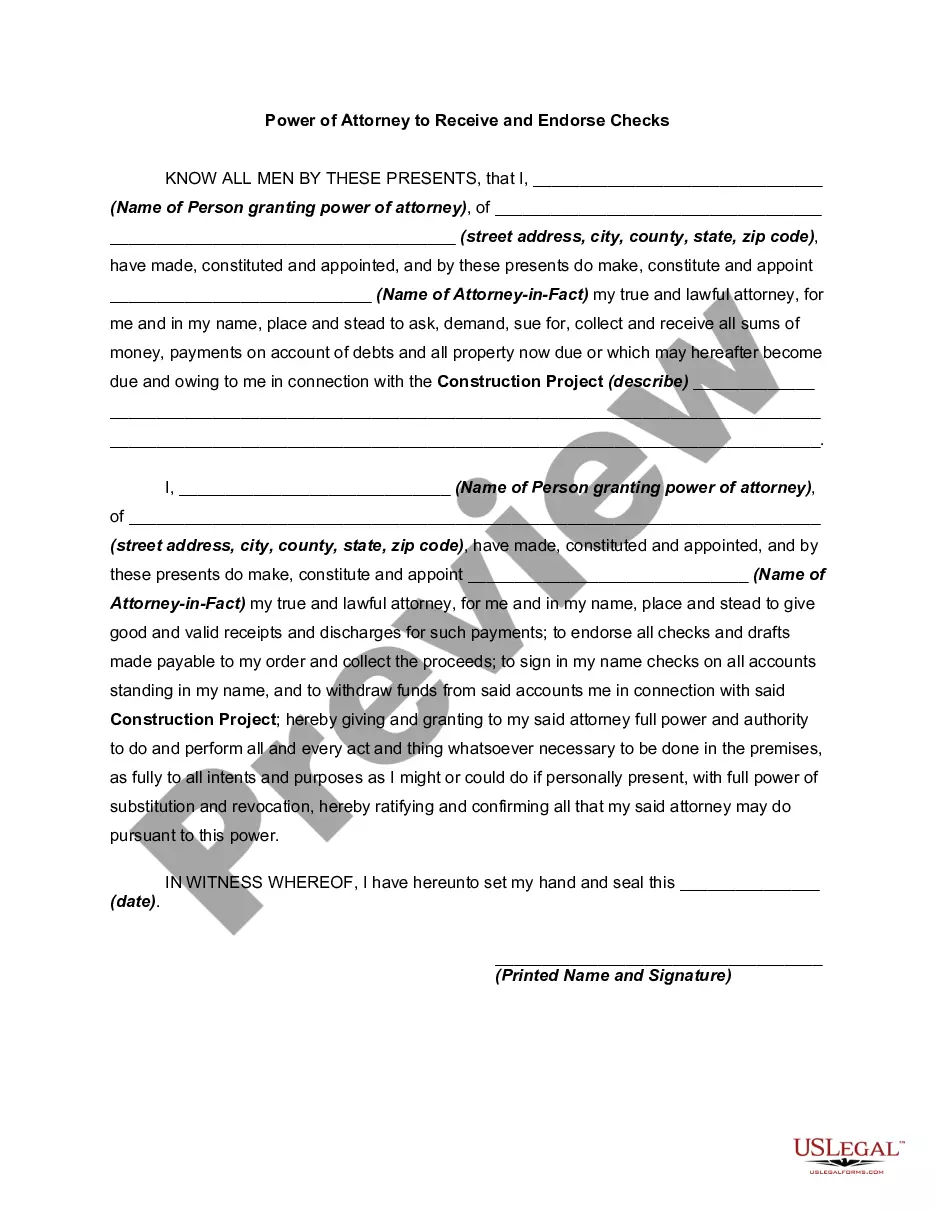

A power of attorney is an instrument containing an authorization for one to act as the agent of the principal. The person appointed is usually called an Attorney-in-Fact. A power of attorney can be either general or limited. This power of attorney is obviously limited.

