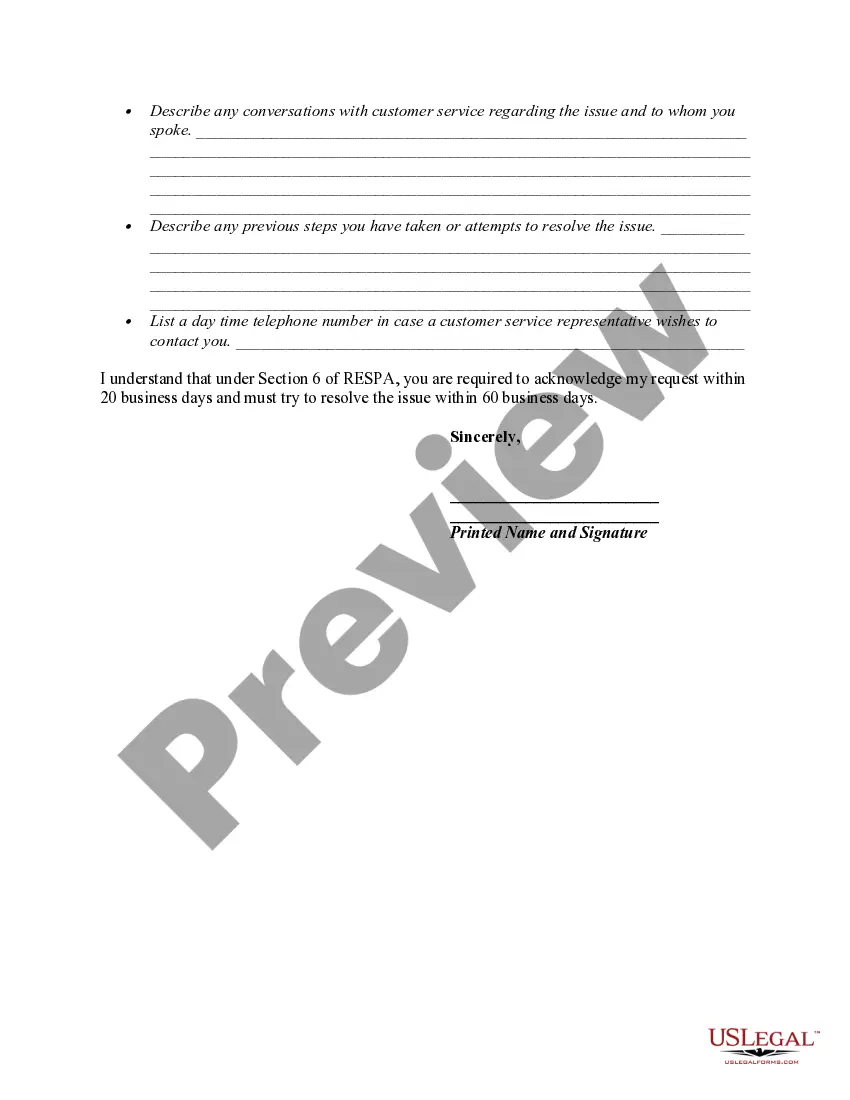

12 USC 2605(e) creates a duty of a loan servicer to respond to the inquiries of borrowers regarding loans covered by RESPA. If the borrower believes there is an error in the mortgage account, he or she can make a "qualified written request" to the loan servicer. The request must be in writing, identify the borrower by name and account, and include a statement of reasons why the borrower believes the account is in error. The request should include the words "qualified written request". It cannot be written on the payment coupon, but must be on a separate piece of paper. The Department of Housing and Urban Development provides a sample letter.

The servicer must acknowledge receipt of the request within 20 days. The servicer then has 60 days (from the request) to take action on the request. The servicer has to either provide a written notification that the error has been corrected, or provide a written explanation as to why the servicer believes the account is correct. Either way, the servicer has to provide the name and telephone number of a person with whom the borrower can discuss the matter.

