San Diego, California Receipt for Payment of Account is a legal document that serves as evidence of a financial transaction between a buyer and a seller or a debtor and a creditor. This receipt acknowledges the payment made by the buyer or debtor to settle their outstanding account balance with the seller or creditor in the city of San Diego. The San Diego California Receipt for Payment of Account typically contains several key details, including the following: 1. Date: The date when the payment is made and the receipt is issued. 2. Receipt Number: A unique serial number for identification and record-keeping purposes. 3. Buyer/Debtor Information: Name, address, and contact details of the individual or entity making the payment. 4. Seller/Creditor Information: Name, address, and contact details of the individual or entity receiving the payment. 5. Account Information: Specifics about the account being settled, such as an account number or reference number. 6. Payment Details: The amount paid, the payment method used (e.g., cash, credit card, check), and any additional fees or discounts applicable. 7. Description of Goods/Services: A brief description of the goods sold or services rendered, if applicable. 8. Terms and Conditions: Any relevant terms or conditions associated with the payment, such as late payment penalties, installment agreements, or payment due dates. 9. Signatures: Both the buyer/debtor and the seller/creditor should sign the receipt to acknowledge the completion of the payment transaction. Different types of San Diego California Receipts for Payment of Account may exist based on the specific nature of the financial transactions involved. These may include: 1. Retail Purchase Receipt: A receipt issued by retail establishments in San Diego, California, to confirm the payment made by a customer for goods purchased. 2. Service Payment Receipt: A receipt given by service providers in San Diego, California, to acknowledge the payment made by a client for services rendered. 3. Rental Payment Receipt: A receipt provided by landlords or property management companies in San Diego, California, to validate the payment made by a tenant for rental purposes. 4. Loan Repayment Receipt: A receipt issued by lenders or financial institutions in San Diego, California, to verify the payment made by a borrower to repay an outstanding loan amount. 5. Invoice Payment Receipt: A receipt used to confirm the payment made by a customer to settle an invoice issued by a business or seller in San Diego, California. It is essential to retain a copy of the San Diego California Receipt for Payment of Account as it serves as proof of payment and provides a reference for both the payer and the payee in the event of any future disputes or discrepancies.

