An Assignment is a transfer of a property right or title to some particular person under an agreement, usually in writing. Unless an assignment is qualified in some way, it is generally considered to be a transfer of the transferor's entire interest in the estate, personal property, or other thing assigned. An escrow account is held in the borrower's name to pay obligations such as property taxes, insurance premiums, lease payments, hazard insurance, and other associated property payments and expenses when they are due in connection with a mortgage loan.

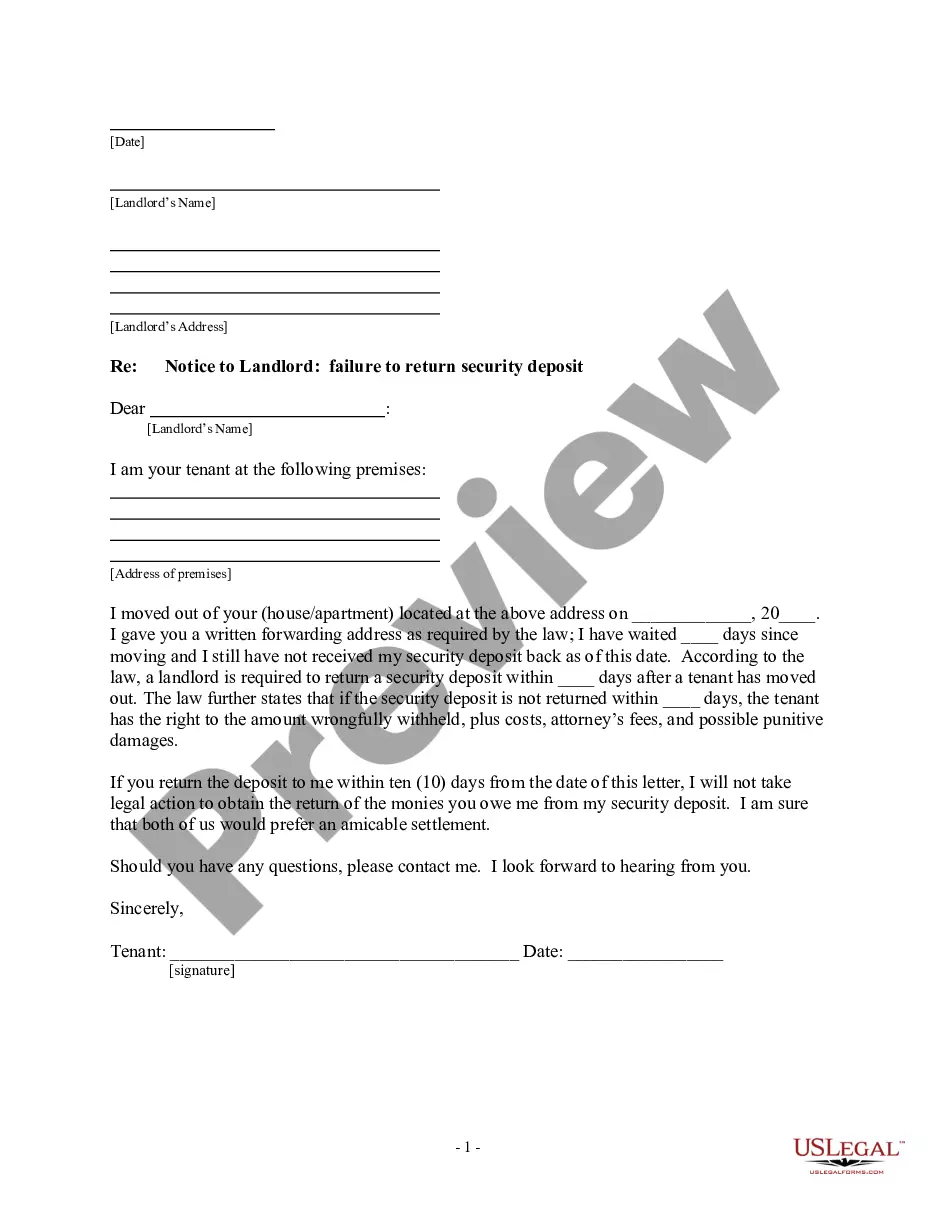

form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Philadelphia Pennsylvania Assignment of Escrow Account is a legal agreement that serves as an important component in various real estate transactions in the vibrant city of Philadelphia, Pennsylvania. This written document outlines the transfer of control and responsibility of funds held in an escrow account from one party to another. In Philadelphia, the Assignment of Escrow Account is typically utilized when there is a change in the stakeholders involved in a real estate transaction. This transition can occur during the process of purchasing or selling properties, lease agreements, or when refinancing mortgages. The Assignment of Escrow Account plays a pivotal role in ensuring a smooth transfer of funds, safeguarding the financial interests of all parties involved, and complying with legal regulations. Various types of Philadelphia Pennsylvania Assignment of Escrow Account may include: 1. Property Purchase Assignment of Escrow Account: This type of Assignment of Escrow Account is commonly utilized during the purchase of residential or commercial properties in Philadelphia. It facilitates the secure transfer of earnest money or down payment from the buyer's escrow account to the seller upon successful closing of the transaction. 2. Lease Agreement Assignment of Escrow Account: In the dynamic rental market of Philadelphia, this type of Assignment of Escrow Account ensures the secure handling of security deposits paid by tenants. It details the transfer of these funds to the landlord or the new property manager, thus ensuring compliance with residential tenancy laws. 3. Mortgage Refinancing Assignment of Escrow Account: When homeowners in Philadelphia opt to refinance their mortgages, this Assignment of Escrow Account allows the smooth transition of outstanding funds from the original lender to the new one. It ensures that property taxes, homeowners insurance premiums, and other related expenses are transferred correctly to the new escrow account. 