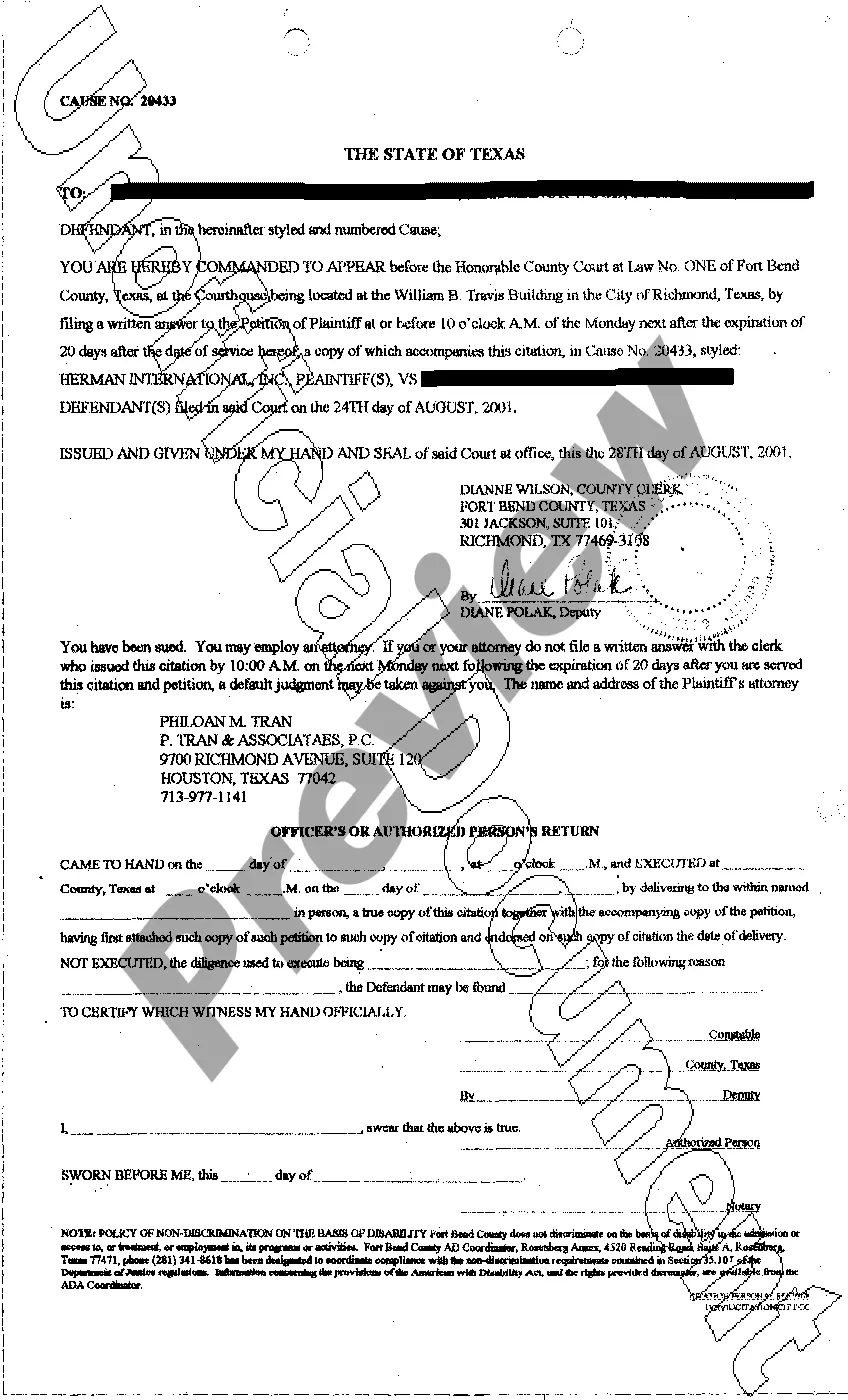

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Palm Beach, Florida is a coastal town located in southeastern Florida, known for its luxurious appeal and pristine sandy beaches. This picturesque destination attracts tourists and investors from various parts of the world, seeking an exclusive and affluent lifestyle. In the real estate realm, Palm Beach offers a host of opportunities for individuals looking to purchase properties and secure mortgages. However, navigating the complex mortgage market can be overwhelming for buyers, leading them to seek assistance from mortgage brokers. One common type of agreement between mortgage brokers in Palm Beach, Florida, is the "Palm Beach Exclusive Brokerage Agreement." This agreement outlines the terms and conditions for the broker to act as an intermediary between the client and potential lenders. It emphasizes the broker's responsibility to find an acceptable lender that meets the client's specific requirements, such as interest rates, loan terms, and financial capacity. Another type of agreement is the "Palm Beach Mortgage Brokerage Engagement Agreement." This agreement is more comprehensive, encompassing a broader range of services provided by the mortgage broker. It includes obligations related to property evaluation, credit analysis, loan application submission, communication with lenders, and negotiation on behalf of the client. This agreement ensures that the mortgage broker is dedicated to finding the most suitable lender for the client's needs, while also ensuring a smooth and efficient mortgage application process. In both types of agreements, keywords such as "Palm Beach mortgage broker," "acceptable lender," "exclusive brokerage," "mortgage brokerage engagement," and "loan terms" are highly relevant. These keywords are essential for search engine optimization (SEO) purposes, helping potential clients find information related to Palm Beach agreements between mortgage brokers and lenders efficiently. Whether you are a prospective homebuyer or a property investor interested in Palm Beach, Florida, partnering with a reliable mortgage broker can simplify the mortgage application process. Understanding the various agreements between mortgage brokers and lenders can assist in choosing the right professional for your specific requirements.Palm Beach, Florida is a coastal town located in southeastern Florida, known for its luxurious appeal and pristine sandy beaches. This picturesque destination attracts tourists and investors from various parts of the world, seeking an exclusive and affluent lifestyle. In the real estate realm, Palm Beach offers a host of opportunities for individuals looking to purchase properties and secure mortgages. However, navigating the complex mortgage market can be overwhelming for buyers, leading them to seek assistance from mortgage brokers. One common type of agreement between mortgage brokers in Palm Beach, Florida, is the "Palm Beach Exclusive Brokerage Agreement." This agreement outlines the terms and conditions for the broker to act as an intermediary between the client and potential lenders. It emphasizes the broker's responsibility to find an acceptable lender that meets the client's specific requirements, such as interest rates, loan terms, and financial capacity. Another type of agreement is the "Palm Beach Mortgage Brokerage Engagement Agreement." This agreement is more comprehensive, encompassing a broader range of services provided by the mortgage broker. It includes obligations related to property evaluation, credit analysis, loan application submission, communication with lenders, and negotiation on behalf of the client. This agreement ensures that the mortgage broker is dedicated to finding the most suitable lender for the client's needs, while also ensuring a smooth and efficient mortgage application process. In both types of agreements, keywords such as "Palm Beach mortgage broker," "acceptable lender," "exclusive brokerage," "mortgage brokerage engagement," and "loan terms" are highly relevant. These keywords are essential for search engine optimization (SEO) purposes, helping potential clients find information related to Palm Beach agreements between mortgage brokers and lenders efficiently. Whether you are a prospective homebuyer or a property investor interested in Palm Beach, Florida, partnering with a reliable mortgage broker can simplify the mortgage application process. Understanding the various agreements between mortgage brokers and lenders can assist in choosing the right professional for your specific requirements.