Montgomery County, Maryland is known for its thriving community and robust real estate market. Just like any other county in the United States, Montgomery County has specific regulations and processes in place for handling liens placed on properties. One crucial aspect of this process is the Montgomery Maryland Release of Lien, which helps property owners clear their titles from any attached liens. A Montgomery Maryland Release of Lien is a legal document that officially acknowledges the satisfaction or removal of a lien on a property located within Montgomery County. It serves as evidence that the lien holder no longer has any claim or interest in the property, allowing the property owner to regain full control and ownership rights. There are several types of Montgomery Maryland Release of Liens, each catering to specific scenarios. Common types include: 1. Mechanic's Lien Release: This type of release is used when a contractor, subcontractor, or supplier has filed a lien against a property due to unpaid construction or renovation work. Once the owed amount is paid or settled, the lien holder can file a Mechanic's Lien Release to release the lien from the property. 2. Property Tax Lien Release: A property tax lien can be placed on a property if the owner fails to pay their property taxes. Once the overdue taxes, including any accumulated interest and penalties, are fully paid or resolved, the government agency responsible for collecting taxes will issue a Property Tax Lien Release. 3. Judgment Lien Release: When a court grants a judgment against a property owner for a monetary claim, a judgment lien is placed on the property. This lien ensures that the creditor can collect the owed amount by selling the property. However, once the judgment is satisfied, the creditor must file a Judgment Lien Release to release the lien and clear the property's title. 4. HOA or Condo Association Lien Release: Homeowners associations (Has) or condo associations can place liens on properties owned by members who fail to pay their dues or assessments. Once the outstanding fees are paid, the association will issue a lien release, allowing the member to regain unrestricted ownership rights. It's important to note that the specific process and requirements for obtaining a Montgomery Maryland Release of Lien may vary depending on the type of lien and the circumstances of it. Property owners seeking to clear a lien from their property should consult with an experienced attorney or professional familiar with Montgomery County's laws and procedures.

Montgomery Maryland Release of Lien

Description

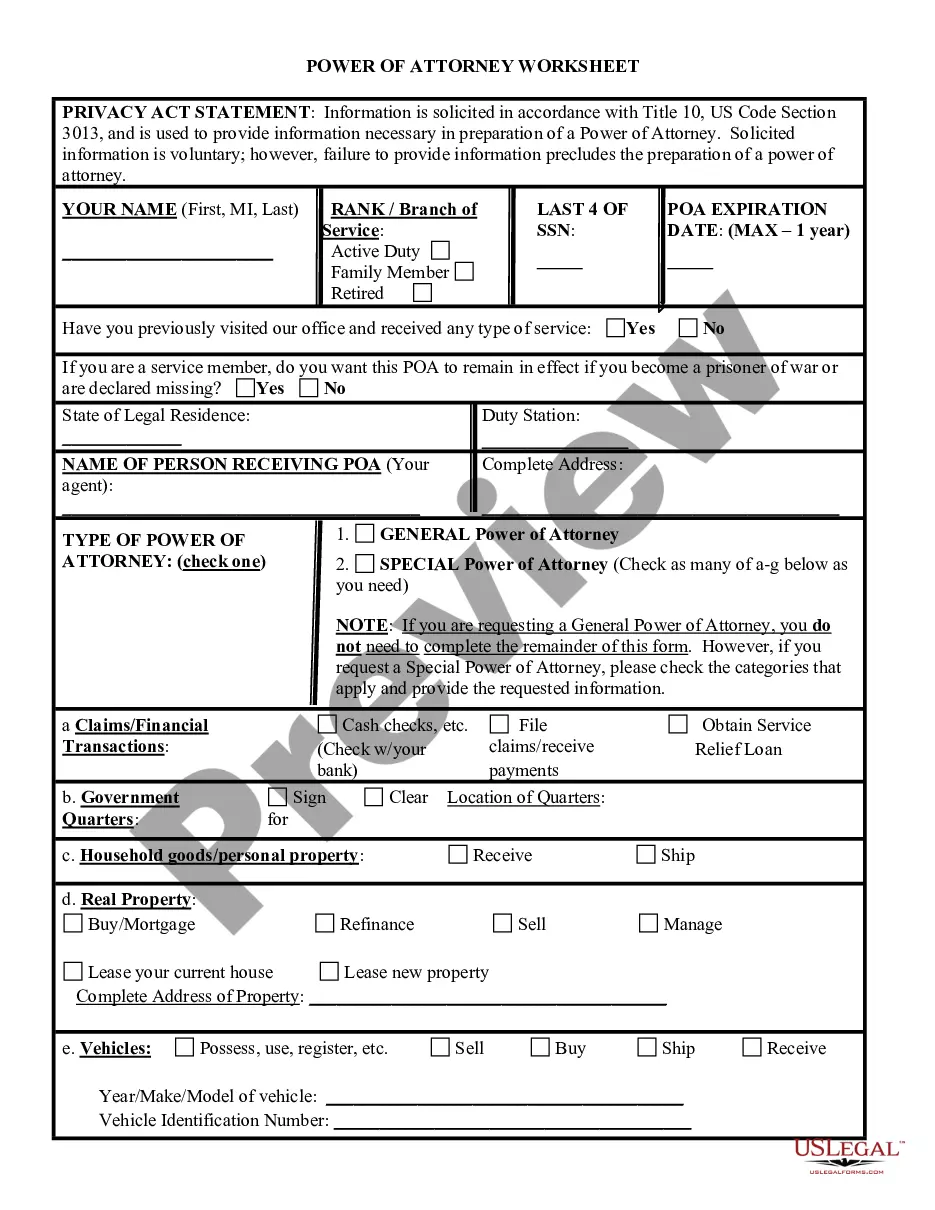

How to fill out Montgomery Maryland Release Of Lien?

Whether you plan to start your company, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you must prepare certain paperwork corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal documents for any personal or business occurrence. All files are grouped by state and area of use, so picking a copy like Montgomery Release of Lien is fast and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a few more steps to get the Montgomery Release of Lien. Adhere to the guide below:

- Make sure the sample fulfills your personal needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab providing your state above to locate another template.

- Click Buy Now to get the file when you find the right one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Montgomery Release of Lien in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you are able to access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!