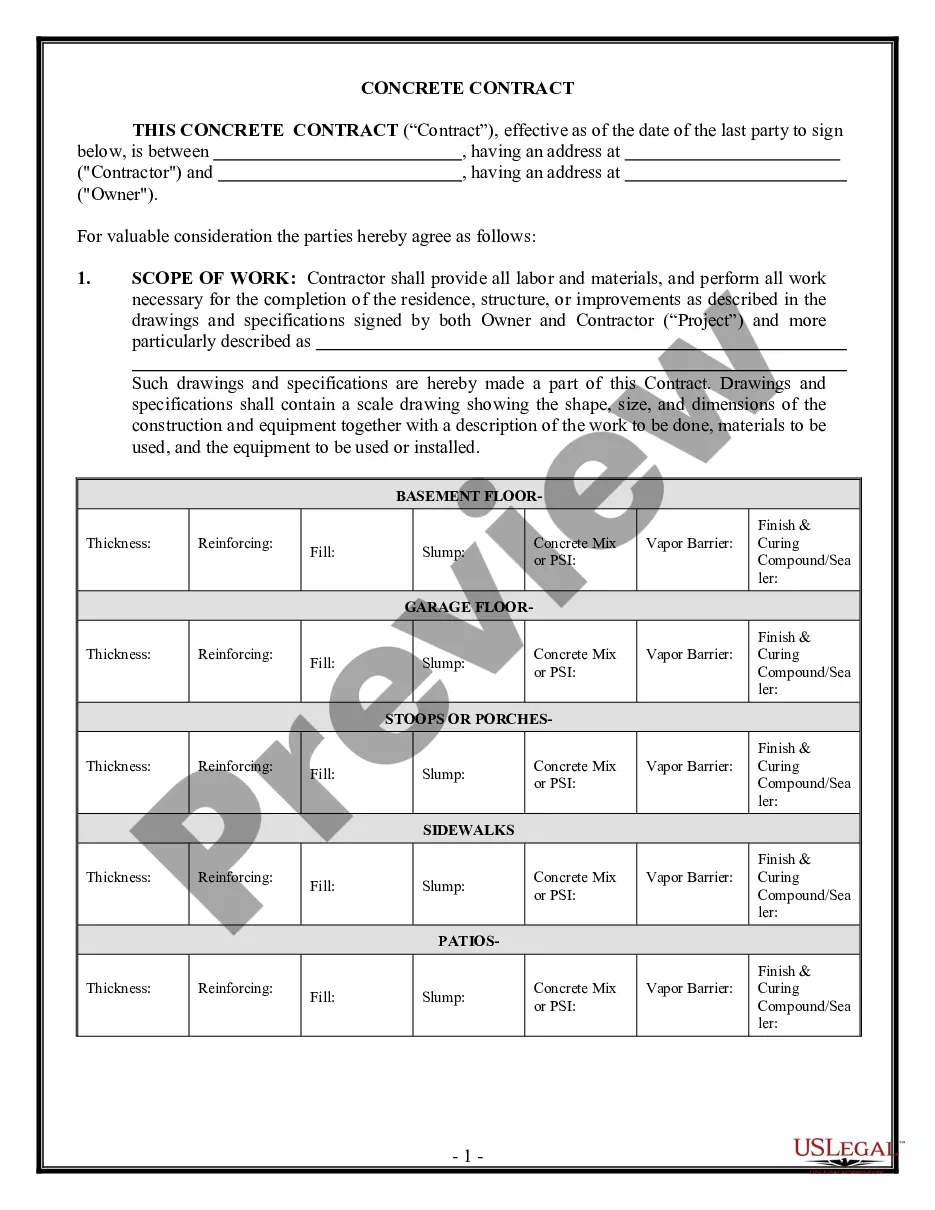

A Chicago Illinois Receipt for Payment of Account is a legal document that serves as proof of payment for a specific account with a designated entity in Chicago, Illinois. It outlines the transaction details, including the date, amount paid, and the purpose for which the payment was made. This receipt is utilized by both businesses and individuals to keep track of financial activities accurately and efficiently. Keywords: Chicago, Illinois, receipt, payment, account, legal document, proof of payment, transaction details, date, amount paid, purpose, financial activities. Types of Chicago Illinois Receipts for Payment of Account include: 1. Business Receipts: These are issued by businesses to acknowledge the payment received from their customers or clients against their accounts. They contain relevant details such as the business's name, address, contact information, and a unique receipt number. 2. Rental Receipts: Landlords or property management companies issue rental receipts whenever tenants pay their rent or related expenses. The receipts include information regarding the property address, tenant's name, date of payment, rental period, and the total amount paid. 3. Utility Bill Receipts: Utility service providers, such as electric, gas, water, or waste management companies, issue receipts when customers make payments towards their utility bills in Chicago, Illinois. These receipts typically include the customer's account number, payment due date, billing period, and the total amount paid. 4. Membership/Credit Card Receipts: Organizations or institutions that offer memberships or operate credit card systems issue receipts to their members or customers for payments made towards their accounts. These receipts contain details such as the member/customer's name, account number, date of payment, and the amount paid. 5. Medical Bill Receipts: Healthcare providers, hospitals, clinics, or healthcare facilities issue receipts to their patients as proof of payment for medical services rendered. These receipts consist of the patient's name, date of service, description of charges, insurance information (if applicable), and the total amount paid. 6. Tax Payment Receipts: The Internal Revenue Service (IRS), along with the Illinois Department of Revenue, issues receipts when individuals or businesses in Chicago pay their taxes. These receipts include the taxpayer's name, taxpayer identification number, date of payment, and the amount paid towards taxes owed. In summary, a Chicago Illinois Receipt for Payment of Account is a crucial documentation tool used to record and verify various types of payments made by businesses, individuals, or organizations. Whether it is for rent, utilities, memberships, medical bills, taxes, or other financial transactions, receipts provide both the payer and payee with a clear record of the payment details.

Chicago Illinois Receipt for Payment of Account

Description

How to fill out Chicago Illinois Receipt For Payment Of Account?

A document routine always accompanies any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and lots of other life situations require you prepare official paperwork that differs throughout the country. That's why having it all collected in one place is so beneficial.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. Here, you can easily locate and get a document for any personal or business objective utilized in your county, including the Chicago Receipt for Payment of Account.

Locating forms on the platform is extremely simple. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the Chicago Receipt for Payment of Account will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guideline to get the Chicago Receipt for Payment of Account:

- Ensure you have opened the right page with your localised form.

