San Diego Release of Lien for Property, log in to your account, and download it. Needless to say, our website can’t take the place of a lawyer entirely. If you need to deal with an exceptionally challenging case, we recommend getting an attorney to review your document before signing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of customers. Join them today and get your state-compliant documents effortlessly!