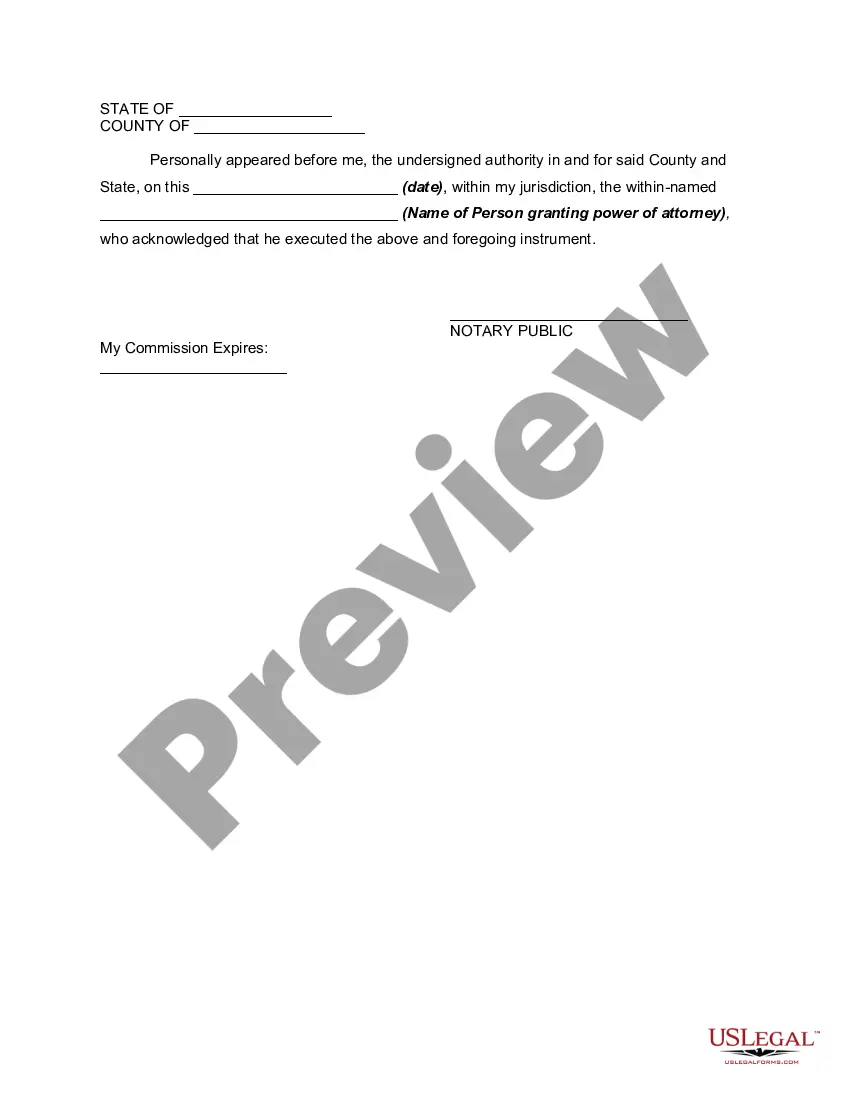

Cook Illinois Power of Attorney to Receive and Endorse Checks is a legal document that grants an individual or organization the authority to act on behalf of another person or entity to receive and endorse checks or other financial instruments in Cook County, Illinois. This power of attorney is commonly used in situations where an individual or entity is unable to personally receive and endorse their own checks due to physical or legal reasons. The Cook Illinois Power of Attorney to Receive and Endorse Checks allows the designated agent, also known as the attorney-in-fact, to perform various actions related to receiving and endorsing checks. This may include cashing or depositing checks into the principal's bank account, endorsing checks on behalf of the principal, and managing any associated financial tasks. There are different types of Cook Illinois Power of Attorney to Receive and Endorse Checks that cater to specific needs and preferences. Some common variations include limited power of attorney, durable power of attorney, and springing power of attorney. 1. Limited Power of Attorney: This type of power of attorney grants the agent limited authority to receive and endorse checks on behalf of the principal for a specific time period or a particular purpose. It may be suitable for temporary situations or specific financial transactions. 2. Durable Power of Attorney: A durable power of attorney remains effective even if the principal becomes incapacitated or mentally incompetent. It enables the agent to continue receiving and endorsing checks on behalf of the principal during such circumstances. 3. Springing Power of Attorney: A springing power of attorney only becomes effective when a specified event or condition occurs. For example, it may come into effect when the principal is declared mentally incapacitated by medical professionals. It is essential to consult with an attorney or legal professional when considering executing a Cook Illinois Power of Attorney to Receive and Endorse Checks to ensure it aligns with specific needs and adheres to the legal requirements in the state of Illinois.Cook Illinois Power of Attorney to Receive and Endorse Checks is a legal document that grants an individual or organization the authority to act on behalf of another person or entity to receive and endorse checks or other financial instruments in Cook County, Illinois. This power of attorney is commonly used in situations where an individual or entity is unable to personally receive and endorse their own checks due to physical or legal reasons. The Cook Illinois Power of Attorney to Receive and Endorse Checks allows the designated agent, also known as the attorney-in-fact, to perform various actions related to receiving and endorsing checks. This may include cashing or depositing checks into the principal's bank account, endorsing checks on behalf of the principal, and managing any associated financial tasks. There are different types of Cook Illinois Power of Attorney to Receive and Endorse Checks that cater to specific needs and preferences. Some common variations include limited power of attorney, durable power of attorney, and springing power of attorney. 1. Limited Power of Attorney: This type of power of attorney grants the agent limited authority to receive and endorse checks on behalf of the principal for a specific time period or a particular purpose. It may be suitable for temporary situations or specific financial transactions. 2. Durable Power of Attorney: A durable power of attorney remains effective even if the principal becomes incapacitated or mentally incompetent. It enables the agent to continue receiving and endorsing checks on behalf of the principal during such circumstances. 3. Springing Power of Attorney: A springing power of attorney only becomes effective when a specified event or condition occurs. For example, it may come into effect when the principal is declared mentally incapacitated by medical professionals. It is essential to consult with an attorney or legal professional when considering executing a Cook Illinois Power of Attorney to Receive and Endorse Checks to ensure it aligns with specific needs and adheres to the legal requirements in the state of Illinois.