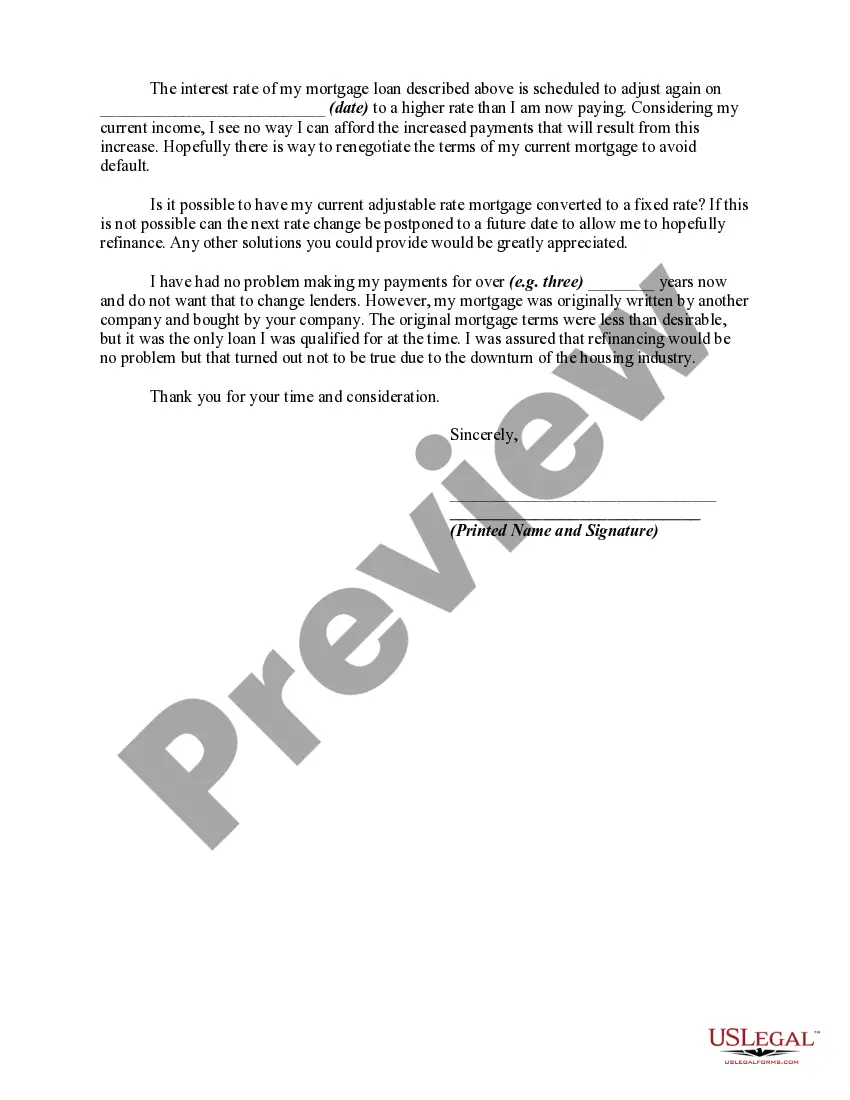

A loan workout is a series of steps taken by a lender with a borrower to resolve the problem of delinquent loan payments. Steps can include rescheduling loan payments into lower installments over a longer period of time so that the entire outstanding principal is eventually repaid. One of the items lenders often ask for during the loan workout or loan modification process is a hardship letter. A hardship letter is a written explanation as to what has caused you to fall behind on your mortgage. Some of the hardships that that lenders consider during the loan workout process are the following: Illness; Loss of Job; Reduced Income; Failed Business; Job Relocation; Death of Spouse or Co-Borrower; Incarceration; Divorce; Military Duty; and Damage to Property (e.g., natural disaster or fire).

