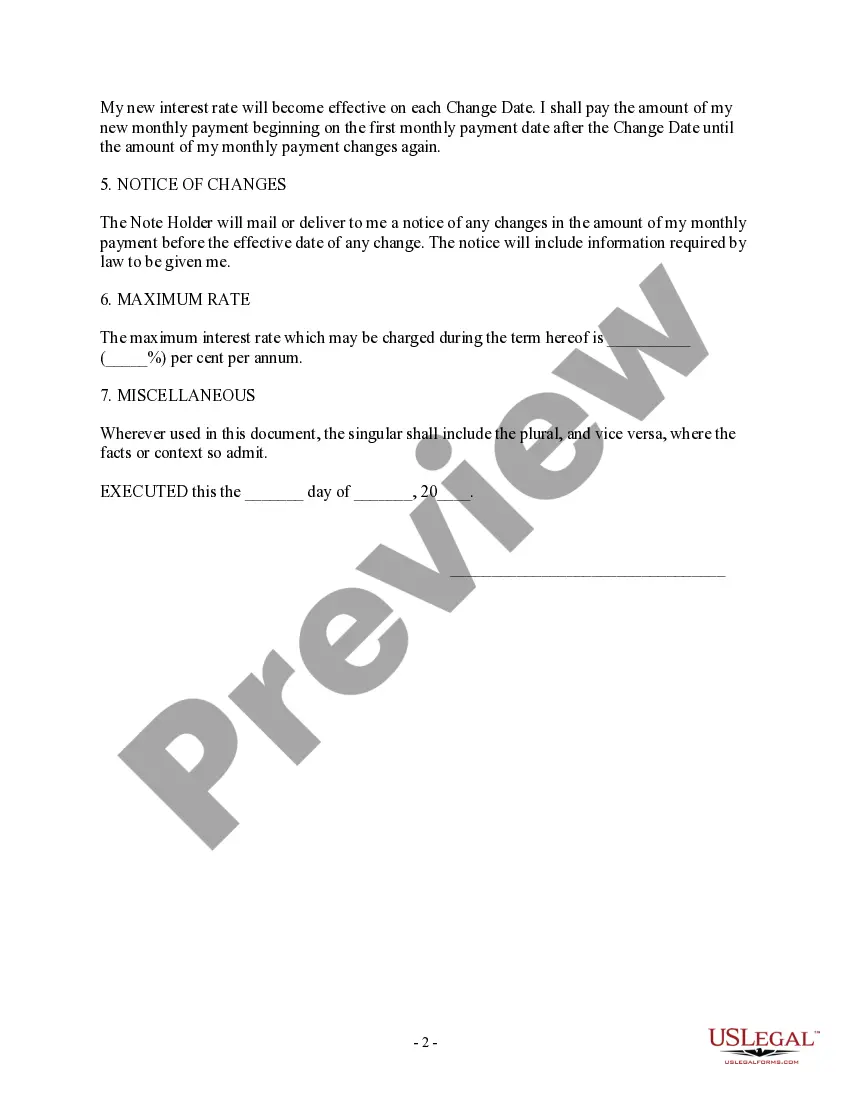

The Lima Arizona Adjustable Rate Rider, also known as the Variable Rate Note, is a legal document that outlines the terms and conditions of an adjustable rate mortgage (ARM) loan in the state of Arizona. This rider and note provide important details regarding the interest rate and payment adjustments throughout the life of the loan. An ARM loan is a type of mortgage loan where the interest rate fluctuates periodically based on various factors such as changes in market conditions. The Lima Arizona Adjustable Rate Rider — Variable Rate Note is designed to allow borrowers to take advantage of potential benefits if interest rates decrease, but also carries the risk of higher payments if interest rates rise. It is essential for borrowers to thoroughly understand the terms and implications of this rider before signing the loan agreement. The Lima Arizona Adjustable Rate Rider — Variable Rate Note may include various types or variations to suit different borrower needs. Some common types of this rider are: 1. Standard Adjustable Rate Rider: This type allows for regular interest rate adjustments based on specified index rates, such as the London Interbank Offered Rate (LIBOR) or the U.S. Prime Rate. The adjustment periods can range from monthly, quarterly, or annually, and the note will outline how the new interest rate is calculated. 2. Initial Fixed Rate Adjustable Rate Rider: This type initially provides a fixed interest rate for a specific period, typically 3, 5, 7, or 10 years, after which the rate becomes adjustable. During the fixed-rate period, borrowers can enjoy stable monthly payments; however, once the adjustment period begins, the rate may change annually, subject to predetermined margins and index rates. 3. Interest-Only Adjustable Rate Rider: This rider allows borrowers to make interest-only payments for a specified period, usually between 3 and 10 years. After the interest-only period ends, the note transitions to a fully amortizing loan with principal and interest payments. 4. Step Rate Adjustable Rate Rider: This type offers an adjustable rate that changes at predetermined intervals, usually every 3 to 5 years. Each period may have a predetermined increase or decrease in the interest rate, offering borrowers a predictable payment structure over the loan term. Remember, the specific terms and details of the Lima Arizona Adjustable Rate Rider — Variable Rate Note may vary depending on the lender, loan program, and borrower's qualifications. It is crucial for borrowers to carefully review the note and consult with a mortgage professional to ensure they fully understand the implications and potential risks associated with adjustable rate mortgages.

Pima Arizona Adjustable Rate Rider - Variable Rate Note

Description

How to fill out Pima Arizona Adjustable Rate Rider - Variable Rate Note?

