A Bexar Texas Receipt for Payment of Account is a document used to acknowledge the payment of an outstanding balance by a customer to a business or organization located in Bexar County, Texas. This receipt serves as proof of payment and helps maintain accurate records for both parties involved. The Bexar Texas Receipt for Payment of Account typically includes important information such as the name and contact details of the payer and payee, the payment date, the amount paid, the invoice or account number, and any additional notes or comments related to the payment. This document serves as a legally binding acknowledgement of payment and helps to establish a clear paper trail for financial transactions. There may be different types of Bexar Texas Receipts for Payment of Account, which can be categorized based on the nature of the transaction or the specific business involved. Some common types include: 1. Retail Receipt for Payment of Account: This type of receipt is used in retail settings where customers make payments towards their account balances for products or services purchased. It is typically issued by stores, restaurants, or service providers. 2. Utility Receipt for Payment of Account: These receipts are used by utility companies such as electric, water, or gas providers in Bexar County. They acknowledge the payment made by customers towards their utility bills or any related charges. 3. Medical Receipt for Payment of Account: Medical facilities in Bexar County generate these receipts to record and acknowledge payments made by patients towards their medical bills or outstanding balances. 4. Educational Institution Receipt for Payment of Account: Schools, colleges, or universities in Bexar County may issue these receipts to students or their parents to confirm the payment of tuition fees, student loans, or any other educational expenses. 5. Professional Services Receipt for Payment of Account: Individuals or businesses providing professional services such as legal, accounting, or consulting services in Bexar County may issue these receipts to clients who make payments towards their outstanding account balances. It's important to note that while the content and format may vary slightly among different types of Bexar Texas Receipts for Payment of Account, the purpose remains the same: to acknowledge and document the payment made towards an outstanding account balance in Bexar County, Texas.

Bexar Texas Receipt for Payment of Account

Description

How to fill out Bexar Texas Receipt For Payment Of Account?

Preparing legal paperwork can be burdensome. In addition, if you decide to ask an attorney to draft a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Bexar Receipt for Payment of Account, it may cost you a lot of money. So what is the best way to save time and money and draft legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario gathered all in one place. Consequently, if you need the latest version of the Bexar Receipt for Payment of Account, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Bexar Receipt for Payment of Account:

- Glance through the page and verify there is a sample for your region.

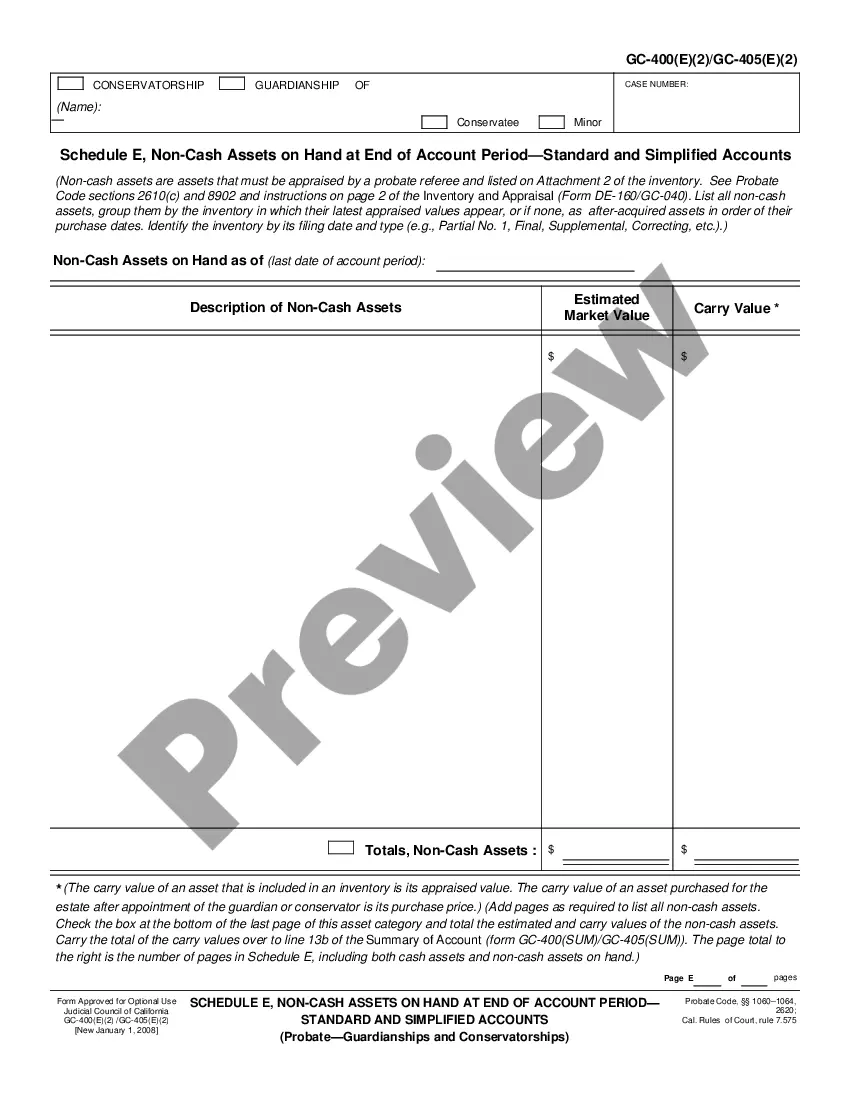

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the document format for your Bexar Receipt for Payment of Account and save it.

Once finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

You can find out how much your current taxes are and make your payment by going to the Property Tax Account Lookup application or you may request a statement by calling us at 972-547-5020 during business hours.

Yes. Texas law makes it the responsibility of the property owner to pay by the tax deadline, even if you do not receive the bill through the U.S. Postal Service. You can view your bill online or send an email request to TaxOffice@TravisCountyTX.gov.

Real estate taxes are the same as real property taxes. They are levied on most properties in America and paid to state and local governments. The funds generated from real estate taxes (or real property taxes) are typically used to help pay for local and state services.

You can pay your property tax online using an eCheck, a credit or debit card, or PayPal. You will immediately receive an emailed receipt. Payments made online by p.m. Central Standard Time on January 31 are considered timely.

When Are Texas Property Taxes Due Exactly? The final Texas property tax due date is January 31st every year. Technically, your property taxes are due as soon as you receive a tax bill. However, you have until January 31st to pay without accruing interest fees or penalties.

The steps for making payments via OTPP as follows; Step 1 - Login to your Bank Portal. User Name.Step 2 - Select Make a Payment option from the main menu.Step 3 Selecting the Payee.Step 4 - Search IRD Details.Step 5: Self-Assessed payment.Step 6: Non Self-Assessed payment.

The Property Tax Lien While the state of Texas doesn't set a specific timeframe for foreclosure, Section 32 of the Texas Tax Code does grant a tax lien on all properties as of January 1 of each year until the property taxes are paid.

You can view your bill online or send an email request to TaxOffice@TravisCountyTX.gov. State law requires you pay your taxes when you receive the bill.

For your convenience, the Bexar County Tax Office offers the option of paying your Property Taxes online with either a major credit card or an electronic check (eCheck).