The Sacramento California Agreement of Shareholders of a Close Corporation with Management by Shareholders is a legal document that outlines the rights, responsibilities, and obligations of shareholders in a close corporation. This agreement serves as a contractual agreement amongst shareholders, establishing clear guidelines for the management and operation of the corporation. In Sacramento, California, there are various types of agreements of shareholders of a close corporation with management by shareholders. Some common variations include: 1. Majority Shareholder Agreement: This type of agreement may be entered into when one shareholder holds a majority of the corporation's shares. It allows the majority shareholder to have greater decision-making power and control over important corporate matters. 2. Equal Shareholder Agreement: When all shareholders of a close corporation have an equal ownership stake, an equal shareholder agreement can be established. This type of agreement ensures that each shareholder has an equal say in corporate decisions and protects their rights. 3. Voting Trust Agreement: In some cases, shareholders may choose to create a voting trust agreement, whereby they collectively pool their voting rights to control the decision-making process. This can be beneficial when shareholders agree to consolidate their voting power to achieve a specific objective or retain corporate control. 4. Buy-Sell Agreement: A buy-sell agreement can also be a part of the Sacramento California Agreement of Shareholders of a Close Corporation with Management by Shareholders. This agreement sets out the terms and conditions for the purchase and sale of shares in the event of retirement, death, disability, or disagreement amongst shareholders. The Agreement of Shareholders governs key areas such as corporate governance, shareholder rights, management responsibilities, profit distribution, decision-making processes, dispute resolution mechanisms, and more. It provides a legal foundation to protect the interests of shareholders and maintain stability within the close corporation. It is crucial for shareholders to consult with attorneys or legal professionals experienced in corporate law and specifically in the state of California to ensure that the Agreement of Shareholders complies with local laws and regulations. This agreement offers a comprehensive framework that safeguards the interests of shareholders while promoting the efficient and effective management of the corporation.

Sacramento California Agreement of Shareholders of a Close Corporation with Management by Shareholders

