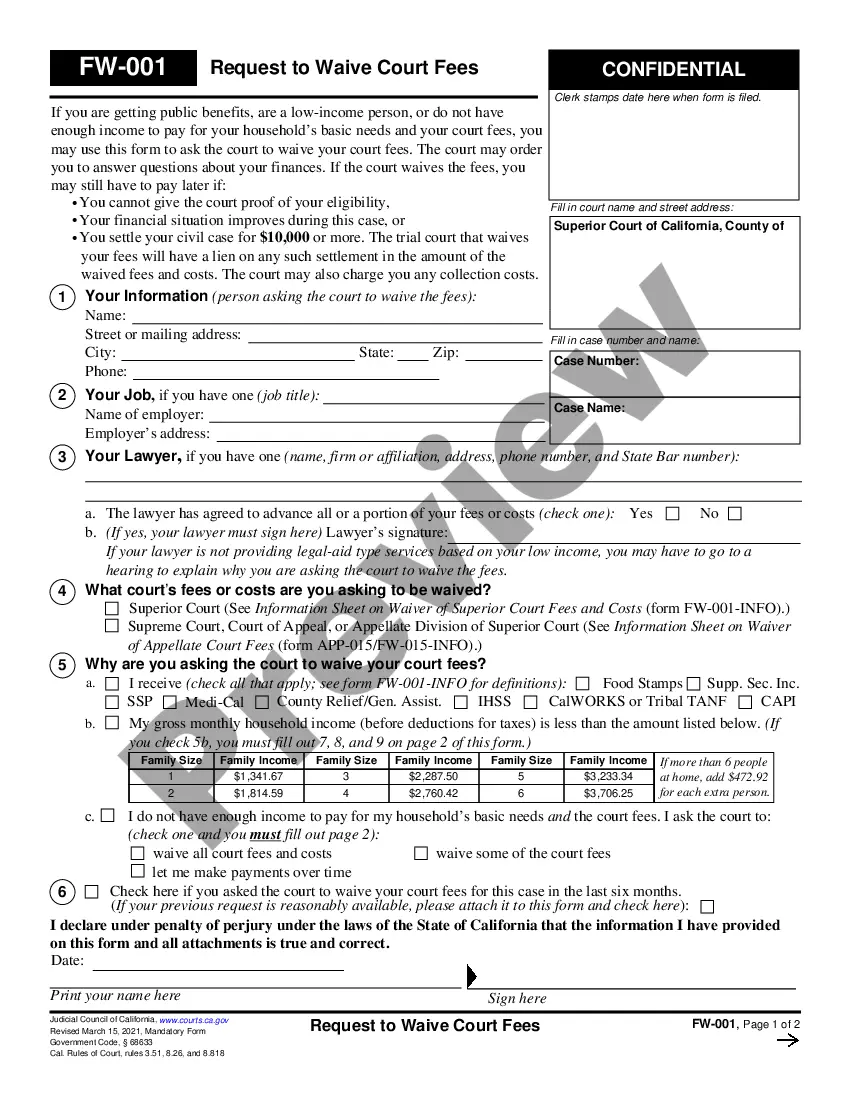

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Orange California is a vibrant city located in Orange County, California, known for its rich history and strong sense of community. It is home to a diverse population and offers a range of amenities and attractions, making it an attractive place to live and work. When it comes to the mortgage industry, mortgage brokers in Orange California often enter into agreements to find acceptable lenders for their clients. These agreements aim to secure the best possible loan options for individuals looking to purchase or refinance properties in the area. There are various types of Orange California agreements between mortgage brokers to find an acceptable lender for their clients. Some of these include: 1. Exclusive Agreement: This type of agreement binds the client to work exclusively with one mortgage broker. It ensures that the broker will use their expertise and network to find the most suitable lender options matching the client's financial requirements and preferences. 2. Non-Exclusive Agreement: In contrast to an exclusive agreement, a non-exclusive agreement allows the client to seek assistance from multiple mortgage brokers simultaneously. This provides the client with the opportunity to explore a broader range of lender options and potentially secure better terms. 3. Referral Agreement: A referral agreement is established between a mortgage broker and another professional involved in the real estate industry, such as a real estate agent or financial advisor. This agreement allows both parties to refer clients to one another and collaborate in finding suitable lenders for their respective clients. 4. Wholesale Lending Agreement: This type of agreement is formed between a mortgage broker and a wholesale lender. Wholesale lenders typically work exclusively with brokers and offer loans at discounted rates. This agreement allows the broker to access a broader range of loan products and potentially secure more favorable terms for their clients. In summary, Orange California offers a dynamic landscape for mortgage brokers to enter into agreements that aim to find an acceptable lender for their clients. Whether through exclusive or non-exclusive agreements, referral arrangements, or partnerships with wholesale lenders, these agreements play a crucial role in helping individuals secure appropriate loan options in the vibrant city of Orange California.Orange California is a vibrant city located in Orange County, California, known for its rich history and strong sense of community. It is home to a diverse population and offers a range of amenities and attractions, making it an attractive place to live and work. When it comes to the mortgage industry, mortgage brokers in Orange California often enter into agreements to find acceptable lenders for their clients. These agreements aim to secure the best possible loan options for individuals looking to purchase or refinance properties in the area. There are various types of Orange California agreements between mortgage brokers to find an acceptable lender for their clients. Some of these include: 1. Exclusive Agreement: This type of agreement binds the client to work exclusively with one mortgage broker. It ensures that the broker will use their expertise and network to find the most suitable lender options matching the client's financial requirements and preferences. 2. Non-Exclusive Agreement: In contrast to an exclusive agreement, a non-exclusive agreement allows the client to seek assistance from multiple mortgage brokers simultaneously. This provides the client with the opportunity to explore a broader range of lender options and potentially secure better terms. 3. Referral Agreement: A referral agreement is established between a mortgage broker and another professional involved in the real estate industry, such as a real estate agent or financial advisor. This agreement allows both parties to refer clients to one another and collaborate in finding suitable lenders for their respective clients. 4. Wholesale Lending Agreement: This type of agreement is formed between a mortgage broker and a wholesale lender. Wholesale lenders typically work exclusively with brokers and offer loans at discounted rates. This agreement allows the broker to access a broader range of loan products and potentially secure more favorable terms for their clients. In summary, Orange California offers a dynamic landscape for mortgage brokers to enter into agreements that aim to find an acceptable lender for their clients. Whether through exclusive or non-exclusive agreements, referral arrangements, or partnerships with wholesale lenders, these agreements play a crucial role in helping individuals secure appropriate loan options in the vibrant city of Orange California.