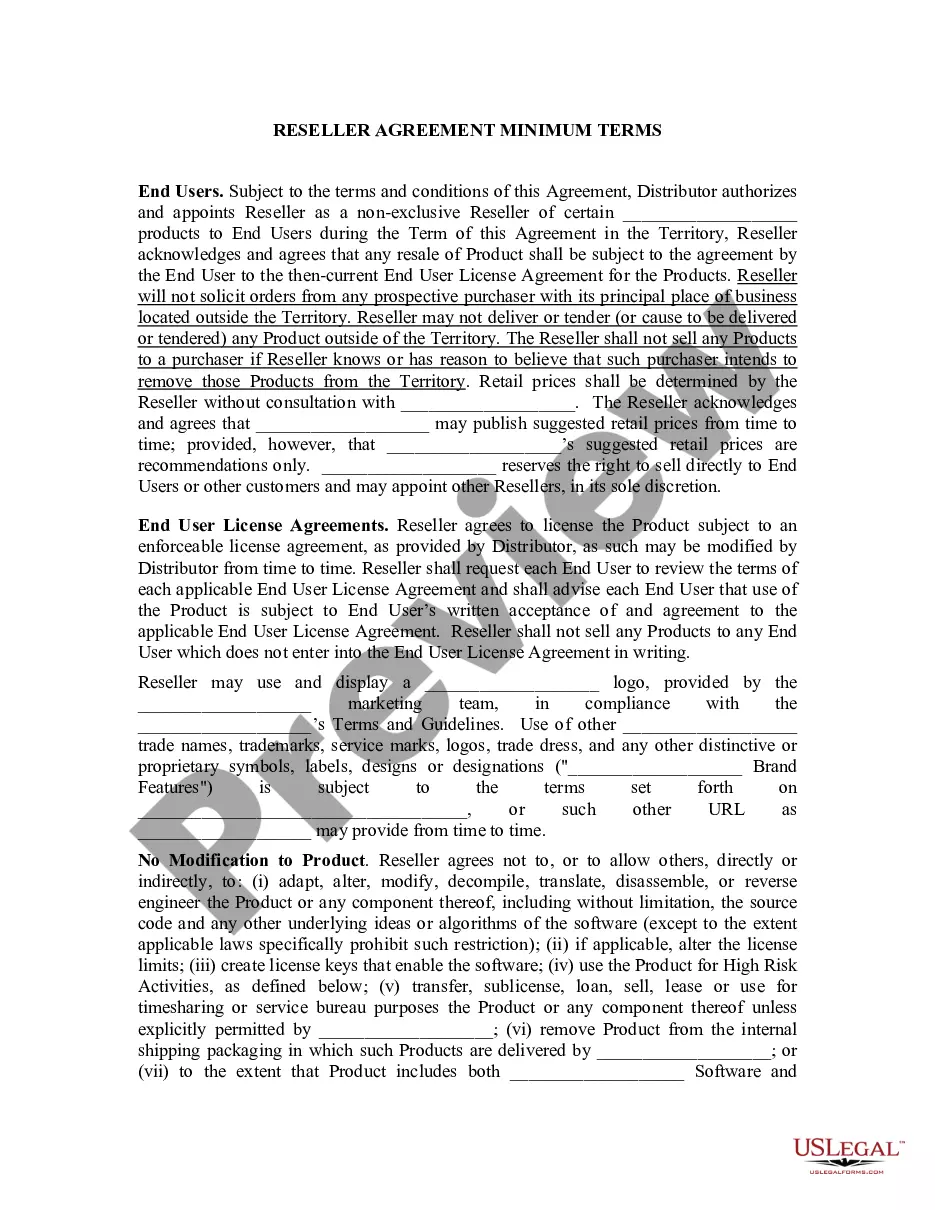

When it comes to financial transactions, it is essential to have proper documentation to ensure accountability and record-keeping. One such critical document is the Montgomery Maryland Receipt for Payment of Account. This receipt serves as proof of payment and demonstrates that a specific account has been settled. It includes various essential details to validate the payment process while safeguarding both the payer and the payee. The Montgomery Maryland Receipt for Payment of Account typically contains the following information: 1. Name and contact details: The receipt includes the name, address, phone number, and email address of the company or person providing the product or service and the recipient of the payment. 2. Date of payment: It is crucial to mention the exact date on which the payment was made. This helps in organizing and tracking financial transactions accurately. 3. Payment method: The receipt specifies the mode of payment chosen by the payer, whether it's cash, check, credit/debit card, or electronic transfer. This information ensures transparency and empowers both parties to reconcile their records. 4. Amount and currency: The total payment amount is stated clearly on the receipt, along with the currency used. It ensures there is no ambiguity regarding the payment made. 5. Description of products/services: This section provides a detailed breakdown of the products or services for which the payment has been made. It may include item names, quantities, unit prices, and any additional charges such as taxes or fees. 6. Account details: If applicable, the receipt might mention specific account details, such as an account number or invoice number. This assists in cross-referencing the payment with the corresponding account, ensuring accuracy and alignment. 7. Signature and stamp: A receipt often includes a space for the recipient to sign and stamp, acknowledging the payment received. This adds an extra layer of authenticity and accountability. Different types of Montgomery Maryland Receipts for Payment of Account can be categorized based on the nature of the transaction or the industry involved. Some common examples include: 1. Retail Receipts: These receipts are issued by retail stores or online vendors to confirm the payment for purchases made by customers. 2. Invoice Receipts: In business-to-business (B2B) transactions, vendors issue invoice receipts to their clients as proof of payment for goods or services rendered. 3. Rent Payment Receipts: Landlords provide this receipt to tenants to acknowledge the payment of monthly rent, ensuring a cohesively managed rental agreement. 4. Utility Payment Receipts: Utility service providers, such as electricity, water, or gas companies, issue receipts when customers make payments towards their bills. 5. Membership/Subscription Payment Receipts: Organizations offering memberships or subscriptions issue receipts when payments are made, ensuring clarity and transparency in financial transactions. Having a well-documented Montgomery Maryland Receipt for Payment of Account is crucial for financial management, auditing, and legal purposes. It ensures that both parties involved have a clear record of the payment and serves as a safeguard against any disputes or misunderstandings that may arise in the future.

Montgomery Maryland Receipt for Payment of Account

Description

How to fill out Montgomery Maryland Receipt For Payment Of Account?

If you need to get a reliable legal document supplier to find the Montgomery Receipt for Payment of Account, consider US Legal Forms. Whether you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate template.

- You can search from over 85,000 forms categorized by state/county and situation.

- The self-explanatory interface, variety of learning resources, and dedicated support team make it easy to locate and complete various papers.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

You can simply type to look for or browse Montgomery Receipt for Payment of Account, either by a keyword or by the state/county the document is created for. After locating needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to get started! Simply locate the Montgomery Receipt for Payment of Account template and check the form's preview and description (if available). If you're comfortable with the template’s language, go ahead and click Buy now. Register an account and select a subscription plan. The template will be immediately available for download as soon as the payment is processed. Now you can complete the form.

Handling your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our extensive variety of legal forms makes this experience less pricey and more reasonably priced. Set up your first business, organize your advance care planning, draft a real estate agreement, or execute the Montgomery Receipt for Payment of Account - all from the convenience of your home.

Sign up for US Legal Forms now!