Laws and regulations in every area differ around the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Pima Adjustable Rate Rider - Variable Rate Note, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for various life and business situations. All the forms can be used many times: once you obtain a sample, it remains accessible in your profile for future use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Pima Adjustable Rate Rider - Variable Rate Note from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Pima Adjustable Rate Rider - Variable Rate Note:

- Examine the page content to ensure you found the correct sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the template when you find the proper one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Cons of Adjustable-Rate Mortgages You could be left with a much higher payment. You might buy more house than you can afford. Budget and financial planning is more difficult. You might end up owing more than your house is worth.

THE NOTE CONTAINS PROVISIONS ALLOWING FOR CHANGES IN THE INTEREST RATE AND THE MONTHLY PAYMENT. THE NOTE LIMITS THE AMOUNT THE BORROWER'S ADJUSTABLE INTEREST RATE CAN CHANGE AT ANY ONE TIME AND THE MINIMUM AND MAXIMUM RATES THE BORROWER MUST PAY.

Adjustable-rate mortgage riders explain that the interest rate on the loan will change on a set date. Condominium riders specify the special terms of condominium ownership, such as the percentage of interest the borrower legally owns in the shared areas, or common elements.

A variable rate mortgage is one where the interest rates change with the market but the monthly payments are always the same. An adjustable rate mortgage is one where the monthly payments can change when the interest rate changes.

Pros of an adjustable-rate mortgage It has lower rates and payments early in the loan term. Because lenders can consider the lower payment when qualifying borrowers, people can buy more expensive homes than they otherwise could. It allows borrowers to take advantage of falling rates without refinancing.

The lender decides which index your loan will use when you apply for the loan, and this choice generally won't change after closing. The margin is the number of percentage points added to the index by the mortgage lender to set your interest rate on an adjustable-rate mortgage (ARM) after the initial rate period ends.

Adjustable-rate mortgage riders explain that the interest rate on the loan will change on a set date. Condominium riders specify the special terms of condominium ownership, such as the percentage of interest the borrower legally owns in the shared areas, or common elements.

An adjustable-rate mortgage (ARM) is a home loan with a variable interest rate. With an ARM, the initial interest rate is fixed for a period of time. After that, the interest rate applied on the outstanding balance resets periodically, at yearly or even monthly intervals.

An adjustable rate note is a debt instrument with an interest rate that can fluctuate over time. Lenders typically use adjustable rates to compensate for risk and inflation, allowing borrowers to save money on their loan's interest payments.