Description

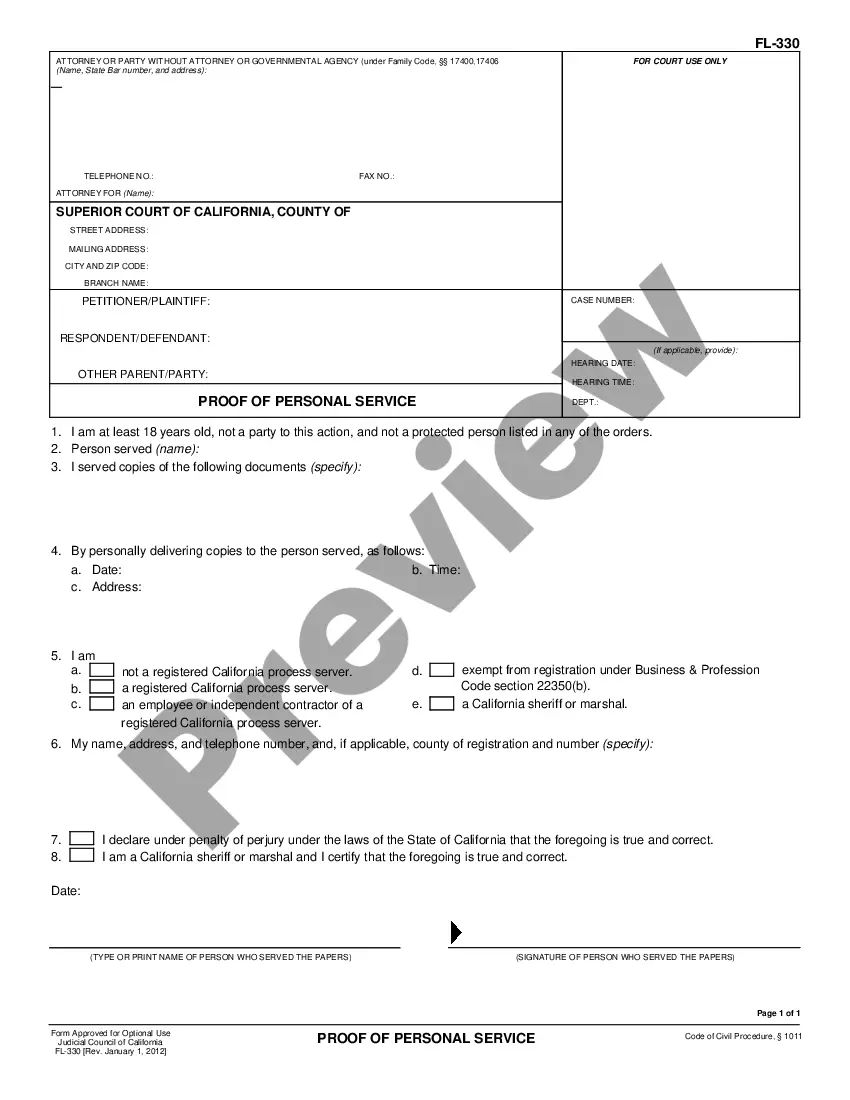

How to fill out Sacramento California Agreement Of Shareholders Of A Close Corporation With Management By Shareholders?

Draftwing paperwork, like Sacramento Agreement of Shareholders of a Close Corporation with Management by Shareholders, to take care of your legal matters is a tough and time-consumming task. Many cases require an attorney’s participation, which also makes this task not really affordable. However, you can acquire your legal affairs into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal documents created for a variety of scenarios and life circumstances. We make sure each document is in adherence with the laws of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the Sacramento Agreement of Shareholders of a Close Corporation with Management by Shareholders template. Simply log in to your account, download the template, and customize it to your requirements. Have you lost your document? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new customers is fairly easy! Here’s what you need to do before downloading Sacramento Agreement of Shareholders of a Close Corporation with Management by Shareholders:

- Make sure that your document is compliant with your state/county since the rules for writing legal documents may differ from one state another.

- Find out more about the form by previewing it or reading a quick intro. If the Sacramento Agreement of Shareholders of a Close Corporation with Management by Shareholders isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to begin using our website and download the form.

- Everything looks great on your side? Click the Buy now button and select the subscription option.

- Select the payment gateway and enter your payment information.

- Your template is good to go. You can try and download it.

It’s an easy task to locate and purchase the appropriate template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive collection. Sign up for it now if you want to check what other perks you can get with US Legal Forms!

Form popularity

FAQ

A California Close Corporation is a corporation designed to give its shareholders more control over the operation of their business. Instead of sitting back and letting others run the company, the owners of a Close Corporation typically act as the company's managers.

Statutory close corporations have existed in California since 1975. They are legally corporations, but offer several unique benefits. 1. A shareholders' agreement for a statutory close corporation can modify, and in many cases eliminate, the formalities and requirements that typically apply to corporations.

In California, you may form both a corporation or a close corporation. While many elements between these two entities remain the same, there are distinct differences that are critical for business owners to understand if they are considering one entity or the other.

A Shareholder Agreement, also known as a stockholder agreement or SPA, is a contract between the stock owners of a corporation that addresses the rights, responsibilities, and ownership of a corporation.

Close corporations are defined by state statute. Close corporation statutes generally permit shareholders to manage the business in place of directors. In such case, shareholders are liable for management decisions and have fiduciary duties.

Section 158 of the California Corporation Codes allows for the formation of close corporations. This section defines a close corporation as a corporation that does not have more than 35 shareholders, and that number of shares and shareholders of the corporation are specified in the Articles of Incorporation.

Shareholder management is the process of a company manages it's affairs with stakeholders. A well-structured and managed shareholder management process is important for every company, as it helps the owners record and keep track of all shares in the company and ensures control of the business is effective.

A shareholders' agreement includes a date; often the number of shares issued; a capitalization table that outlines shareholders and their percentage ownership; any restrictions on transferring shares; pre-emptive rights for current shareholders to purchase shares to maintain ownership percentages (for example, in the

At each annual general meeting of the company, one-third of the total number of directors must retire from office and be subject to re-election. Shareholders can remove a director from the board simply by failing to re-elect him. Executive directors, however, are exempt from this requirement.

The shareholders of any company have a responsibility to ensure that the company is well run and well managed. They do this by monitoring the performance of the company and raising their objections or giving their approval to the actions of the management of the company.