Phoenix, Arizona Qualified Written Request (BWR) under Section 6 of the Real Estate Settlement Procedures Act (RESP) is a formal written inquiry that consumers can submit to mortgage services to obtain information or address concerns regarding their mortgage loan. A BWR is a powerful tool provided by RESP, a federal law designed to protect consumers during the home buying and mortgage financing process. Under Section 6, it outlines specific requirements for mortgage services to respond to such requests in a timely manner. When submitting a Phoenix, Arizona BWR, it is crucial to include relevant keywords, such as: 1. RESP: RESP is a federal law that aims to prevent abusive practices in the mortgage industry. 2. Section 6: Refers to the specific part of RESP that outlines the requirements for mortgage services to respond to qualified written requests. 3. Qualified Written Request: The formal written inquiry submitted by a consumer to their mortgage service. 4. Phoenix, Arizona: The geographical location, specifying that the BWR is related to a property or mortgage loan in the Phoenix, Arizona area. 5. Mortgage Service: The company responsible for collecting mortgage payments and managing the loan on behalf of the lender. Different types of Phoenix, Arizona Was under Section 6 of RESP may include: 1. Request for Loan Information: A BWR designed to obtain detailed information about the mortgage loan, such as interest rates, payment history, escrow account details, or any potential errors in the loan servicing. 2. Escrow Account Discrepancy Inquiry: A BWR addressing concerns related to escrow accounts, such as incorrect calculations, mishandled funds, or failure to pay property taxes and insurance on time. 3. Loan Modification or Loss Mitigation Inquiry: A BWR seeking information about loan modification or loss mitigation options to explore alternatives to foreclosure or to address financial hardships. 4. Complaint or Dispute Resolution: A BWR used to voice a complaint or dispute regarding the mortgage service's actions, including billing errors, improper fees, or mishandling of loan payments. It is crucial to ensure that the Phoenix, Arizona BWR complies with the specific requirements outlined in Section 6 of RESP, including the inclusion of necessary details, such as loan account number, borrower's information, and a clear description of the requested information or concern.Phoenix, Arizona Qualified Written Request (BWR) under Section 6 of the Real Estate Settlement Procedures Act (RESP) is a formal written inquiry that consumers can submit to mortgage services to obtain information or address concerns regarding their mortgage loan. A BWR is a powerful tool provided by RESP, a federal law designed to protect consumers during the home buying and mortgage financing process. Under Section 6, it outlines specific requirements for mortgage services to respond to such requests in a timely manner. When submitting a Phoenix, Arizona BWR, it is crucial to include relevant keywords, such as: 1. RESP: RESP is a federal law that aims to prevent abusive practices in the mortgage industry. 2. Section 6: Refers to the specific part of RESP that outlines the requirements for mortgage services to respond to qualified written requests. 3. Qualified Written Request: The formal written inquiry submitted by a consumer to their mortgage service. 4. Phoenix, Arizona: The geographical location, specifying that the BWR is related to a property or mortgage loan in the Phoenix, Arizona area. 5. Mortgage Service: The company responsible for collecting mortgage payments and managing the loan on behalf of the lender. Different types of Phoenix, Arizona Was under Section 6 of RESP may include: 1. Request for Loan Information: A BWR designed to obtain detailed information about the mortgage loan, such as interest rates, payment history, escrow account details, or any potential errors in the loan servicing. 2. Escrow Account Discrepancy Inquiry: A BWR addressing concerns related to escrow accounts, such as incorrect calculations, mishandled funds, or failure to pay property taxes and insurance on time. 3. Loan Modification or Loss Mitigation Inquiry: A BWR seeking information about loan modification or loss mitigation options to explore alternatives to foreclosure or to address financial hardships. 4. Complaint or Dispute Resolution: A BWR used to voice a complaint or dispute regarding the mortgage service's actions, including billing errors, improper fees, or mishandling of loan payments. It is crucial to ensure that the Phoenix, Arizona BWR complies with the specific requirements outlined in Section 6 of RESP, including the inclusion of necessary details, such as loan account number, borrower's information, and a clear description of the requested information or concern.