San Antonio Texas Receipt for Payment of Account: Detailed Description and Types A San Antonio Texas Receipt for Payment of Account is a legal document that serves as proof of payment for services or goods rendered by an individual or business located in San Antonio, Texas. It ensures transparency, protects the rights of both parties involved, and allows for easy record-keeping. This receipt typically includes several key elements, such as: 1. Header: It usually contains the logo, name, and contact information of the business or individual issuing the receipt, including their mailing address, telephone number, and email address. 2. Date and Receipt Number: The receipt should bear the date of the transaction and a unique identifier, such as a receipt number, to help keep track of payments. 3. Customer Information: The name, address, and contact details of the customer or client utilizing the services or purchasing the goods. 4. Description of Goods or Services: A detailed breakdown or description of the goods or services provided must be included. It may consist of item names, quantities, unit prices, and any applicable taxes or discounts. 5. Total Amount Paid: The receipt should clearly state the total amount paid, including all taxes and fees. 6. Payment Method: The method used to make the payment should be mentioned, whether it was made in cash, check, credit card, electronic funds transfer, or any other acceptable form of payment. Furthermore, depending on the nature of the transaction, there may be various types of San Antonio Texas Receipts for Payment of Account, including: 1. Retail Receipt: Typically issued by a retail store or business for the purchase of goods by a customer. 2. Service Receipt: This type of receipt is generated when a service-based business, such as a salon, repair service, or consultancy, receives payment for their services. 3. Rental Receipt: Used by rental property owners or property management companies to acknowledge rental payments received from tenants. 4. Invoice Receipt: When a business or contractor provides an invoice for goods or services rendered, the customer's payment acknowledgment will be in the form of an invoice receipt. 5. Online Payment Receipt: In the digital age, online payments are widely used. A receipt is generated electronically or emailed to customers to confirm their payment for online purchases or services. It is essential to retain and organize San Antonio Texas Receipts for Payment of Account, as they serve as proof of payment in case of any disputes, warranty claims, or for bookkeeping purposes. All involved parties should keep a copy for their records, ensuring transparency and accurate financial tracking.

San Antonio Texas Receipt for Payment of Account

Description

How to fill out San Antonio Texas Receipt For Payment Of Account?

Whether you intend to open your business, enter into an agreement, apply for your ID renewal, or resolve family-related legal concerns, you must prepare certain paperwork meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal templates for any individual or business case. All files are grouped by state and area of use, so opting for a copy like San Antonio Receipt for Payment of Account is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several additional steps to obtain the San Antonio Receipt for Payment of Account. Adhere to the instructions below:

- Make certain the sample meets your individual needs and state law regulations.

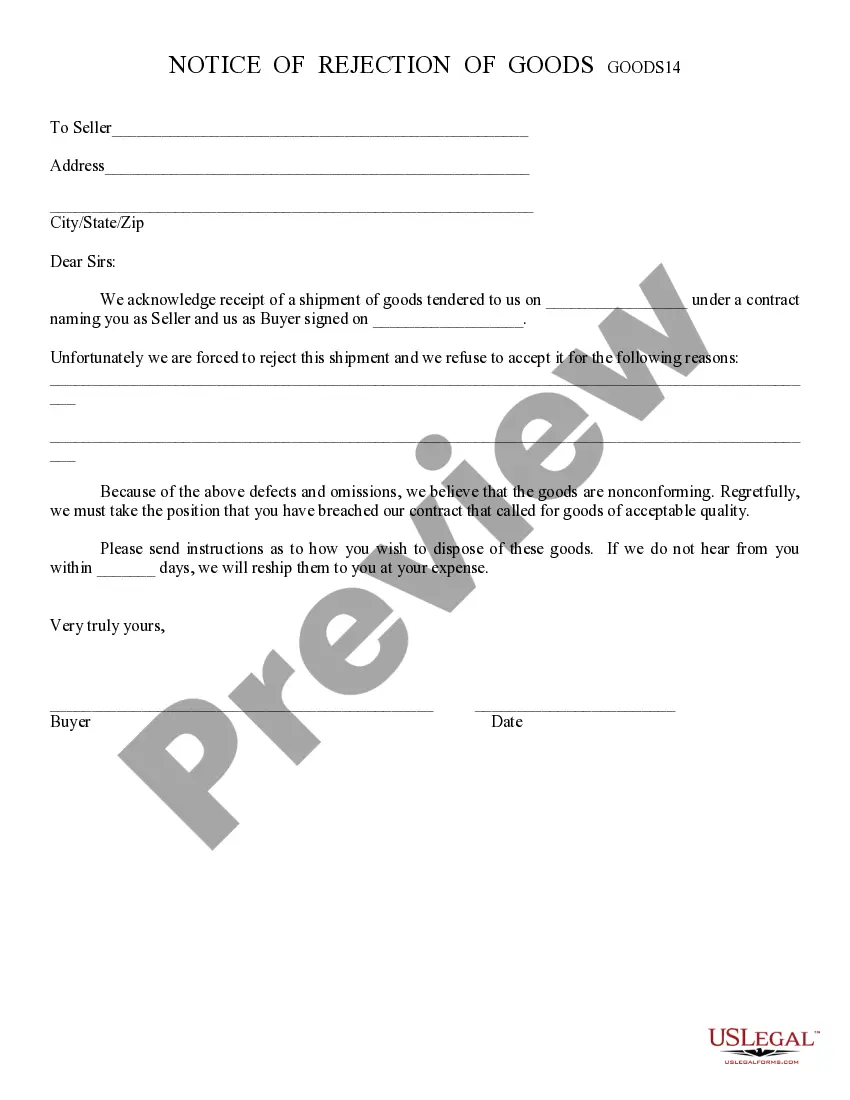

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab providing your state above to locate another template.

- Click Buy Now to get the file when you find the proper one.

- Opt for the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the San Antonio Receipt for Payment of Account in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you can access all of your previously purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!