San Diego, California Adjustable Rate Rider — Variable Rate Note is a legal document commonly used in real estate transactions to modify the terms of a promissory note with adjustable interest rates. This rider allows borrowers to have more flexibility in their mortgage loans, as the interest rate can change over time based on certain factors. This description aims to provide a detailed overview while incorporating relevant keywords related to this topic. San Diego, California, known for its beautiful beaches and sunny climate, offers borrowers the option to include an Adjustable Rate Rider — Variable Rate Note in their mortgage agreement. This rider is an addendum to the standard promissory note and provides a mechanism to adjust the interest rate periodically during the loan term. By opting for an adjustable rate rider, borrowers in San Diego can take advantage of fluctuating interest rates and potentially benefit from lower rates during certain market conditions. The main purpose of this rider is to provide borrowers with increased flexibility in managing their mortgage payments and to align the interest rate with prevailing market rates. The San Diego Adjustable Rate Rider — Variable Rate Note typically contains specific terms and conditions regarding the adjustment of the interest rate. These adjustments are usually tied to an index, such as the treasury index, the prime rate, or the London Interbank Offered Rate (LIBOR). Multiple types of adjustable rate riders may exist in San Diego, each using different indexes for rate adjustments. Some common types of Adjustable Rate Riders in San Diego include: 1. Treasury Adjustable Rate Rider: Under this rider, the interest rate adjustment is based on the movements of the U.S. Treasury securities. The interest rate may be set by adding a specific margin or spread to the prevailing Treasury index rate. 2. LIBOR Adjustable Rate Rider: This rider sets the interest rate based on the London Interbank Offered Rate, which represents the average interest rate at which major international banks lend to each other. The interest rate formula usually includes a margin added to the LIBOR rate. 3. CFI Adjustable Rate Rider: The CFI (Cost of Funds Index) Adjustable Rate Rider calculates the interest rate based on the average interest expenses of financial institutions located in the 11th Federal Home Loan Bank District, which includes San Diego. Lenders typically add a specific margin to the CFI index to determine the rate adjustment. It's important for borrowers in San Diego, California to carefully review and understand the terms and conditions outlined in the Adjustable Rate Rider — Variable Rate Note before signing any mortgage agreements. Consulting with a real estate attorney or mortgage professional can help ensure that borrowers make informed decisions and understand the potential risks and benefits of adjustable rate mortgages.

San Diego California Adjustable Rate Rider - Variable Rate Note

Description

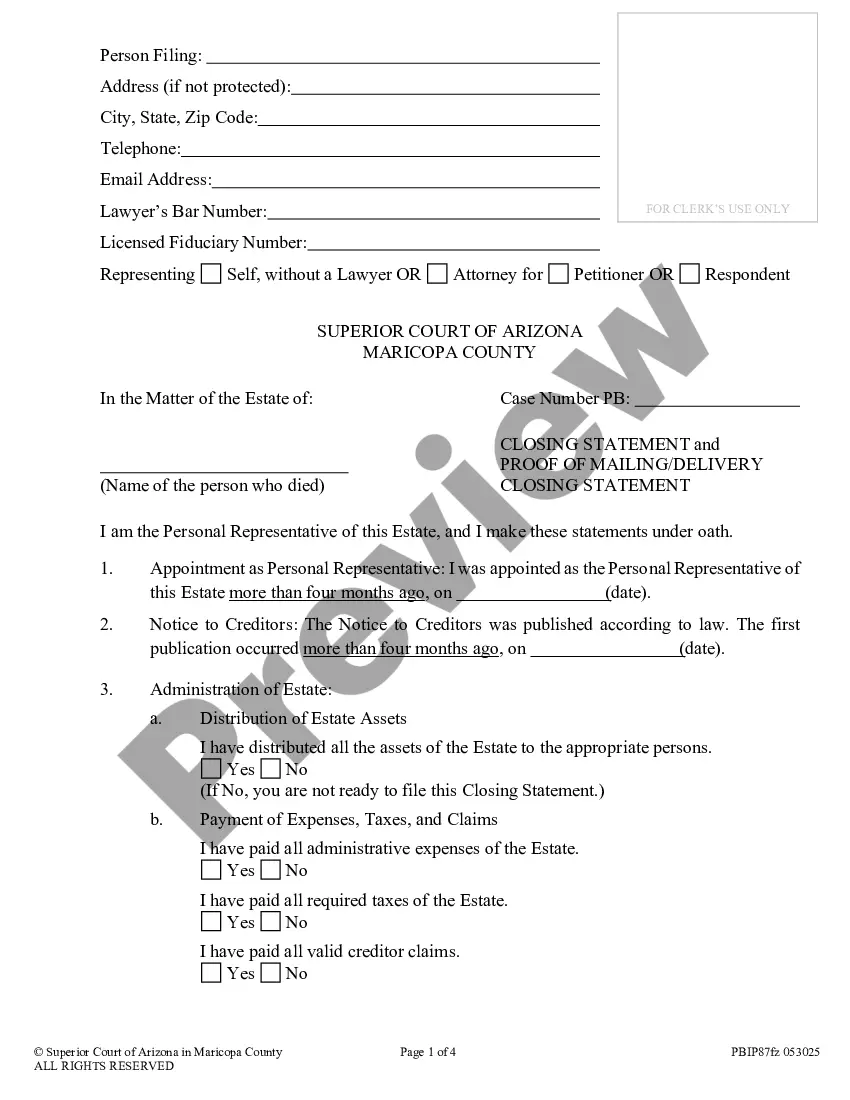

How to fill out San Diego California Adjustable Rate Rider - Variable Rate Note?

