Collin County, Texas is a rapidly growing area located in the northeastern part of the state. With its booming real estate market, it's crucial for homeowners to have a thorough understanding of important legal processes, such as the Collin Texas Release of Lien for Real Estate. A release of lien is a legal document that denotes the removal of a lien, which is a claim over a property used as collateral for a debt. In real estate, a lien can be filed against a property by various parties, such as contractors, suppliers, or lenders, to ensure payment for services rendered or debts owed. In Collin County, Texas, there are different types of release of lien for real estate that homeowners and real estate professionals should be aware of. These include: 1. Mechanic's Lien Release: This type of release is commonly used in the construction industry. If a contractor, subcontractor, or material supplier has not been paid for their services or materials used in a construction project, they can file a mechanic's lien against the property. Once the debt is settled, they must file a mechanic's lien release to remove the lien. 2. Tax Lien Release: When property taxes are not paid, the county tax assessor can place a tax lien on the property. This lien ensures that the outstanding taxes will be paid when the property is sold. Once the taxes are cleared, the tax authority issues a tax lien release, which removes the lien from the property. 3. Mortgage Lien Release: When a homeowner pays off their mortgage loan, the lender must issue a mortgage lien release. This document legally declares that the mortgage has been satisfied and removes the lender's claim on the property. 4. Judgment Lien Release: If a property owner loses a lawsuit and is ordered to pay a judgment, the successful party can file a judgment lien against the property to ensure payment. Upon settling the judgment, a judgment lien release is filed to release the lien from the property. It's essential to understand that obtaining a release of lien is crucial when buying or selling a property in Collin County, Texas. A property with an existing lien can hinder the title transfer process, affect the property's marketability, and potentially lead to legal complications. Therefore, it's advisable to work with a qualified real estate attorney or title company to navigate the release of lien process effectively. In conclusion, the Collin Texas Release of Lien for Real Estate is a necessary legal step to ensure the clear transfer of property ownership. Various types of liens can affect a property's title, and obtaining the appropriate release of lien is crucial to avoid potential issues. Whether it's a mechanic's lien, tax lien, mortgage lien, or judgment lien, homeowners and real estate professionals must be diligent in completing the necessary documentation to remove any encumbrances on the property.

Collin Texas Release of Lien for Real Estate

Description

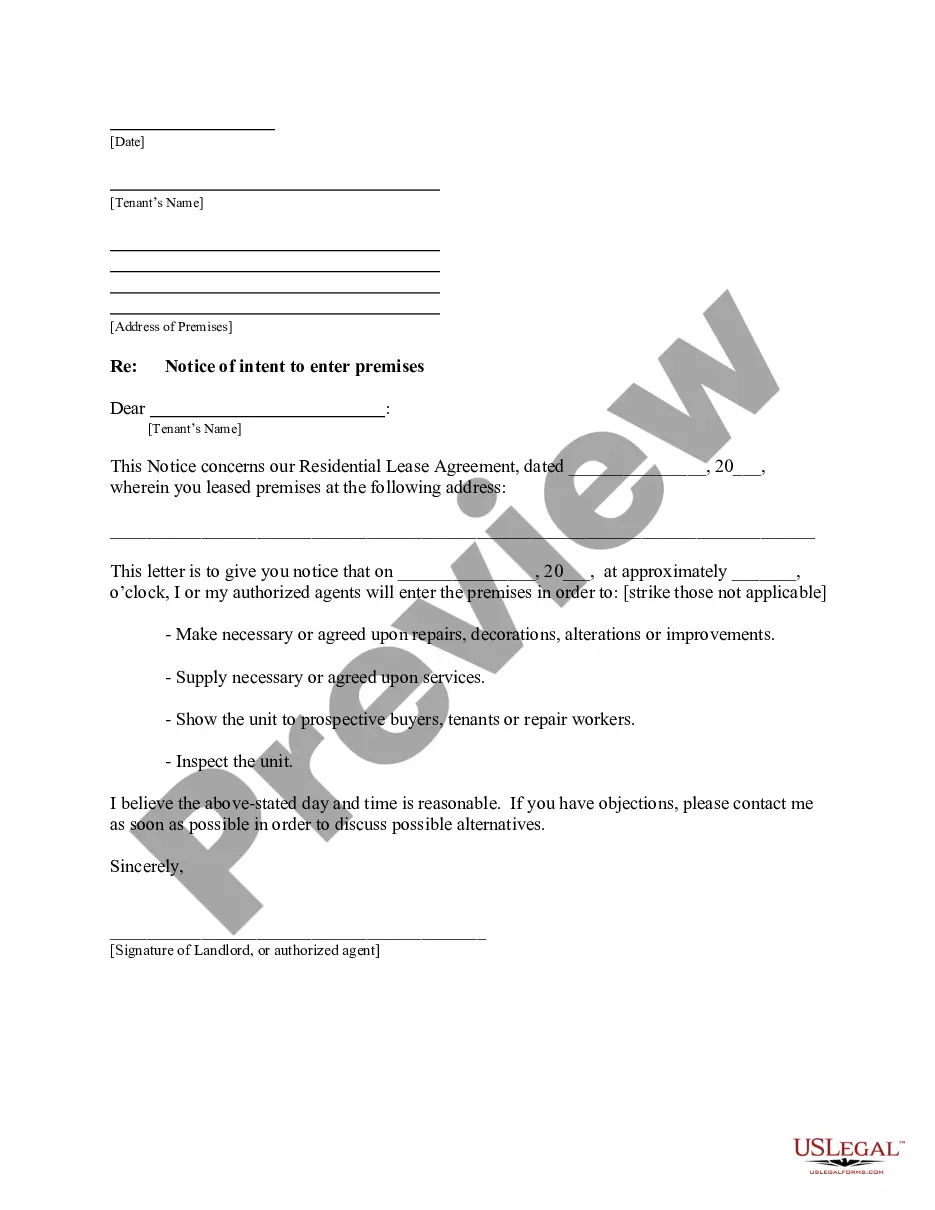

How to fill out Collin Texas Release Of Lien For Real Estate?

Whether you intend to open your business, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare specific paperwork meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal templates for any personal or business occurrence. All files are collected by state and area of use, so picking a copy like Collin Release of Lien for Real Estate is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few additional steps to get the Collin Release of Lien for Real Estate. Follow the instructions below:

- Make certain the sample meets your individual needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab providing your state above to find another template.

- Click Buy Now to get the file once you find the right one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Collin Release of Lien for Real Estate in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you are able to access all of your previously purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!