San Diego California Receipt for Payment of Account

Description

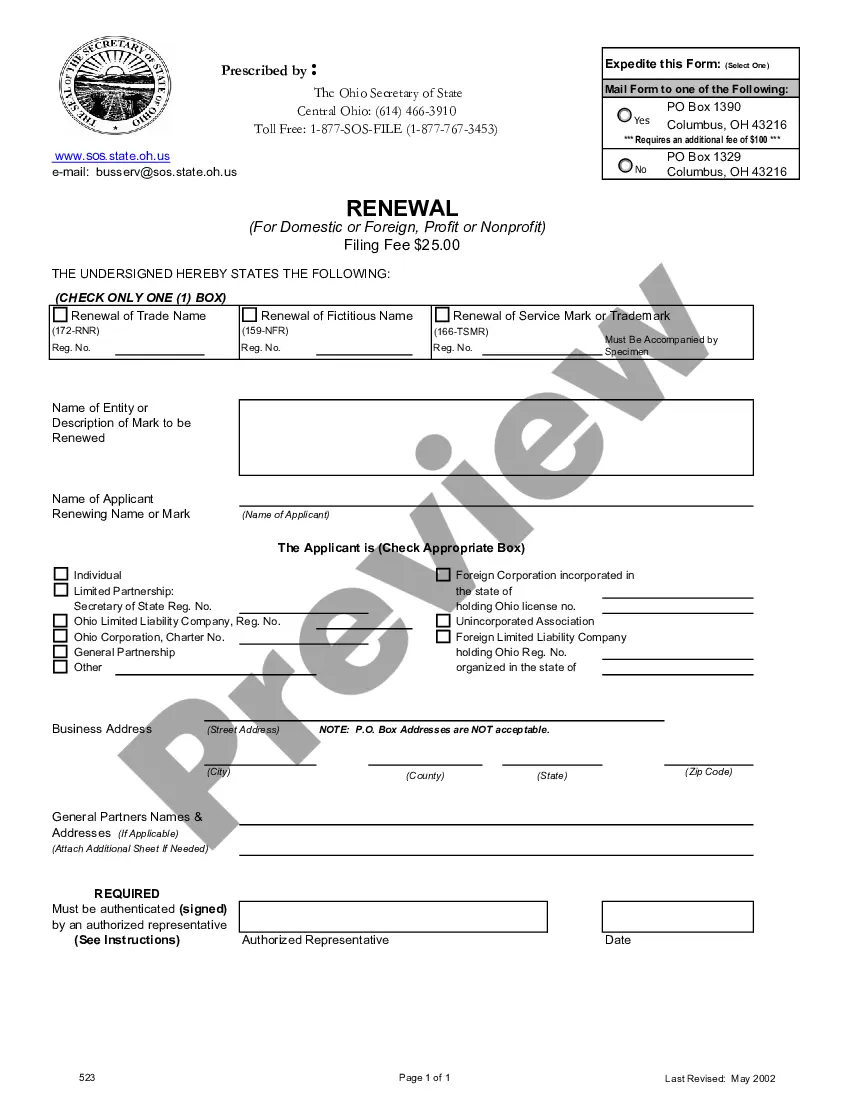

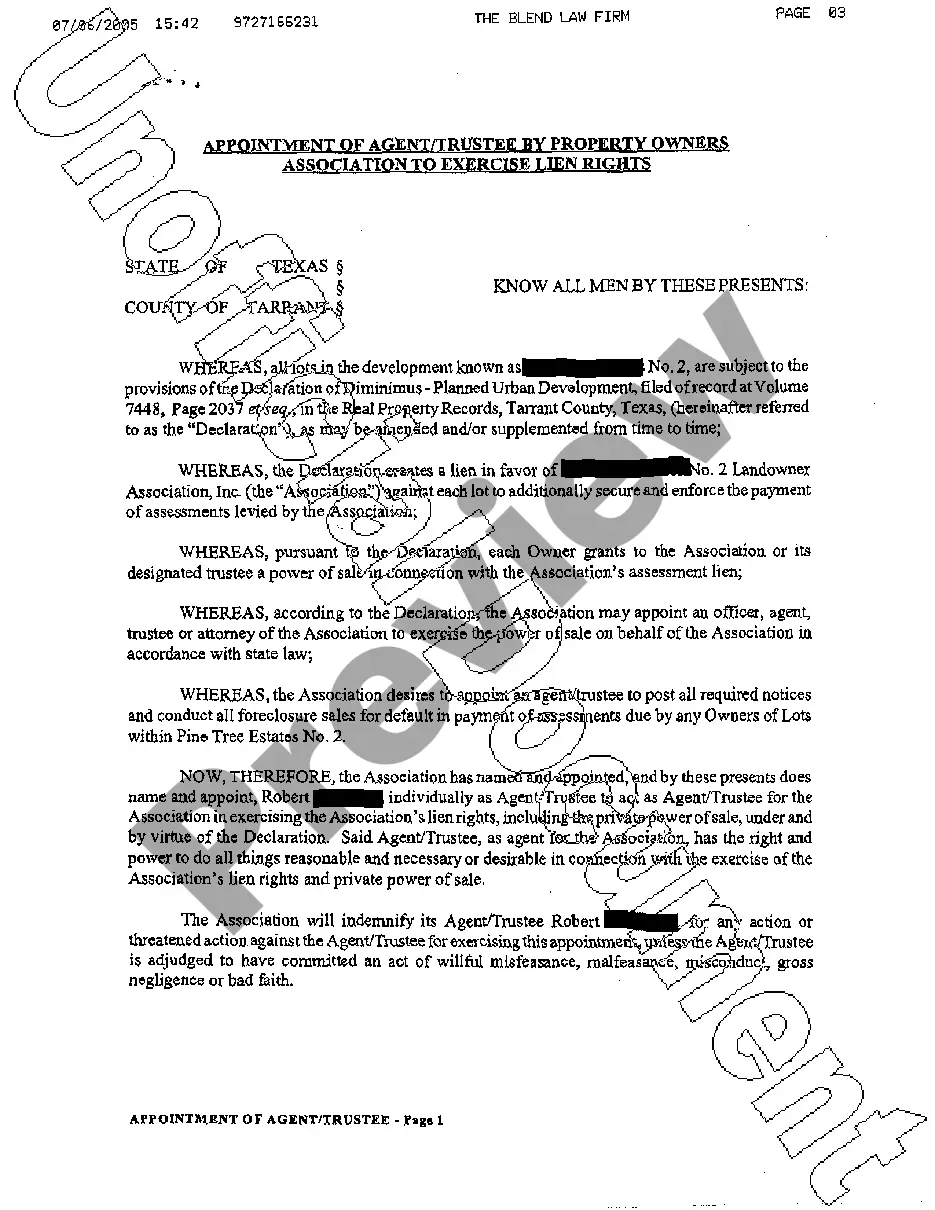

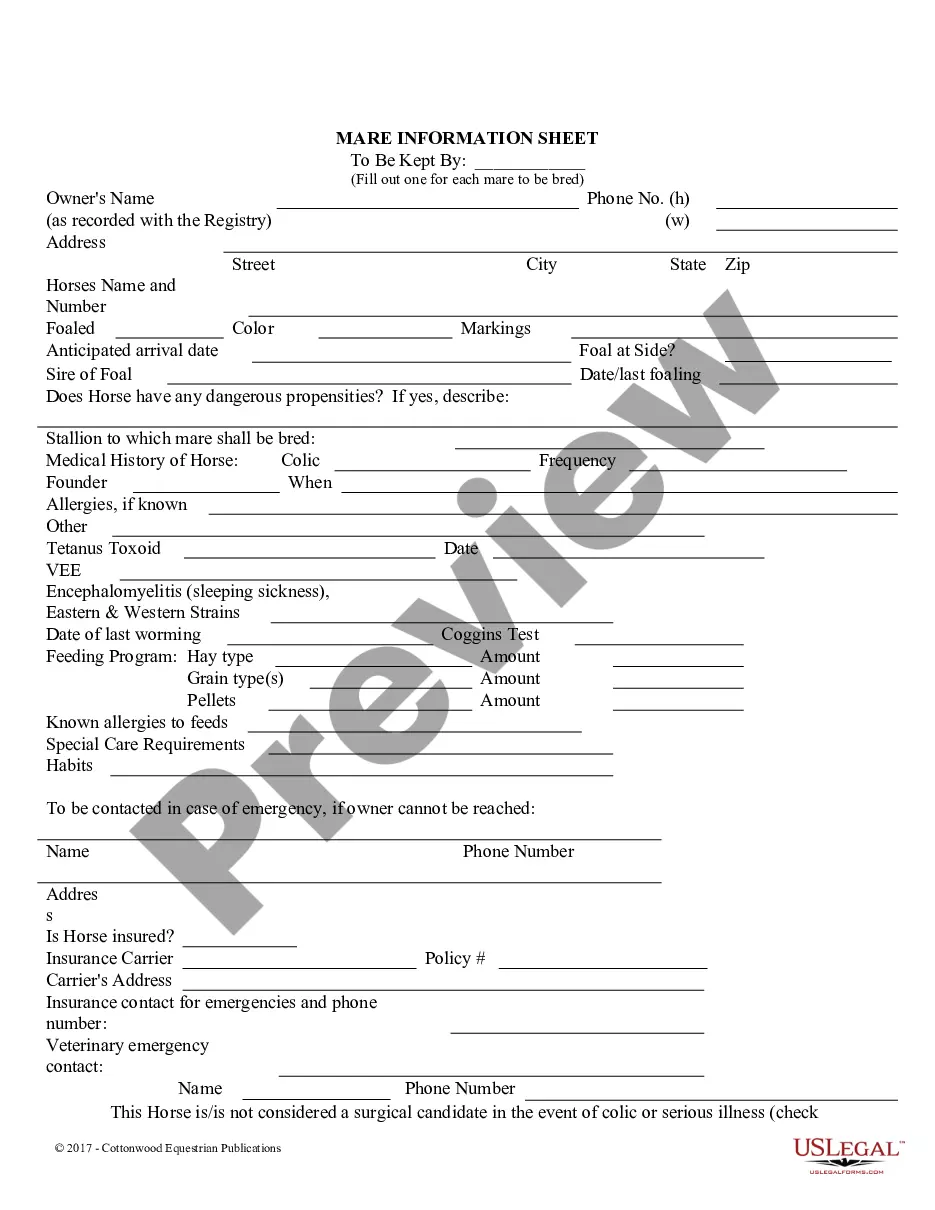

How to fill out San Diego California Receipt For Payment Of Account?

Preparing legal documentation can be difficult. Besides, if you decide to ask a legal professional to write a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the San Diego Receipt for Payment of Account, it may cost you a fortune. So what is the most reasonable way to save time and money and draw up legitimate forms in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario gathered all in one place. Therefore, if you need the current version of the San Diego Receipt for Payment of Account, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the San Diego Receipt for Payment of Account:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the file format for your San Diego Receipt for Payment of Account and download it.

When finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