Whether you intend to open your business, enter into a contract, apply for your ID renewal, or resolve family-related legal concerns, you must prepare specific documentation meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal templates for any personal or business occasion. All files are collected by state and area of use, so opting for a copy like San Diego Adjustable Rate Rider - Variable Rate Note is quick and simple.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a couple of additional steps to get the San Diego Adjustable Rate Rider - Variable Rate Note. Adhere to the guidelines below:

- Make sure the sample meets your personal needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to get the sample when you find the right one.

- Select the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the San Diego Adjustable Rate Rider - Variable Rate Note in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you can access all of your previously purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

An adjustable rate note is a debt instrument with an interest rate that can fluctuate over time. Lenders typically use adjustable rates to compensate for risk and inflation, allowing borrowers to save money on their loan's interest payments.

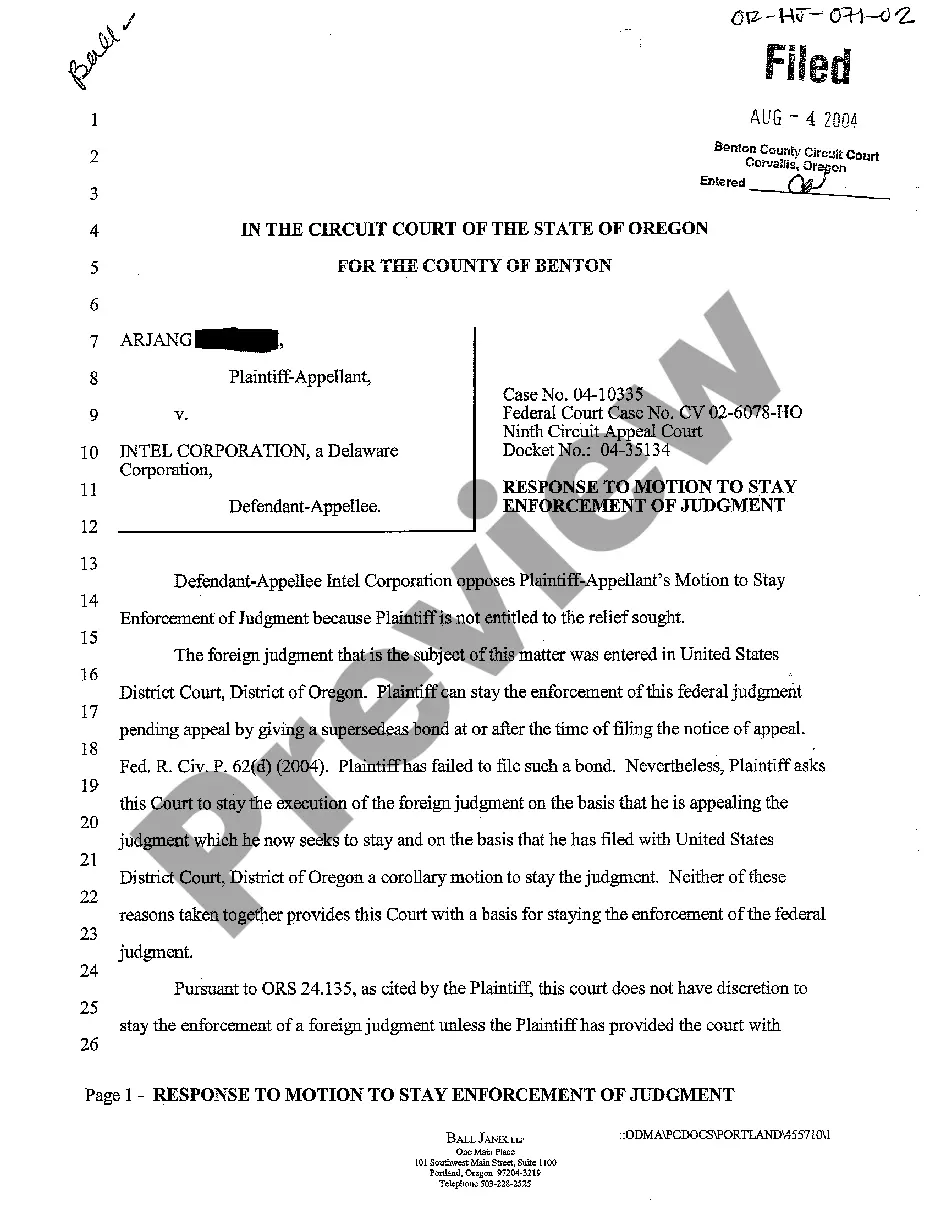

Adjustable-rate mortgage riders explain that the interest rate on the loan will change on a set date. Condominium riders specify the special terms of condominium ownership, such as the percentage of interest the borrower legally owns in the shared areas, or common elements.

