San Antonio Texas Release of Lien: A Comprehensive Overview of the Different Types and Their Importance In the legal realm, a release of lien refers to the process or document that formally releases any claims, encumbrances, or liens a party has on a property or asset. Liens are typically placed on a property when an individual or business owes a debt or payment to another party, and can hinder sales, refinancing, or other transactions involving the property. A release of lien serves to remove these obstacles by stating that the debt has been satisfied or otherwise resolved. San Antonio, Texas, a vibrant city rich in history and culture, adheres to specific legal guidelines when it comes to the release of liens. It is crucial for both property owners and lien holders to fully understand the different types of release of liens available in San Antonio to protect their interests and ensure smooth transactions. Let's delve into the various types of San Antonio Texas Release of Lien: 1. Mechanic's Lien Release: This type of release is commonly used in construction or renovation projects where a contractor, subcontractor, or supplier places a lien on a property to secure payment for services rendered or materials provided. Once a property owner pays the associated debts, a mechanic's lien release can be obtained to remove the encumbrance. 2. Property Liens Release: These releases pertain to general liens placed on a property, such as those related to property taxes, mortgages, or judgments. Property owners must fulfill their obligations, such as paying outstanding taxes or satisfying mortgage debts to obtain a release and clear the title for further transactions. 3. Vendor Lien Release: In cases where a property owner finances a purchase directly through a vendor or supplier, such as when buying appliances or furniture, a vendor lien may be imposed to ensure payment. Upon repayment or fulfillment of the agreed terms, a release of lien should be obtained to confirm the debt's resolution. 4. Federal or State Tax Liens Release: If a property owner is delinquent on taxes owed to the Internal Revenue Service (IRS) or the Texas Comptroller of Public Accounts, a tax lien can be placed on their property. To release these liens, the property owner must pay off the outstanding tax debt, enter into a payment plan, or satisfy other requirements set forth by the appropriate tax authority. The aforementioned release of liens in San Antonio, Texas, are crucial for property owners, as they ensure a clear and marketable title to their assets. Buyers, lenders, and other interested parties can have confidence in the property's legal status when these liens are properly released. It is essential to work with experienced legal professionals or title companies when navigating these complex processes to ensure compliance with local laws and protect both parties' interests. In conclusion, a San Antonio Texas Release of Lien serves as a critical legal document, enabling property owners to remove encumbrances and satisfy outstanding debts to facilitate seamless transactions. Whether it's a mechanic's lien release, property lien release, vendor lien release, or federal/state tax lien release, understanding the specific requirements and seeking proper legal guidance is essential to navigate the process successfully.

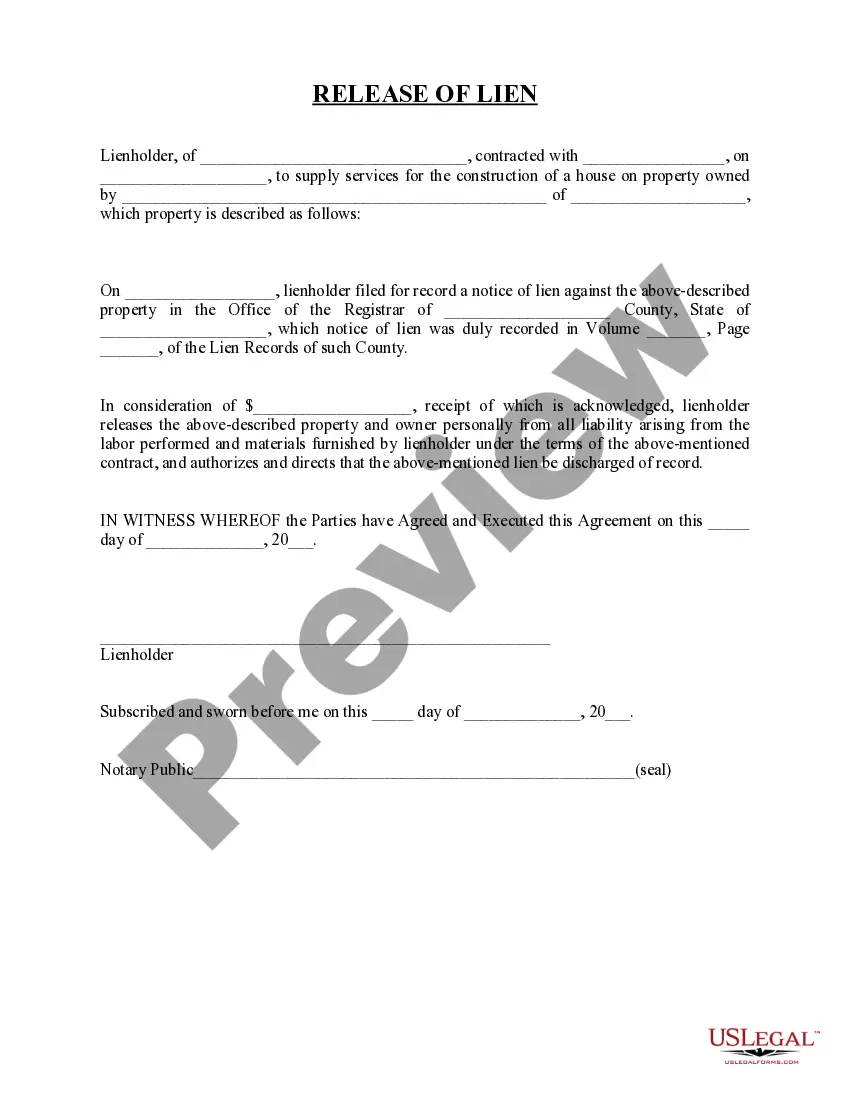

San Antonio Texas Release of Lien

Description

How to fill out San Antonio Texas Release Of Lien?

Draftwing forms, like San Antonio Release of Lien, to manage your legal affairs is a challenging and time-consumming task. A lot of situations require an attorney’s participation, which also makes this task not really affordable. However, you can take your legal matters into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal forms created for a variety of cases and life situations. We make sure each form is in adherence with the regulations of each state, so you don’t have to worry about potential legal issues compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how straightforward it is to get the San Antonio Release of Lien form. Simply log in to your account, download the form, and customize it to your needs. Have you lost your form? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is fairly straightforward! Here’s what you need to do before getting San Antonio Release of Lien:

- Make sure that your form is compliant with your state/county since the rules for writing legal paperwork may differ from one state another.

- Learn more about the form by previewing it or going through a quick intro. If the San Antonio Release of Lien isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or create an account to begin utilizing our service and download the document.

- Everything looks great on your side? Hit the Buy now button and choose the subscription plan.

- Pick the payment gateway and type in your payment details.

- Your form is good to go. You can try and download it.

It’s easy to find and buy the appropriate template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive collection. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!