The Wayne Michigan Line of Credit Promissory Note is a legally binding document that outlines the terms and conditions of a loan agreement between a borrower and a lender in the state of Michigan. This promissory note serves as evidence of the borrower's promise to repay a specific amount of money borrowed, along with any accrued interest, within a specified time frame. Keywords: Wayne Michigan, Line of Credit, Promissory Note, loan agreement, borrower, lender, repayment, interest, time frame. In Wayne, Michigan, there are various types of Line of Credit Promissory Notes available to borrowers based on their specific financial needs. Some different types are: 1. Personal Line of Credit Promissory Note: This type of promissory note is suited for individuals who require a revolving line of credit to meet their personal financial requirements. It allows borrowers to borrow funds up to a predetermined credit limit and repay the borrowed amount in scheduled installments. 2. Business Line of Credit Promissory Note: Designed for business owners, this promissory note offers flexibility in managing cash flow, inventory, and other operational expenses. It allows businesses to access funds as needed within a predetermined credit limit, making it an ideal financing option for fluctuating business expenses. 3. Home Equity Line of Credit (HELOT) Promissory Note: HELOT promissory notes are secured by the borrower's home equity and are commonly used for home improvement projects, debt consolidation, or any other purpose. Similar to a credit card, borrowers can draw funds up to their approved credit limit and make monthly payments based on the outstanding balance and interest rate. 4. Student Line of Credit Promissory Note: This type of promissory note is tailored for students pursuing higher education. It enables students to borrow funds for tuition, accommodation, textbooks, and other educational expenses. Repayment terms may vary, allowing flexibility for students to start repaying the loan after completing their education. Keywords: Personal, Business, Home Equity, HELOT, Student, loan, borrowing, revolving, cash flow, credit limit, installments, operational expenses, home improvement, debt consolidation, tuition, educational expenses, flexibility. Whether it is for personal, business, home equity, or educational purposes, the Wayne Michigan Line of Credit Promissory Note provides a clear framework for borrowers and lenders to establish a mutual understanding of loan terms. It is essential for both parties to carefully review and understand all aspects of the promissory note before signing the agreement to ensure compliance and transparency throughout the lending process. Keywords: loan terms, borrowing, lending process, compliance, transparency, agreement, mutual understanding.

Wayne Michigan Line of Credit Promissory Note

Description

How to fill out Wayne Michigan Line Of Credit Promissory Note?

Laws and regulations in every area differ from state to state. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Wayne Line of Credit Promissory Note, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals searching for do-it-yourself templates for various life and business occasions. All the forms can be used many times: once you obtain a sample, it remains accessible in your profile for further use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Wayne Line of Credit Promissory Note from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Wayne Line of Credit Promissory Note:

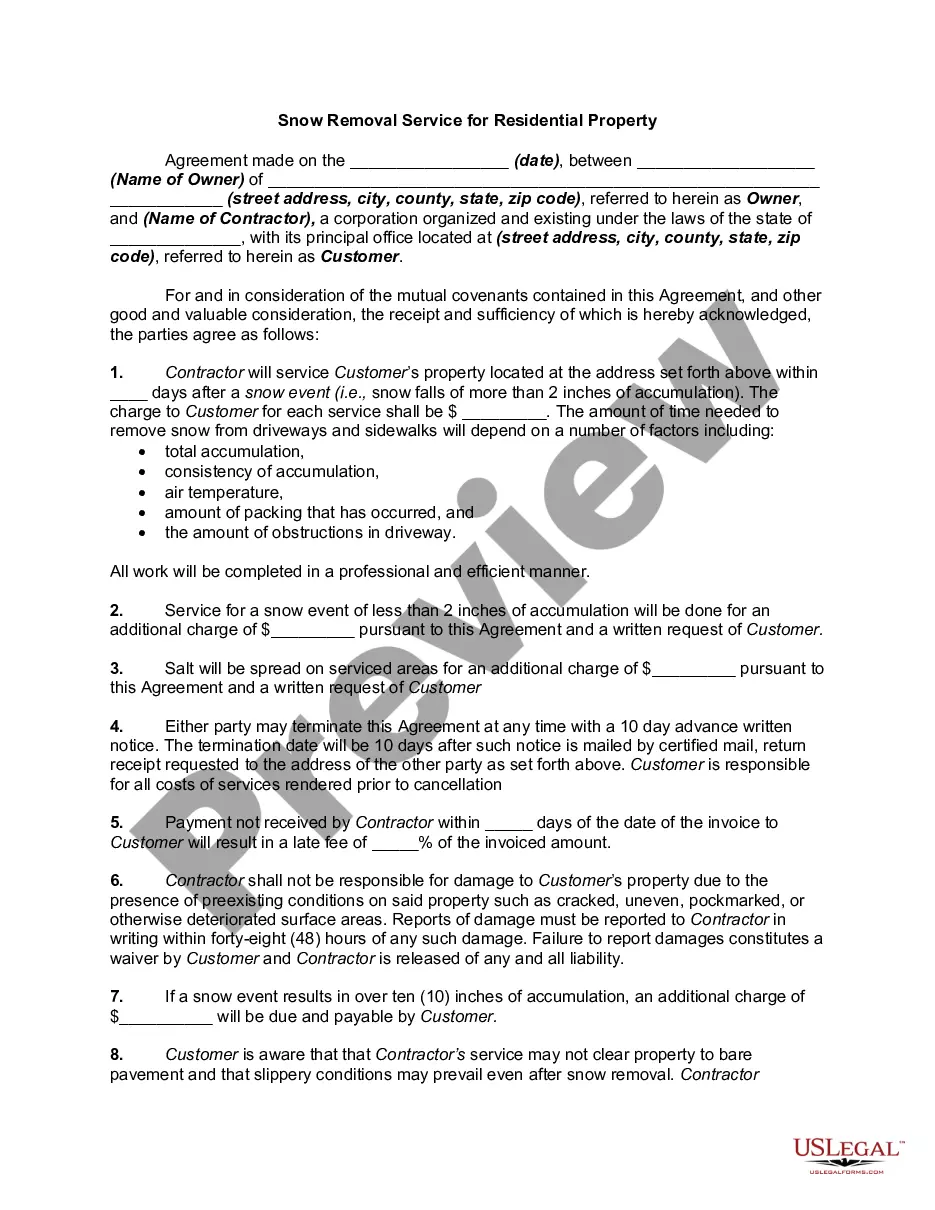

- Examine the page content to ensure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the document when you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!