4. Commercial Real Estate Assignment of Escrow Account: This type of Assignment of Escrow Account applies specifically to commercial properties in Philadelphia. It involves the transfer of escrow funds related to the purchase, sale, or leasing of commercial real estate properties. This ensures that substantial amounts of money involved in commercial transactions are handled securely and transparently. Overall, Philadelphia Pennsylvania Assignment of Escrow Account serves as a vital legal document in various real estate transactions in the city. It establishes a framework for the secure transfer of funds, protects the financial interests of all parties involved, and ensures compliance with local laws and regulations.Philadelphia Pennsylvania Assignment of Escrow Account is a legal agreement that serves as an important component in various real estate transactions in the vibrant city of Philadelphia, Pennsylvania. This written document outlines the transfer of control and responsibility of funds held in an escrow account from one party to another. In Philadelphia, the Assignment of Escrow Account is typically utilized when there is a change in the stakeholders involved in a real estate transaction. This transition can occur during the process of purchasing or selling properties, lease agreements, or when refinancing mortgages. The Assignment of Escrow Account plays a pivotal role in ensuring a smooth transfer of funds, safeguarding the financial interests of all parties involved, and complying with legal regulations. Various types of Philadelphia Pennsylvania Assignment of Escrow Account may include: 1. Property Purchase Assignment of Escrow Account: This type of Assignment of Escrow Account is commonly utilized during the purchase of residential or commercial properties in Philadelphia. It facilitates the secure transfer of earnest money or down payment from the buyer's escrow account to the seller upon successful closing of the transaction. 2. Lease Agreement Assignment of Escrow Account: In the dynamic rental market of Philadelphia, this type of Assignment of Escrow Account ensures the secure handling of security deposits paid by tenants. It details the transfer of these funds to the landlord or the new property manager, thus ensuring compliance with residential tenancy laws. 3. Mortgage Refinancing Assignment of Escrow Account: When homeowners in Philadelphia opt to refinance their mortgages, this Assignment of Escrow Account allows the smooth transition of outstanding funds from the original lender to the new one. It ensures that property taxes, homeowners insurance premiums, and other related expenses are transferred correctly to the new escrow account. 4. Commercial Real Estate Assignment of Escrow Account: This type of Assignment of Escrow Account applies specifically to commercial properties in Philadelphia. It involves the transfer of escrow funds related to the purchase, sale, or leasing of commercial real estate properties. This ensures that substantial amounts of money involved in commercial transactions are handled securely and transparently. Overall, Philadelphia Pennsylvania Assignment of Escrow Account serves as a vital legal document in various real estate transactions in the city. It establishes a framework for the secure transfer of funds, protects the financial interests of all parties involved, and ensures compliance with local laws and regulations.