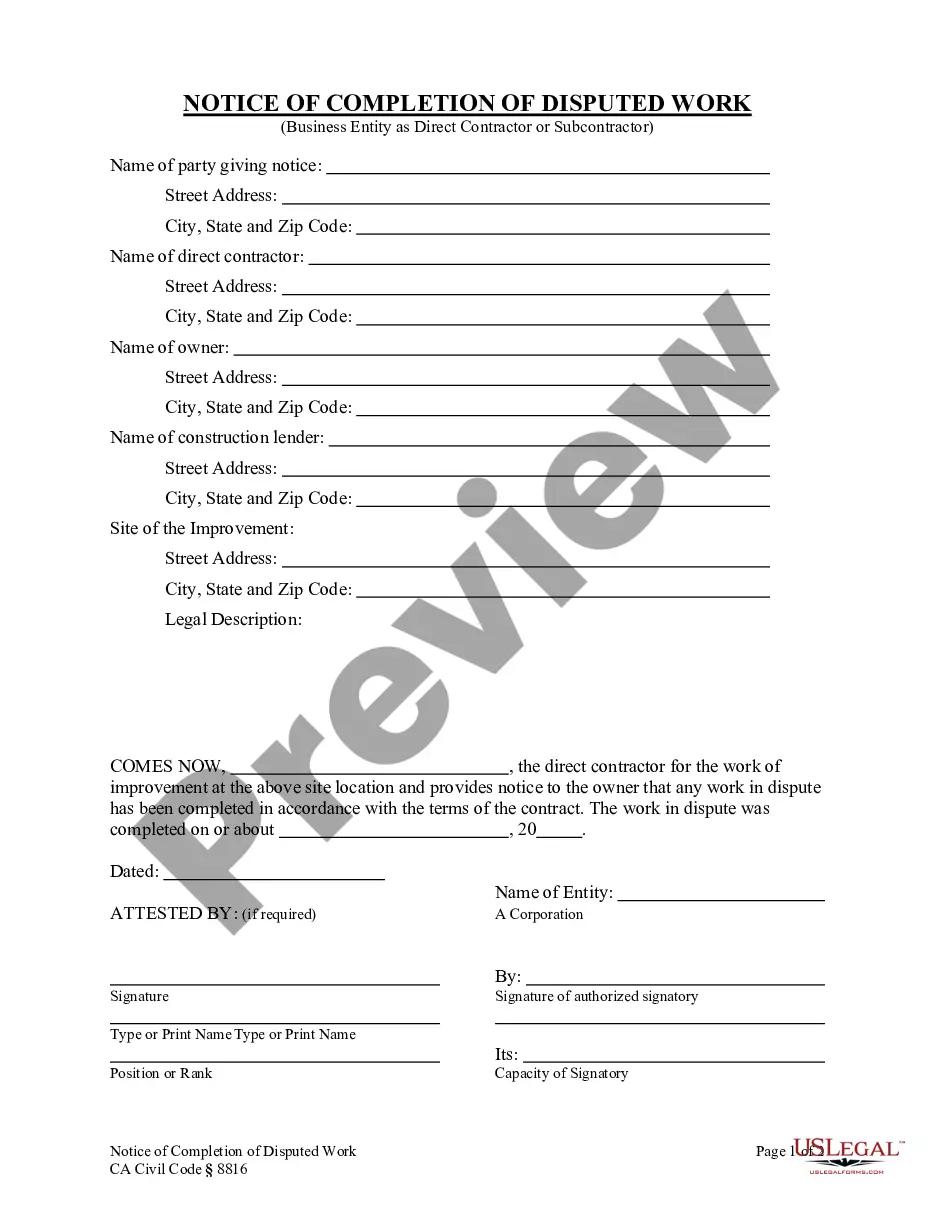

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A San Bernardino California Agreement between Mortgage Brokers to Find Acceptable Lender for Client is a formal agreement signed between mortgage brokers in San Bernardino, California, with the purpose of collaboratively seeking and identifying a suitable lender to meet the financial needs of a specific client. This agreement serves as a binding contract outlining the obligations and responsibilities of multiple mortgage brokers involved in the process of finding an acceptable lender for a client in San Bernardino, California. By pooling their expertise and resources, these brokers aim to provide their client with the best possible financing options. Keywords: San Bernardino, California, Mortgage brokers, Agreement, Acceptable lender, Client, Formal agreement, Signed, Collaboratively, Seeking, Identifying, Suitable lender, Financial needs, Binding contract, Obligations, Responsibilities, Pooling expertise, Pooling resources, Financing options. Different types of San Bernardino California Agreements between Mortgage Brokers to Find Acceptable Lender for Client may include: 1. Exclusive Broker Agreement: This type of agreement is signed between mortgage brokers exclusively engaged by the client, limiting the search for an acceptable lender to a select group. 2. Joint Broker Agreement: In this agreement, multiple mortgage brokers collectively assist the client in finding an acceptable lender by combining their efforts, resources, and networks. 3. Referral Agreement: This type of agreement may be established when one mortgage broker, who is unable to find an acceptable lender for a client, refers the client to another broker with expertise in the specific loan requirements or a larger lender network. 4. Confidentiality Agreement: This agreement ensures that all participating mortgage brokers maintain the utmost confidentiality regarding the client's personal and financial information during the lender search process. 5. Fees and Compensation Agreement: This agreement specifies the terms related to the fees and compensation that the mortgage brokers will receive upon successfully finding an acceptable lender for the client. Note: These are imaginary variations of the mentioned agreement types and may not mirror the exact legal arrangements in place.A San Bernardino California Agreement between Mortgage Brokers to Find Acceptable Lender for Client is a formal agreement signed between mortgage brokers in San Bernardino, California, with the purpose of collaboratively seeking and identifying a suitable lender to meet the financial needs of a specific client. This agreement serves as a binding contract outlining the obligations and responsibilities of multiple mortgage brokers involved in the process of finding an acceptable lender for a client in San Bernardino, California. By pooling their expertise and resources, these brokers aim to provide their client with the best possible financing options. Keywords: San Bernardino, California, Mortgage brokers, Agreement, Acceptable lender, Client, Formal agreement, Signed, Collaboratively, Seeking, Identifying, Suitable lender, Financial needs, Binding contract, Obligations, Responsibilities, Pooling expertise, Pooling resources, Financing options. Different types of San Bernardino California Agreements between Mortgage Brokers to Find Acceptable Lender for Client may include: 1. Exclusive Broker Agreement: This type of agreement is signed between mortgage brokers exclusively engaged by the client, limiting the search for an acceptable lender to a select group. 2. Joint Broker Agreement: In this agreement, multiple mortgage brokers collectively assist the client in finding an acceptable lender by combining their efforts, resources, and networks. 3. Referral Agreement: This type of agreement may be established when one mortgage broker, who is unable to find an acceptable lender for a client, refers the client to another broker with expertise in the specific loan requirements or a larger lender network. 4. Confidentiality Agreement: This agreement ensures that all participating mortgage brokers maintain the utmost confidentiality regarding the client's personal and financial information during the lender search process. 5. Fees and Compensation Agreement: This agreement specifies the terms related to the fees and compensation that the mortgage brokers will receive upon successfully finding an acceptable lender for the client. Note: These are imaginary variations of the mentioned agreement types and may not mirror the exact legal arrangements in place.