San Jose, California, often referred to as the capital of Silicon Valley, is a vibrant city located in the heart of the San Francisco Bay Area. With a population of over one million residents, San Jose is known for its technological innovation, diverse culture, and thriving economy. In recent years, the cost of living in San Jose has risen significantly, leading to financial hardships for many homeowners. As a result, homeowners may find themselves struggling to keep up with their mortgage payments, creating a need for loan modification options. One type of loan modification that homeowners in San Jose may consider is requesting a change from an adjustable interest rate to a fixed rate. This request can be made to their lender or loan service, outlining the financial hardships they are facing and the need for a more stable interest rate. By transitioning to a fixed rate, homeowners can have a predictable monthly payment, providing them with greater financial stability and peace of mind. In the San Jose, California, area, there are several variations of the request for loan modification due to financial hardship, specifically when it comes to changing adjustable interest rates to fixed rates. These may include: 1. Request for loan modification due to job loss or reduction in income: This particular request is relevant for homeowners who have experienced a sudden loss of employment or a significant decrease in their income, making it challenging to meet their current mortgage obligations. By requesting a change to a fixed interest rate, homeowners can aim to create a more affordable and sustainable mortgage payment. 2. Request for loan modification due to medical emergencies or unexpected expenses: Homeowners who have incurred substantial medical expenses or unforeseen financial burdens may submit a modification request based on these circumstances. Changing to a fixed rate can help alleviate financial stress and enable homeowners to manage their mortgage payments more effectively. 3. Request for loan modification due to interest rate adjustments: Adjustable rate mortgages often come with periodic interest rate adjustments, which can result in increased monthly payments for homeowners. To mitigate this, borrowers experiencing financial difficulties may seek a modification that shifts their adjustable rate to a fixed rate, providing stability and preventing potential further financial strain. In conclusion, San Jose, California, homeowners facing financial hardships have the option to request a loan modification from their lender or loan service. By specifying the need for a change from an adjustable interest rate to a fixed rate, individuals can potentially find relief and set themselves on a more sustainable path towards homeownership. Whether the hardships stem from job loss, medical emergencies, or interest rate adjustments, a well-detailed request can help homeowners in San Jose secure the loan modification they require.San Jose, California, often referred to as the capital of Silicon Valley, is a vibrant city located in the heart of the San Francisco Bay Area. With a population of over one million residents, San Jose is known for its technological innovation, diverse culture, and thriving economy. In recent years, the cost of living in San Jose has risen significantly, leading to financial hardships for many homeowners. As a result, homeowners may find themselves struggling to keep up with their mortgage payments, creating a need for loan modification options. One type of loan modification that homeowners in San Jose may consider is requesting a change from an adjustable interest rate to a fixed rate. This request can be made to their lender or loan service, outlining the financial hardships they are facing and the need for a more stable interest rate. By transitioning to a fixed rate, homeowners can have a predictable monthly payment, providing them with greater financial stability and peace of mind. In the San Jose, California, area, there are several variations of the request for loan modification due to financial hardship, specifically when it comes to changing adjustable interest rates to fixed rates. These may include: 1. Request for loan modification due to job loss or reduction in income: This particular request is relevant for homeowners who have experienced a sudden loss of employment or a significant decrease in their income, making it challenging to meet their current mortgage obligations. By requesting a change to a fixed interest rate, homeowners can aim to create a more affordable and sustainable mortgage payment. 2. Request for loan modification due to medical emergencies or unexpected expenses: Homeowners who have incurred substantial medical expenses or unforeseen financial burdens may submit a modification request based on these circumstances. Changing to a fixed rate can help alleviate financial stress and enable homeowners to manage their mortgage payments more effectively. 3. Request for loan modification due to interest rate adjustments: Adjustable rate mortgages often come with periodic interest rate adjustments, which can result in increased monthly payments for homeowners. To mitigate this, borrowers experiencing financial difficulties may seek a modification that shifts their adjustable rate to a fixed rate, providing stability and preventing potential further financial strain. In conclusion, San Jose, California, homeowners facing financial hardships have the option to request a loan modification from their lender or loan service. By specifying the need for a change from an adjustable interest rate to a fixed rate, individuals can potentially find relief and set themselves on a more sustainable path towards homeownership. Whether the hardships stem from job loss, medical emergencies, or interest rate adjustments, a well-detailed request can help homeowners in San Jose secure the loan modification they require.