Orange California Disputed Open Account Settlement is a legal process that aims to resolve financial disputes between parties in Orange, California. It involves the settlement of an open account, which refers to an outstanding debt or payment that is due to a creditor. This settlement process is designed to reach a resolution and mitigate the need for litigation. Keywords: Orange California, disputed open account settlement, legal process, financial disputes, open account, outstanding debt, payment, creditor, resolution, litigation. There are a few types of Orange California Disputed Open Account Settlement that individuals or businesses may encounter: 1. Individual Disputed Open Account Settlement: This refers to disputes between two individuals over an open account, such as unpaid loans, credit card debts, or unpaid services. 2. Business Disputed Open Account Settlement: In this type of settlement, disputes arise between businesses regarding outstanding payments for goods, services, or contractual obligations. 3. Legal Disputed Open Account Settlement: This type of settlement involves the engagement of legal professionals, such as attorneys or mediators, to facilitate the resolution process between the parties involved in the disputed open account. 4. Small Claims Disputed Open Account Settlement: Small claims court can be utilized when the disputed amount is within a specific monetary limit. This settlement type provides a simplified and expedited process for resolving disputes. 5. Settlement Agreements: Once an agreement is reached between the parties involved in the disputed open account, a settlement agreement is typically drafted. This legal document outlines the terms and conditions of the settlement, including payment terms, dispute resolution clauses, or any other agreed-upon terms. 6. Credit Reporting Disputed Open Account Settlement: If a disputed open account has negatively impacted an individual's credit report, a settlement can include provisions to remove or update the account information to accurately reflect the resolution. In Orange California, the Disputed Open Account Settlement process is an essential step to resolve financial disputes without resorting to prolonged legal battles. It enables parties to reach a mutually agreed-upon solution and move forward towards a resolution. Keywords: Orange California, disputed open account settlement, individual, business, legal, small claims, settlement agreements, credit reporting.

Orange California Disputed Open Account Settlement

Description

How to fill out Orange California Disputed Open Account Settlement?

How much time does it normally take you to create a legal document? Given that every state has its laws and regulations for every life scenario, locating a Orange Disputed Open Account Settlement meeting all regional requirements can be tiring, and ordering it from a professional lawyer is often pricey. Numerous web services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web catalog of templates, collected by states and areas of use. In addition to the Orange Disputed Open Account Settlement, here you can get any specific document to run your business or individual affairs, complying with your regional requirements. Experts check all samples for their actuality, so you can be sure to prepare your paperwork properly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed sample, and download it. You can get the file in your profile anytime in the future. Otherwise, if you are new to the platform, there will be some extra actions to complete before you get your Orange Disputed Open Account Settlement:

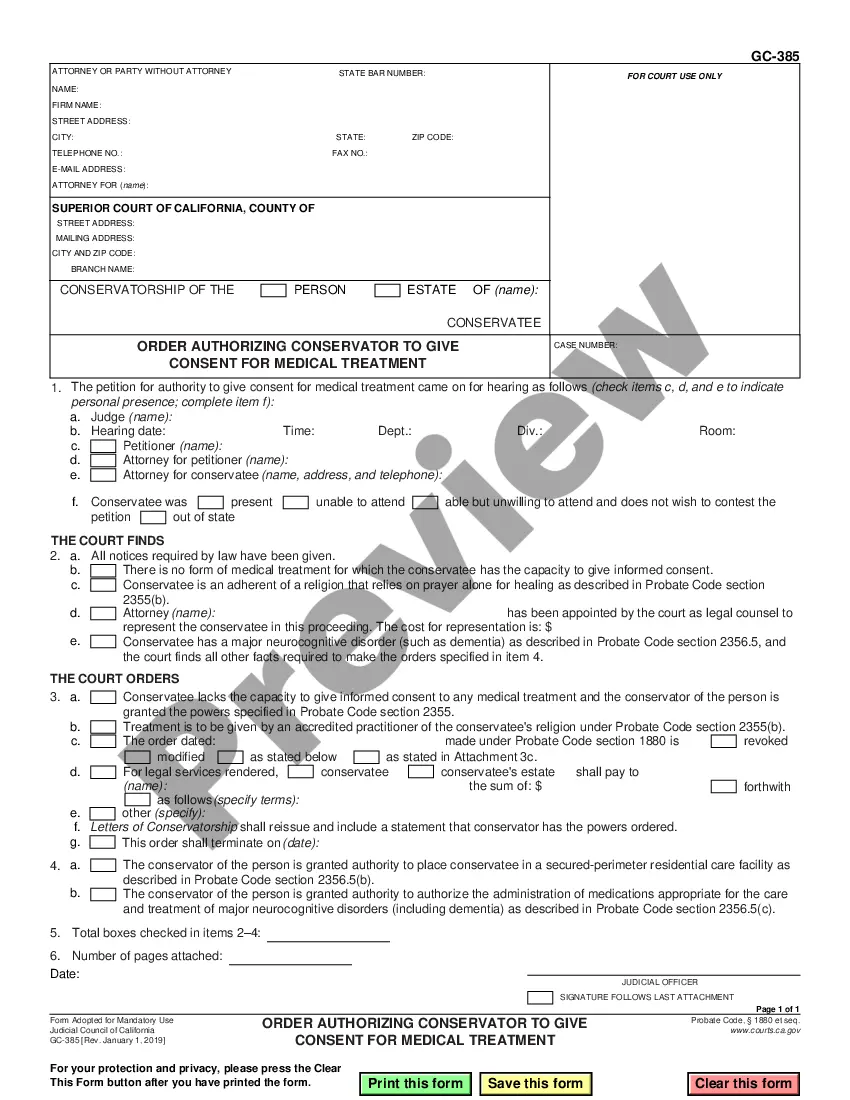

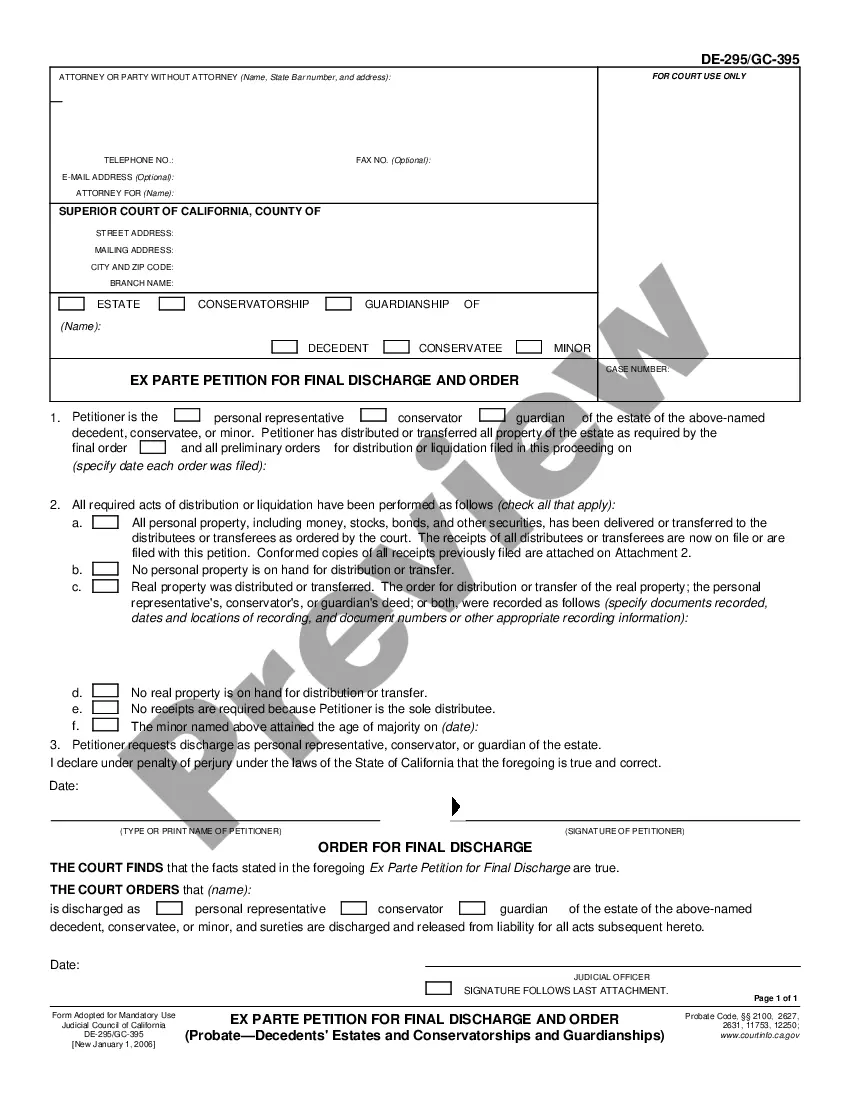

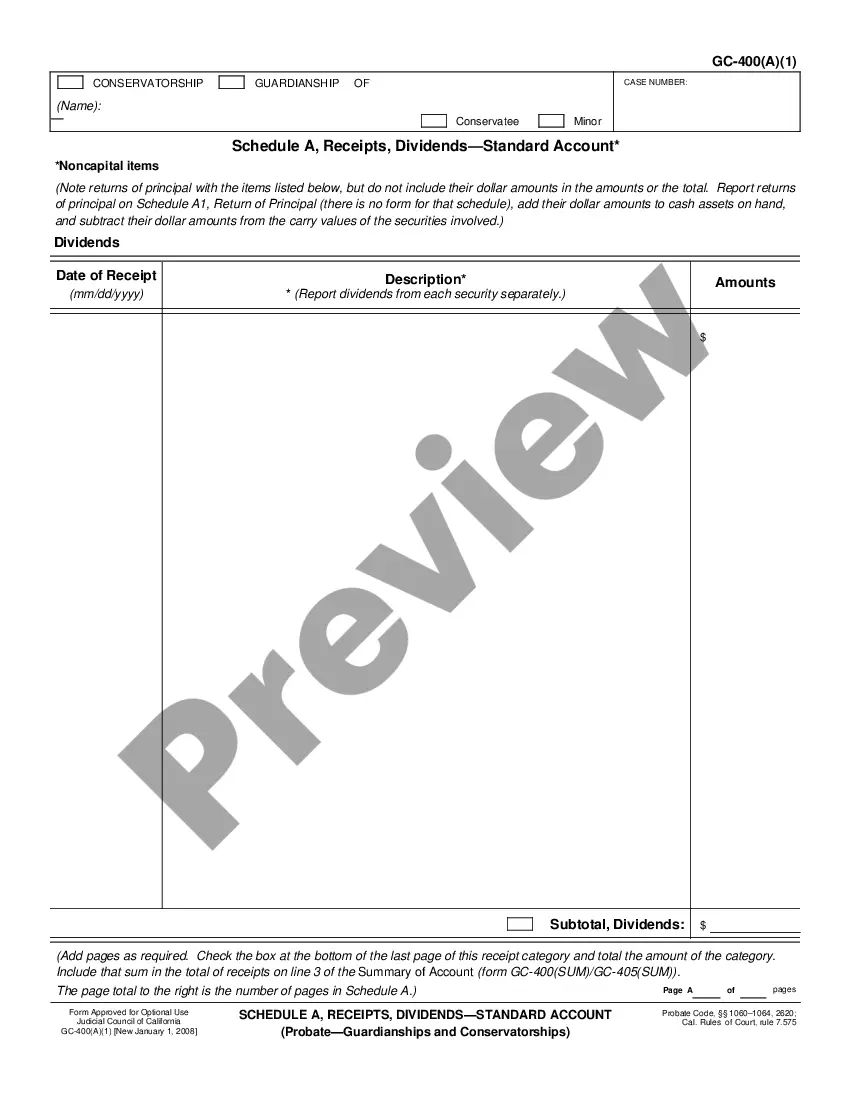

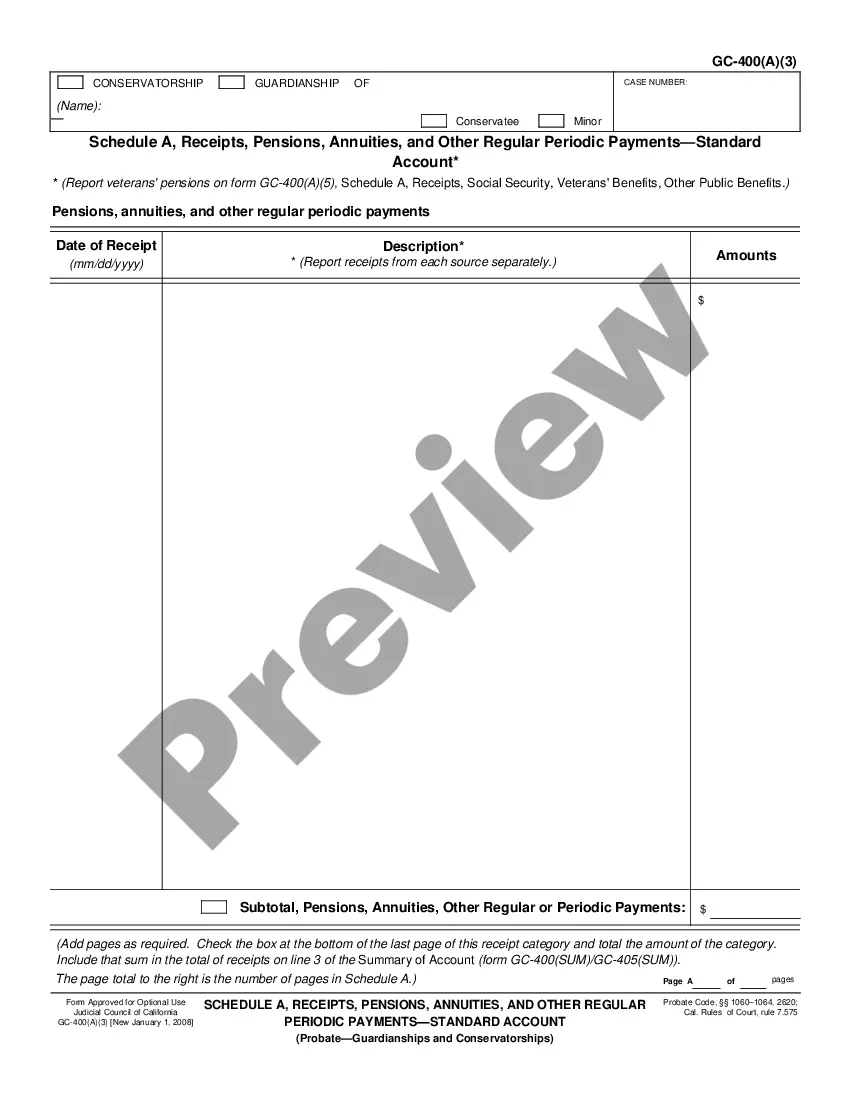

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document utilizing the related option in the header.

- Click Buy Now once you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Orange Disputed Open Account Settlement.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!