Disaster risk reduction (DRR) is a systematic approach to identifying, assessing and reducing the risks of disaster. It aims to reduce socio-economic vulnerabilities to disaster as well as dealing with the environmental and other hazards that trigger them.

If you do not receive your annual tax bill by November 1, you should request one. You will need your PIN number, which you can find on a previous year's tax bill, or the address of the property. You may request a bill via our online payment system or call (951) 955-3900.

Where can I obtain a copy of my tax bill? You may call the Tax Collector's Office at (877) 829-4732 or email taxman@sdcounty.ca.gov for information.

Is Revenue Recovery Inc Legit, Fake Or A Scam? Revenue Recovery Inc is a legitimate company. They are not a fake company, or a scam. But, they may spam call and harass you.

The County of San Diego Assessor's Office can provide information about any parcel of land located within the County of San Diego . The office can also be reached at 619-236-3771. Properties owned by the City of San Diego can be viewed at the Map of City-owned Land.

Why are you intercepting my tax refund? Revenue and Recovery participates in the State and Federal Tax Refund Intercept Programs. Welfare overpayments, court ordered fines, restitution, and dependency attorney fees are just a few of the types of delinquent accounts that are subject to tax intercept.

A3. Yes, the 2020 Recovery Rebate Credit can be reduced to pay debts owed to other federal government agencies (separate from federal income tax debt) as well as to state agencies. Keep in mind that the credit is part of your 2020 tax refund and your tax refund is subject to any offset.

Payment Forms In-Person Cash, Personal or Business Check, Money Order, Cashier's Check, Credit Card (No eCheck or Debit in Person). Online eCheck, Credit Card, Visa Debit Card, Wire Transfer. Mail Personal or Business Check, Money Order, Cashier's Check.

You may pay your Business Tax billing statement online using Visa, MasterCard, and Electronic Fund Transfer (eCheck). Payments processed after p.m. (PST) will post the following business day; any penalties accrued during this time may apply.

The Revenue Recovery Team collects court fines as directed by the Superior Court of California, outstanding fees due to the county in association to court cases, victim restitution, and other delinquent fees owed to various county departments.