Discrimination favoring management or highly paid employees is not permitted for deductible health and accident insurance plans. For self-insured medical reimbursement plans (i.e., direct payment or reimbursement by the employer of the medical bills of the employee or family), no discrimination, either in eligibility or benefits, is permitted if "highly compensated individuals" are to receive all plan benefits tax-free. The plan must benefit, in general, at least 70% of employees who are not highly compensated employees. However, there are exceptions. A "highly compensated employee" is one who has a significant ownership interest in the company, or who is one of the five highest paid officers or employees. An alternative designation is an income threshold, currently $80,000. If a self-insured plan is discriminatory, an employee who is considered a highly compensated employee must include the amount of discriminatory benefits received in gross income.

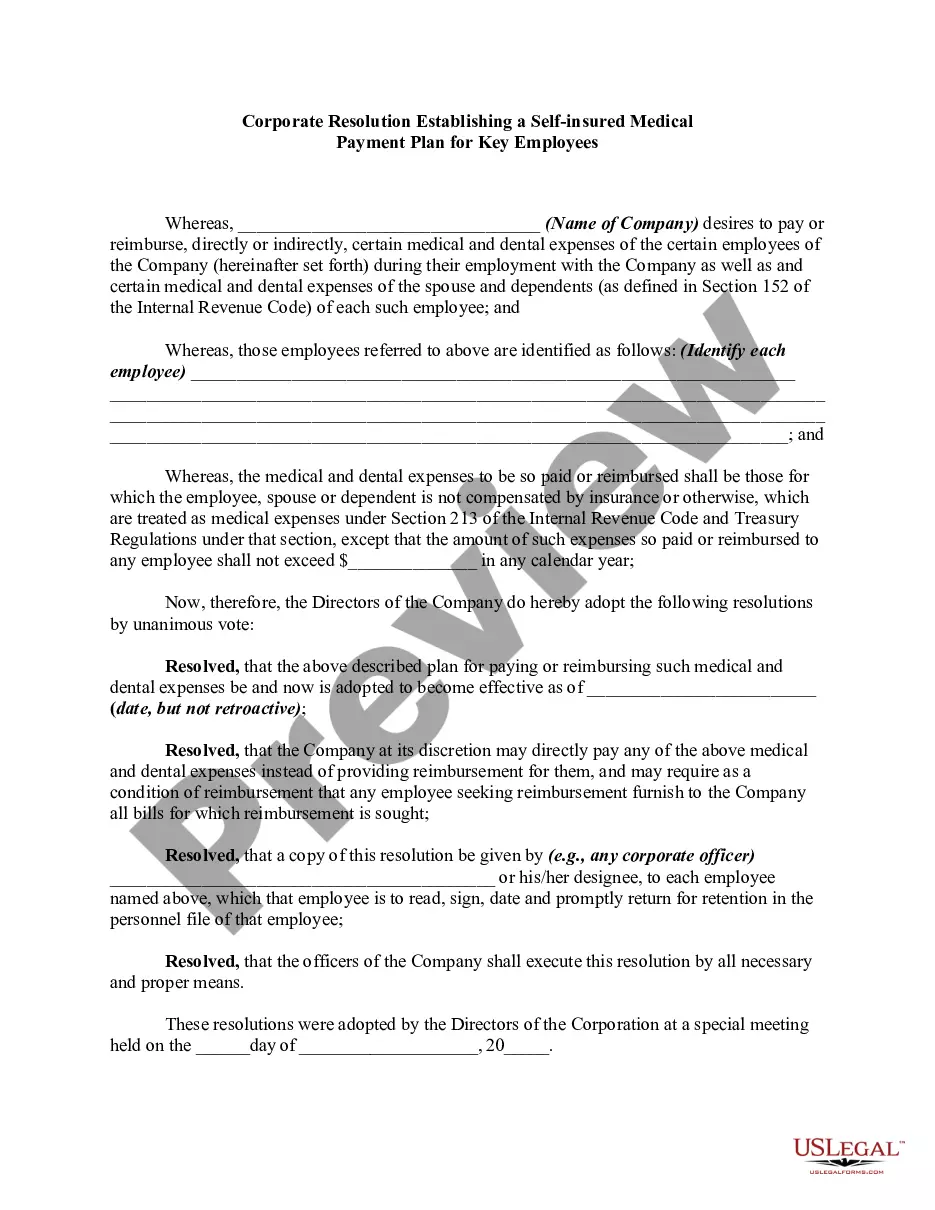

Title: Collin Texas Corporate Resolution: Establishing a Self-insured Medical Payment Plan for Key Employees Keywords: Collin Texas, corporate resolution, self-insured, medical payment plan, key employees. Description: Collin Texas Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees is a legally binding document that outlines the intent, guidelines, and responsibilities of a company in providing self-insured medical coverage for its key employees. This resolution demonstrates the company's proactive approach in providing comprehensive healthcare benefits to its crucial workforce. A self-insured medical payment plan is a cost-effective alternative to traditional insurance options, wherein the company assumes the financial risk of medical claims instead of relying on an insurance provider. By establishing such a plan, the company retains the flexibility to design customized benefit packages tailored specifically to the needs of its key employees. Benefits of Collin Texas Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees: 1. Cost Control: Self-insured plans enable businesses to have direct control over the costs associated with healthcare benefits. The company can better manage expenses by monitoring claims, negotiating rates with healthcare providers, and implementing wellness programs to improve employee health outcomes. 2. Customized Approach: Unlike standard health insurance plans, self-insured medical payment plans allow employers to tailor benefits to meet the unique requirements of key employees. This can include additional coverage options for certain medical services or specialized treatment options for specific conditions. 3. Cash Flow Management: By self-insuring, companies can maintain better cash flow control. They have the ability to set aside funds specifically designated for healthcare claims, ensuring sufficient resources are available as claims arise and avoiding unnecessary premium payments to insurance carriers. 4. Employee Engagement: Offering a self-insured medical payment plan as a benefit reinforces a company's commitment to employee well-being and often boosts employee satisfaction and retention. Employees appreciate the enhanced value and flexibility of a self-insured plan, which can result in increased loyalty and productivity. Collin Texas Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees Types: 1. Collin Texas Corporate Resolution Establishing a Fully Self-insured Medical Payment Plan: This type of resolution indicates that the employer takes full responsibility for all medical claims, including administration, payouts, and regulatory compliance. 