- Use the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form corresponds to your needs.

- Search for another document using the search option in case the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Decide on the suitable subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Chicago Receipt for Payment of Account on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

You may choose to file online using computer tax preparation (Tax-Prep) software. This allows you to file your IL-1040 electronically using department approved commercial software or web-based applications.

You can file Form ST-1, Sales and Use Tax and E911 Surcharge electronically using MyTax Illinois to report your sales and use tax liability. If you are reporting sales for more than one location or from a changing location, you must also submit Form ST-2, Multiple Site Form.

Individual Income Tax Addresses AreaAddressIL-1040, Illinois Individual Income Tax ReturnWithout Payment PO BOX 19041 SPRINGFIELD IL 62794-9041 With Payment PO BOX 19027 SPRINGFIELD IL 62794-9027IL-1040-ES, Estimated Income Tax Payments for IndividualsILLINOIS DEPARTMENT OF REVENUE SPRINGFIELD IL 62736-00014 more rows

The Illinois sales tax rate is currently 6.25%. The County sales tax rate is 1.75%. The Chicago sales tax rate is 1.25%.

Quick This blog provides instructions on how to file and pay sales tax in Illinois using form ST-1. This is the most commonly used form to file and pay sales tax in Illinois. However, if you are filing a past due return, be sure to select the correct version of this form.

The City does not impose an income tax on residents or workers in Chicago. All residents of Illinois, including Chicago residents, are subject to State and Federal income taxes.

Make sure your check or money order includes the following information: Your name and address. Daytime phone number. Social Security number (the SSN shown first if it's a joint return) or employer identification number. Tax year. Related tax form or notice number.

A nonresident alien, you must file Form IL-1040 if your income is taxed under federal income tax law. You must attach a copy of your federal Form 1040NR, U.S. Nonresident Alien Income Tax Return, or federal Form 1040NR-EZ, U.S. Income Tax Return for Certain Nonresident Aliens With No Dependents.

To file a City of Chicago tax return via our web site please visit . All you need is your IRIS (Integrated Revenue Information System) account number and your unique PIN to begin the filing process.

Can I file this return and pay the tax due electronically? Yes, you can use MyTax Illinois at mytax.illinois.gov to file your Form ST-1, and, if applicable, Form ST-2 and Schedule GT. MyTax Illinois also allows for electronic payment of any tax due.

More info

My tuition, fees, and insurance will not go ahead because I do not have my license. Fill out a Rent Receipt to keep track of rent payments while my license is in my name, and you can log in using your WIPED username and password. My tuition will go ahead, but can you refund the money I originally paid to you? You can fill out a Refund Receipt from the “Payment History” tab. Once you have completed the Refund Receipt, we can check whether you have made a payment in the account and determine whether the money is available to be refunded, or you can provide additional information about the payment that would help us to process our refund. Is the Office of Financial Aid an automated system or can I talk with a representative? The Office of Financial Aid is an automated system that processes payments, student and parent data, financial aid information, and reports to the WIPED. Any phone calls, e-mails, or visits to the office by a student or parent, are strictly prohibited.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.