Collin Texas Agreement of Shareholders of a Close Corporation with Management by Shareholders The Collin Texas Agreement of Shareholders of a Close Corporation with Management by Shareholders is a legal document that outlines the internal governance structure and procedures for a close corporation in Collin County, Texas. It specifically addresses the relationship between the shareholders who actively participate in the management of the corporation, integrating their rights and responsibilities. Key terms associated with this agreement include: 1. Close Corporation: A close corporation is a privately held company with a limited number of shareholders who actively participate in the management. 2. Shareholders: These are the individuals or entities that own shares in the close corporation. 3. Management by Shareholders: This concept refers to the active involvement of shareholders in the day-to-day management, decision-making, and operations of the corporation. 4. Internal Governance: This encompasses the rules and procedures that regulate the activities and relationships within the close corporation. 5. Shareholder Rights: The agreement outlines the rights and privileges of each shareholder, such as voting rights, information access, and decision-making authority. 6. Shareholder Responsibilities: The agreement specifies the responsibilities and obligations of shareholders in managing the corporation. This may include attending meetings, providing expertise, and acting in the best interest of the corporation. 7. Decision-Making Mechanisms: The agreement establishes the mechanisms for making decisions, such as voting procedures, quorum requirements, and resolution of conflicts or deadlocks. 8. Profit Distribution: It defines how profits will be allocated among the shareholders based on their shares or other predetermined criteria. 9. Transferability of Shares: The agreement may restrict the transfer of shares to maintain stability and control within the corporation. It may include provisions concerning buy-sell agreements, rights of first refusal, or restrictions on selling to outsiders. 10. Dissolution and Exit Strategies: The agreement may address procedures for dissolving the corporation or handling the departure of shareholders, including the sale of shares, buyouts, or valuation mechanisms. While it is named the "Collin Texas Agreement of Shareholders of a Close Corporation with Management by Shareholders," there might not be different variations or types with distinct names specific to Collin County. However, the actual content and provisions of the agreement may vary depending on the specific needs, preferences, and circumstances of the close corporation and its shareholders. It is vital for shareholders of a close corporation in Collin County, Texas, to consult legal professionals experienced in corporate law to draft and customize an agreement that best suits their interests and complies with state laws.

Collin Texas Agreement of Shareholders of a Close Corporation with Management by Shareholders

Description

How to fill out Collin Texas Agreement Of Shareholders Of A Close Corporation With Management By Shareholders?

Laws and regulations in every sphere vary throughout the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the Collin Agreement of Shareholders of a Close Corporation with Management by Shareholders, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for various life and business scenarios. All the documents can be used multiple times: once you pick a sample, it remains available in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Collin Agreement of Shareholders of a Close Corporation with Management by Shareholders from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Collin Agreement of Shareholders of a Close Corporation with Management by Shareholders:

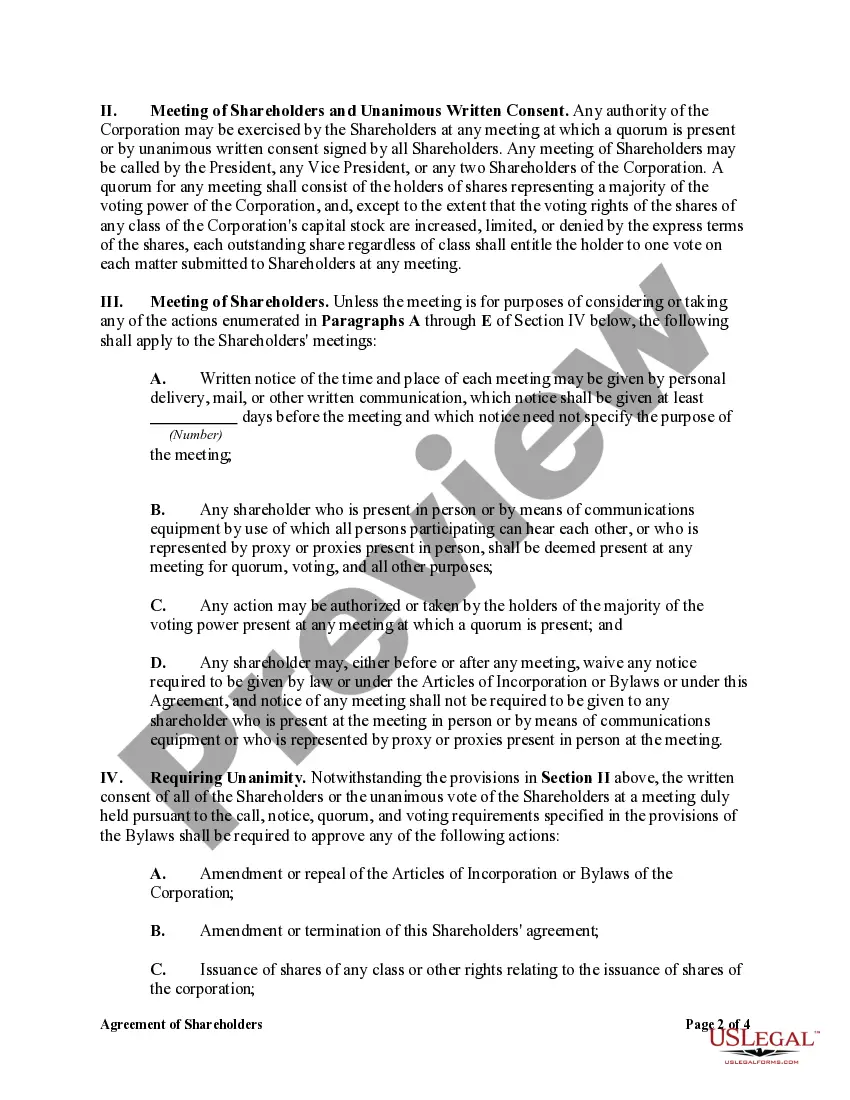

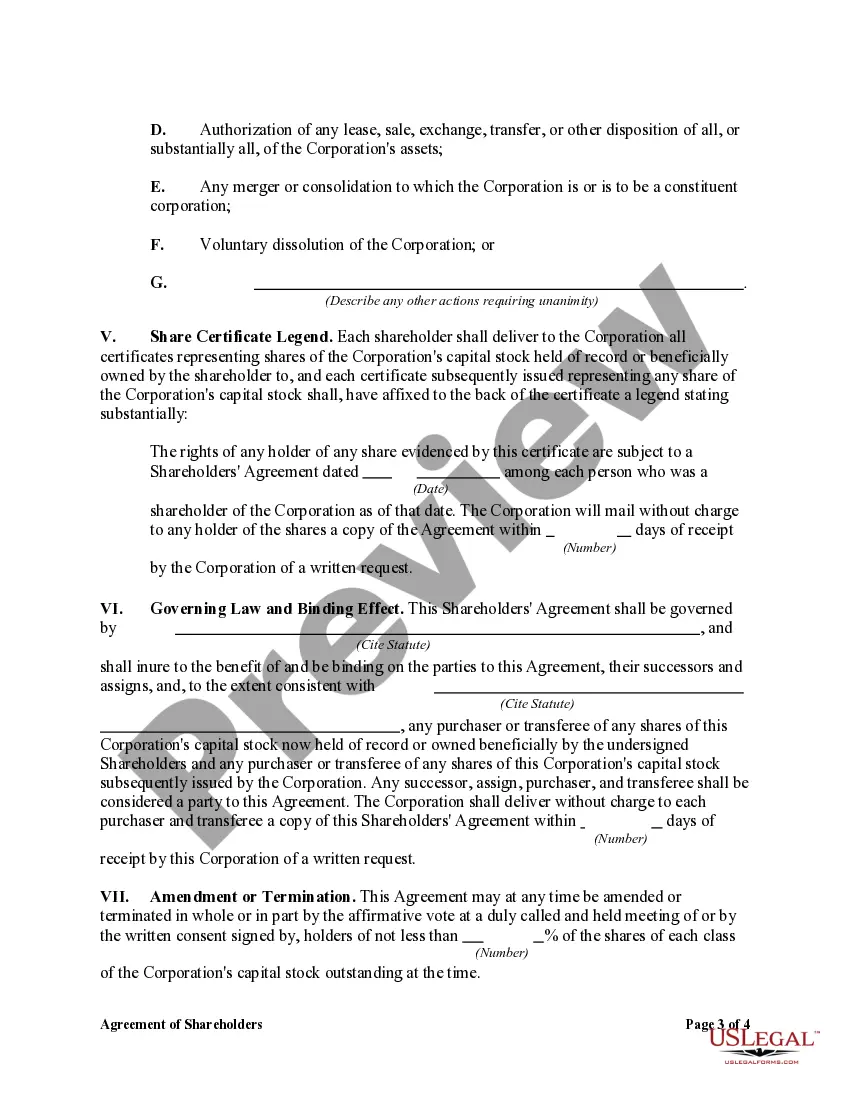

- Take a look at the page content to make sure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the template once you find the right one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

The board of directors is elected by the shareholders of a corporation to oversee and govern the management and to make corporate decisions on their behalf. As a result, the board is directly responsible for protecting and managing shareholders' interests in the company.

The board of directors is elected by the shareholders of a corporation to oversee and govern the management and to make corporate decisions on their behalf. As a result, the board is directly responsible for protecting and managing shareholders' interests in the company.

Shareholder management is the process of a company manages it's affairs with stakeholders. A well-structured and managed shareholder management process is important for every company, as it helps the owners record and keep track of all shares in the company and ensures control of the business is effective.

(b) A corporation's shareholders may amend or repeal the corporation's bylaws even though the bylaws may also be amended or repealed by its board of directors.

A shareholders' agreement includes a date; often the number of shares issued; a capitalization table that outlines shareholders and their percentage ownership; any restrictions on transferring shares; pre-emptive rights for current shareholders to purchase shares to maintain ownership percentages (for example, in the

Shareholder agreements differ from company bylaws. Bylaws work in conjunction with a company's articles of incorporation to form the legal backbone of the business and govern its operations. A shareholder agreement, on the other hand, is optional.

Given this flexibility, most companies allow their bylaws to be amended solely by the board without shareholder approval, although bylaws occasionally require shareholder approval for their amendment. to quickly amend the bylaws can provide critical breathing room for the board right when it needs it.

A Shareholder Agreement, also known as a stockholder agreement or SPA, is a contract between the stock owners of a corporation that addresses the rights, responsibilities, and ownership of a corporation.

Yes. A shareholders' agreement, once signed, is a legally binding contract. Legally binding contracts require four elements: offer, acceptance, consideration, and the understanding that a contract is being formed.

But an entitlement contained in the bylaws or a shareholders' agreement does not result in automatic forfeiture of a board seat upon termination of employment. 2. A shareholders' agreement cannot deprive the board of its statutory authority to manage corporate affairs and appoint officers. Schroeder v.