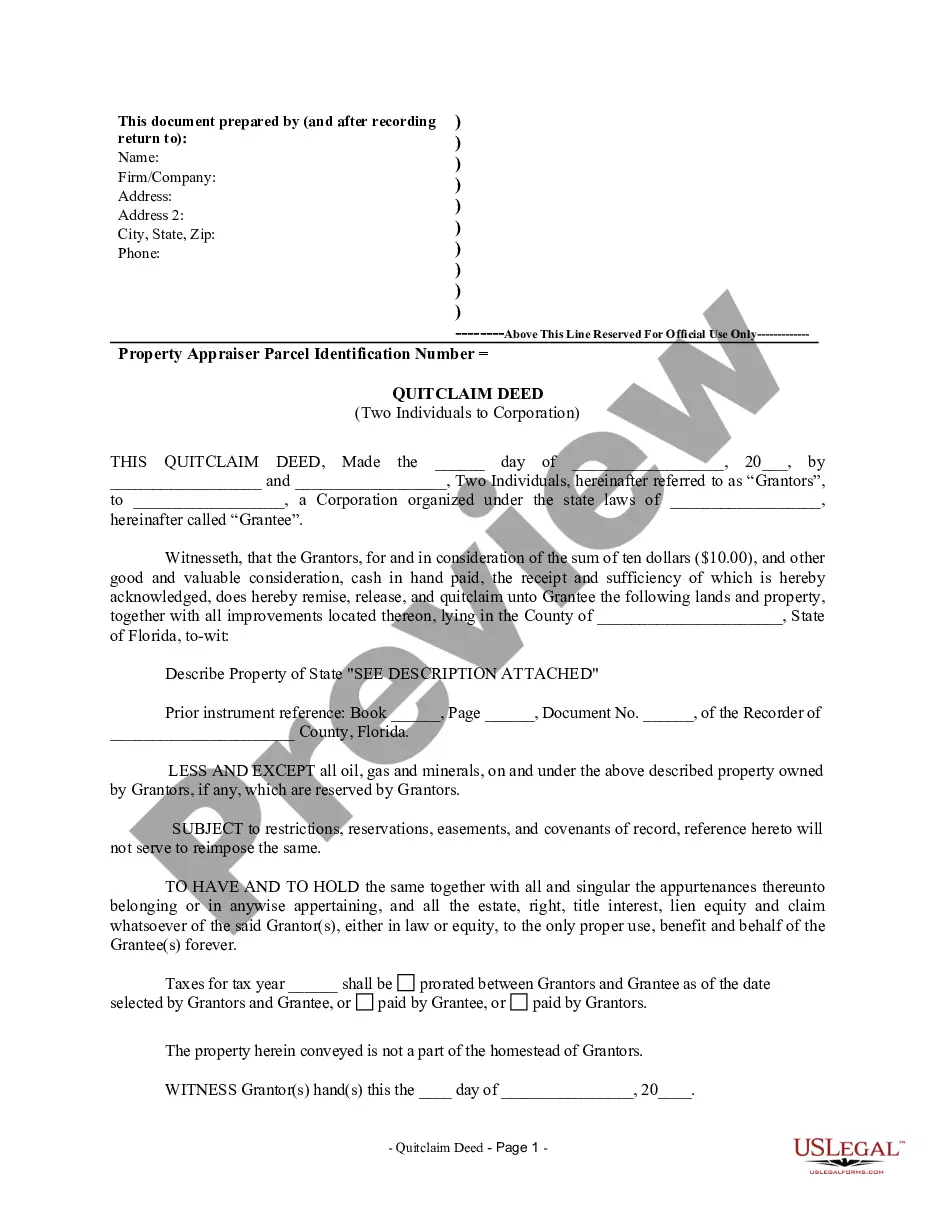

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Los Angeles California Deed of Trust Securing Obligations Pursuant to Indemnification Agreement is a legally binding document that serves as a form of security for a loan or financial obligation. It is commonly utilized in real estate transactions to protect lenders or creditors in case of default by the borrower. This deed of trust outlines the terms and conditions agreed upon by the parties involved, including the borrower, lender, and trustee. It describes the responsibilities, rights, and obligations of each party to ensure the smooth execution of the loan or contractual agreement. The deed of trust acts as a lien on the property, giving the lender the right to foreclose and sell the property if the borrower fails to meet their obligations. It provides a level of protection for the lender, allowing them to recoup their investment in case of default or breach of contract. The Los Angeles California Deed of Trust Securing Obligations Pursuant to Indemnification Agreement is drafted in compliance with the state's laws and regulations. It includes essential details such as: 1. Identification of the parties involved: The names and addresses of the borrower, lender, and trustee are listed to establish their roles and responsibilities. 2. Property description: A detailed description of the property being used as collateral is provided, including its legal description and address. 3. Loan terms: The deed of trust specifies the principal amount of the loan, the interest rate, repayment terms, and any other financial obligations agreed upon between the parties. 4. Indemnification provisions: This agreement may include indemnification clauses, aiming to protect the lender from any losses, claims, or damages arising from the borrower's actions or failure to fulfill their obligations. 5. Default and foreclosure procedures: The deed of trust outlines the events that would be considered a default, such as non-payment or violation of loan terms. It also outlines the foreclosure process, including notice requirements, timelines, and the trustee's role in the event of default. Different types of Los Angeles California Deed of Trust Securing Obligations Pursuant to Indemnification Agreement may include specific provisions tailored to different types of loans or transactions. For instance, there are agreements designed for commercial real estate loans, residential mortgages, or construction loans. Each type may have different requirements and terms based on the nature of the loan and the parties involved. Overall, the Los Angeles California Deed of Trust Securing Obligations Pursuant to Indemnification Agreement is a crucial legal document that safeguards the interests of both borrowers and lenders in financial transactions. It establishes clear guidelines and procedures to ensure a smooth and secure lending process while providing a level of protection for all parties involved.