Adjustable-rate mortgage riders explain that the interest rate on the loan will change on a set date. Condominium riders specify the special terms of condominium ownership, such as the percentage of interest the borrower legally owns in the shared areas, or common elements.

A variable rate mortgage is one where the interest rates change with the market but the monthly payments are always the same. An adjustable rate mortgage is one where the monthly payments can change when the interest rate changes.

Cons of Adjustable-Rate Mortgages You could be left with a much higher payment. You might buy more house than you can afford. Budget and financial planning is more difficult. You might end up owing more than your house is worth.

Below are the risks most commonly encountered with adjustable rate mortgages. Rising monthly payments and payment shock.Negative amortization.Refinancing your mortgage.Prepayment penalties.Falling housing prices.

Adjustable-Rate Mortgage Benefits The bank (usually) rewards you with a lower initial rate because you're taking the risk that interest rates could rise in the future. 2feff Contrast the situation with a fixed-rate mortgage, where the bank takes that risk.

Pros of an adjustable-rate mortgage It has lower rates and payments early in the loan term. Because lenders can consider the lower payment when qualifying borrowers, people can buy more expensive homes than they otherwise could. It allows borrowers to take advantage of falling rates without refinancing.

An adjustable rate note is a debt instrument with an interest rate that can fluctuate over time. Lenders typically use adjustable rates to compensate for risk and inflation, allowing borrowers to save money on their loan's interest payments.

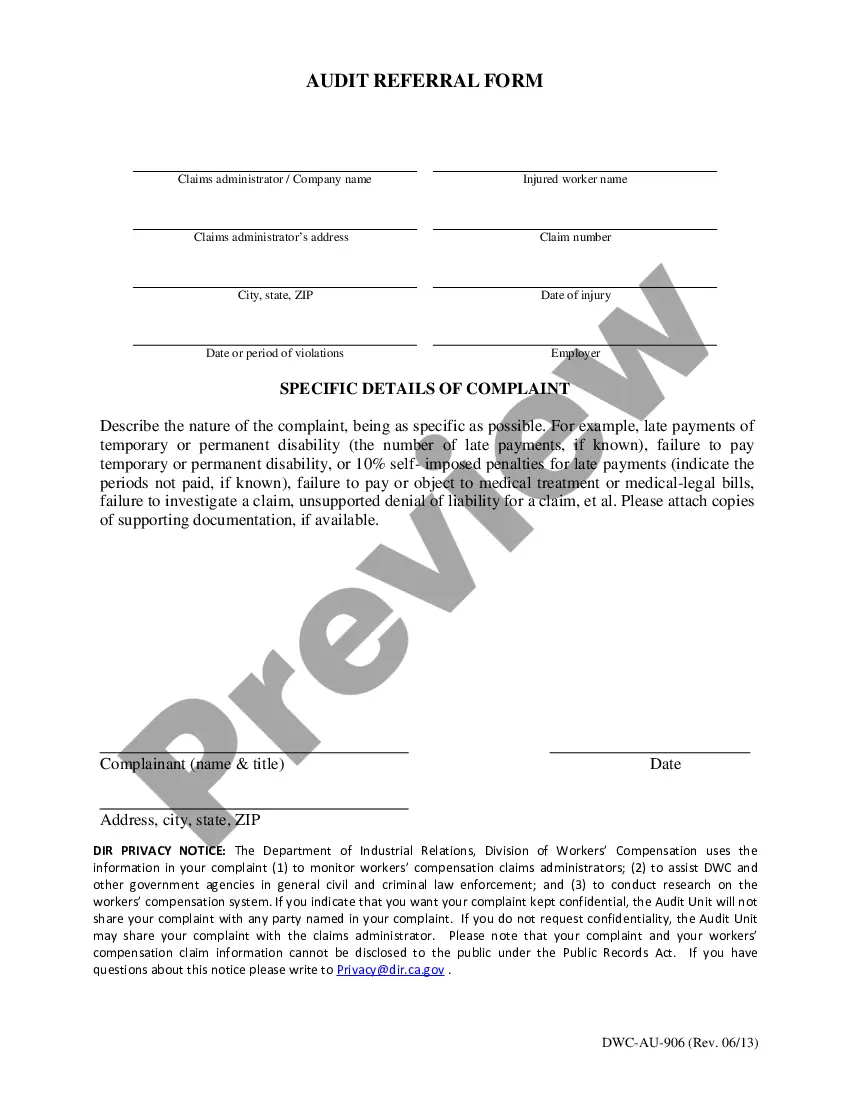

THE NOTE CONTAINS PROVISIONS ALLOWING FOR CHANGES IN THE INTEREST RATE AND THE MONTHLY PAYMENT. THE NOTE LIMITS THE AMOUNT THE BORROWER'S ADJUSTABLE INTEREST RATE CAN CHANGE AT ANY ONE TIME AND THE MINIMUM AND MAXIMUM RATES THE BORROWER MUST PAY.