Oakland Michigan Lease Purchase Agreement for Equipment is a legally binding contract that allows individuals or businesses in Oakland County, Michigan, to lease equipment with the option to purchase it at the end of the lease term. It is a beneficial arrangement for those who require expensive equipment but may not have the immediate capital to purchase it outright. Under this agreement, the lessor (equipment owner) grants the lessee (equipment user) the right to possess and use the equipment in exchange for regular lease payments. These lease payments typically span a fixed period, ranging from months to years, and are calculated based on factors such as the equipment's value, lease term, interest rates, and depreciation. The lease purchase agreement offers flexibility and a clear pathway towards equipment ownership. At the end of the lease term, the lessee has the option to purchase the equipment by paying a predetermined price called the "buyout" or "residual value." The buyout price can either be fixed upfront or determined based on a percentage of the equipment's original cost. The lessee may also negotiate the buyout price with the lessor before signing the agreement. This type of lease agreement is particularly beneficial for businesses or individuals with evolving equipment needs, as it enables them to upgrade to newer models or types of equipment when the lease term ends. It also allows lessees to deduct lease payments as business expenses, potentially offering tax advantages. In Oakland Michigan, there are different types of lease purchase agreements for equipment, including: 1. Fair Market Value (FMV) Lease: This agreement allows the lessee to purchase the equipment at its fair market value at the end of the lease term. The fair market value is determined based on the equipment's appraised worth in the current market conditions. 2. Dollar Buyout Lease: With this type of agreement, the lessee is obligated to purchase the equipment for a predetermined fixed amount at the end of the lease term. The buyout price is usually set at $1, symbolizing that the lessee has effectively leased the equipment with the intent to purchase it outright. 3. Fixed-Term Lease: This lease purchase agreement has a predetermined fixed term, typically ranging from 24 to 60 months. At the end of the term, the lessee has the option to buy the equipment or return it to the lessor. 4. Progress Payment Lease: This type of agreement involves progressive payments made over the lease term. The lessee gradually acquires more equity in the equipment, and at the end of the term, they can purchase the equipment by paying the remaining balance. 5. Master Lease Agreement: This is a framework agreement that allows businesses to lease multiple pieces of equipment within a specific timeframe. It gives the lessee the flexibility to add or return equipment based on their changing needs without going through the process of negotiating a new lease for each item. In summary, an Oakland Michigan Lease Purchase Agreement for Equipment offers a convenient and flexible pathway for individuals or businesses to acquire the necessary equipment while spreading the costs over time. Whether opting for a Fair Market Value, Dollar Buyout, Fixed-Term, Progress Payment, or Master Lease Agreement, lessees can choose the type that best suits their financial goals and equipment requirements.

Oakland Michigan Lease Purchase Agreement for Equipment

Description

How to fill out Oakland Michigan Lease Purchase Agreement For Equipment?

Dealing with legal forms is a must in today's world. However, you don't always need to seek qualified assistance to create some of them from scratch, including Oakland Lease Purchase Agreement for Equipment, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in different types ranging from living wills to real estate paperwork to divorce documents. All forms are organized based on their valid state, making the searching experience less challenging. You can also find detailed materials and guides on the website to make any tasks related to paperwork completion straightforward.

Here's how you can find and download Oakland Lease Purchase Agreement for Equipment.

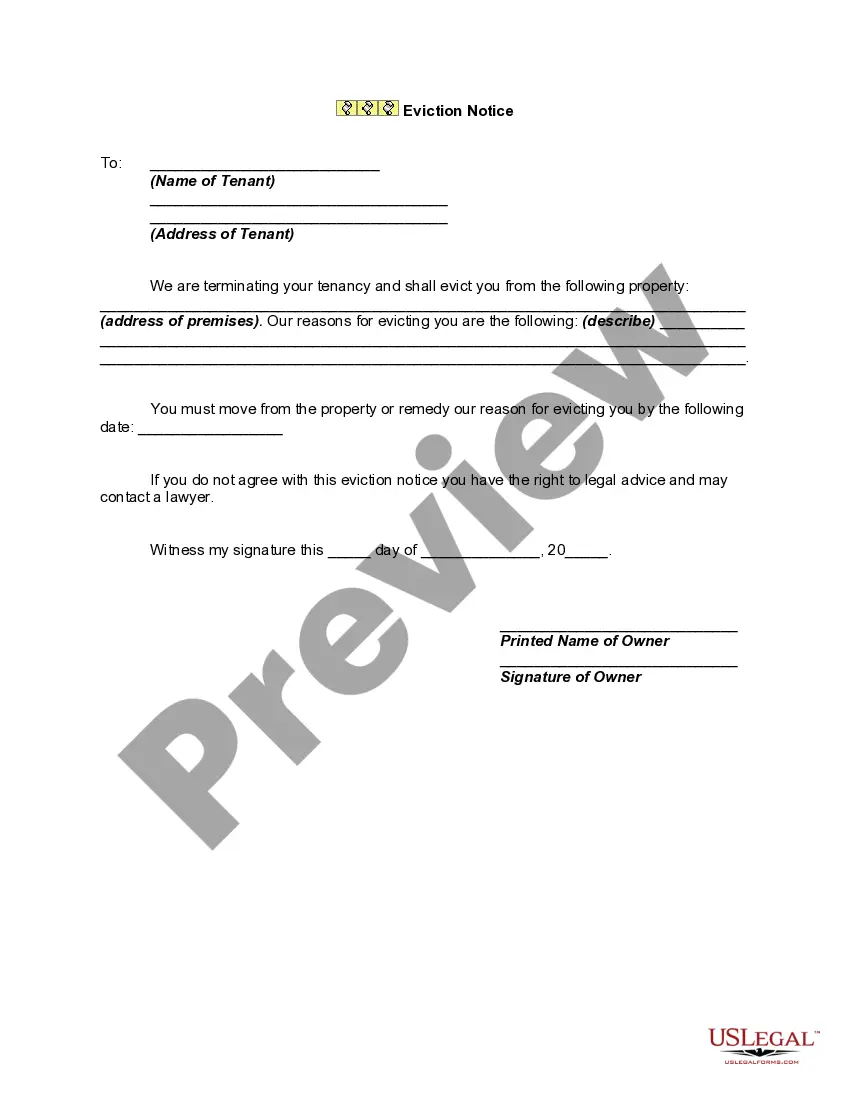

- Go over the document's preview and outline (if available) to get a general idea of what you’ll get after getting the form.

- Ensure that the document of your choice is adapted to your state/county/area since state regulations can affect the legality of some records.

- Check the similar forms or start the search over to find the appropriate file.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a needed payment gateway, and purchase Oakland Lease Purchase Agreement for Equipment.

- Select to save the form template in any offered format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Oakland Lease Purchase Agreement for Equipment, log in to your account, and download it. Of course, our website can’t replace a legal professional completely. If you need to deal with an extremely challenging case, we recommend using the services of a lawyer to examine your document before signing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of customers. Become one of them today and get your state-compliant documents effortlessly!