2. Collin Texas Corporate Resolution Establishing a Partially Self-insured Medical Payment Plan: This resolution outlines a plan where the company assumes a portion of the financial risk for medical claims, usually up to a certain threshold, and obtains stop-loss insurance for claims exceeding that limit. In conclusion, Collin Texas Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees provides ample benefits for both employers and key employees. By implementing a self-insured plan, companies can exercise more control over healthcare costs while offering tailored benefits to attract and retain valuable employees.Title: Collin Texas Corporate Resolution: Establishing a Self-insured Medical Payment Plan for Key Employees Keywords: Collin Texas, corporate resolution, self-insured, medical payment plan, key employees. Description: Collin Texas Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees is a legally binding document that outlines the intent, guidelines, and responsibilities of a company in providing self-insured medical coverage for its key employees. This resolution demonstrates the company's proactive approach in providing comprehensive healthcare benefits to its crucial workforce. A self-insured medical payment plan is a cost-effective alternative to traditional insurance options, wherein the company assumes the financial risk of medical claims instead of relying on an insurance provider. By establishing such a plan, the company retains the flexibility to design customized benefit packages tailored specifically to the needs of its key employees. Benefits of Collin Texas Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees: 1. Cost Control: Self-insured plans enable businesses to have direct control over the costs associated with healthcare benefits. The company can better manage expenses by monitoring claims, negotiating rates with healthcare providers, and implementing wellness programs to improve employee health outcomes. 2. Customized Approach: Unlike standard health insurance plans, self-insured medical payment plans allow employers to tailor benefits to meet the unique requirements of key employees. This can include additional coverage options for certain medical services or specialized treatment options for specific conditions. 3. Cash Flow Management: By self-insuring, companies can maintain better cash flow control. They have the ability to set aside funds specifically designated for healthcare claims, ensuring sufficient resources are available as claims arise and avoiding unnecessary premium payments to insurance carriers. 4. Employee Engagement: Offering a self-insured medical payment plan as a benefit reinforces a company's commitment to employee well-being and often boosts employee satisfaction and retention. Employees appreciate the enhanced value and flexibility of a self-insured plan, which can result in increased loyalty and productivity. Collin Texas Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees Types: 1. Collin Texas Corporate Resolution Establishing a Fully Self-insured Medical Payment Plan: This type of resolution indicates that the employer takes full responsibility for all medical claims, including administration, payouts, and regulatory compliance. 2. Collin Texas Corporate Resolution Establishing a Partially Self-insured Medical Payment Plan: This resolution outlines a plan where the company assumes a portion of the financial risk for medical claims, usually up to a certain threshold, and obtains stop-loss insurance for claims exceeding that limit. In conclusion, Collin Texas Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees provides ample benefits for both employers and key employees. By implementing a self-insured plan, companies can exercise more control over healthcare costs while offering tailored benefits to attract and retain valuable employees.