Discrimination favoring management or highly paid employees is not permitted for deductible health and accident insurance plans. For self-insured medical reimbursement plans (i.e., direct payment or reimbursement by the employer of the medical bills of the employee or family), no discrimination, either in eligibility or benefits, is permitted if "highly compensated individuals" are to receive all plan benefits tax-free. The plan must benefit, in general, at least 70% of employees who are not highly compensated employees. However, there are exceptions. A "highly compensated employee" is one who has a significant ownership interest in the company, or who is one of the five highest paid officers or employees. An alternative designation is an income threshold, currently $80,000. If a self-insured plan is discriminatory, an employee who is considered a highly compensated employee must include the amount of discriminatory benefits received in gross income.

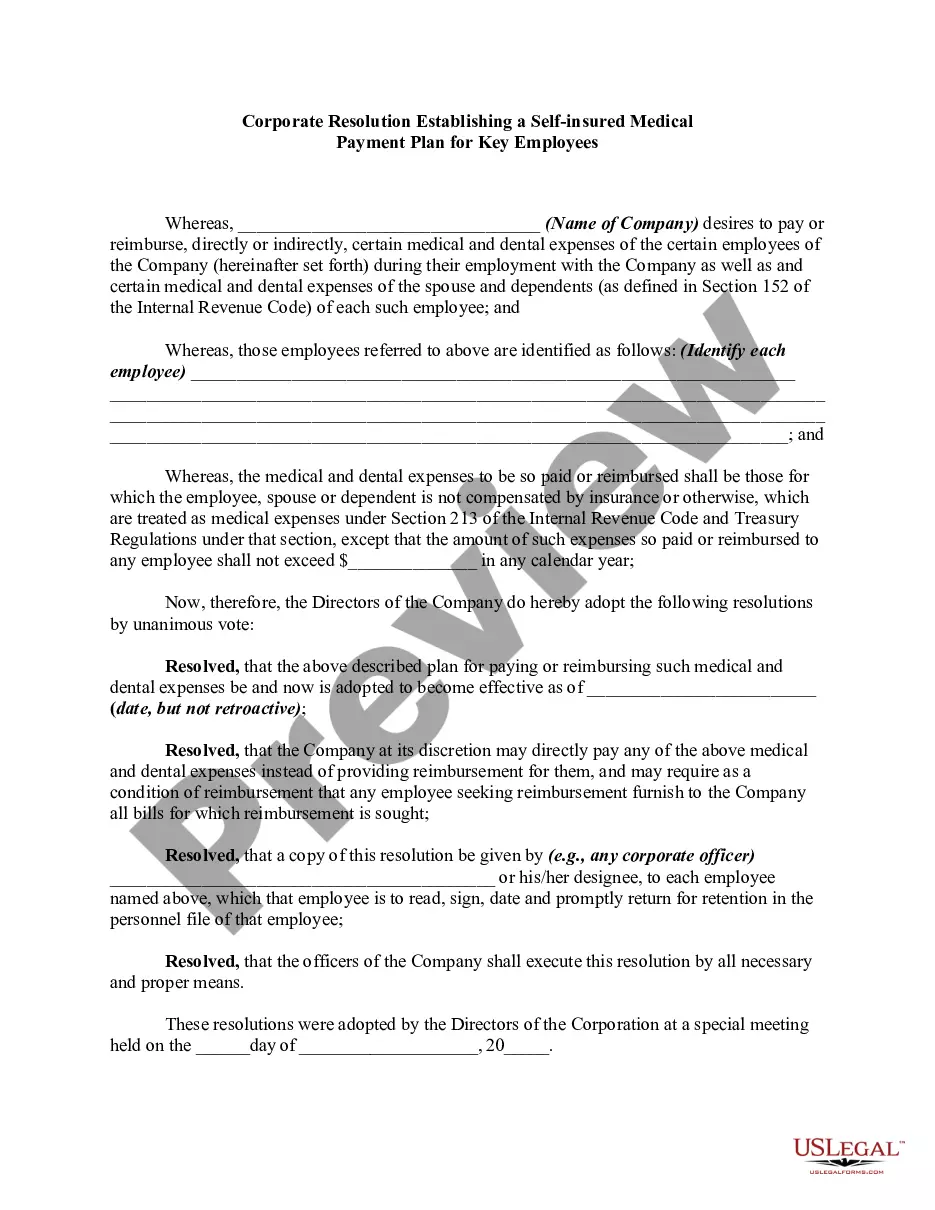

Tarrant Texas Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees In Tarrant, Texas, many corporations opt to establish a self-insured medical payment plan for key employees as a means to provide comprehensive healthcare coverage while maintaining control over costs. This corporate resolution is a strategic decision made by companies to tailor their benefit offerings to meet the unique needs of their valuable key employees. A self-insured medical payment plan offers businesses the flexibility to customize healthcare benefits, ensuring that key employees receive the highest quality medical care while minimizing expenses. By assuming the financial risk associated with healthcare claims, companies can better manage costs, avoid hefty insurance premiums, and gain greater control over their employee benefits program. The Tarrant Texas Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees involves several key components. Firstly, it outlines the intent of the corporation to switch from traditional insurance coverage to a self-insured model. This important decision is based on a thorough analysis of the company's financial stability, risk tolerance, and the unique needs of their key employees. The resolution also details the responsibilities and obligations of the corporation in implementing and maintaining the self-insured medical payment plan. This encompasses various elements such as funding the plan, creating reserves for claim payments, establishing administrative procedures, and adhering to applicable federal and state regulations. Moreover, the Tarrant Texas Corporate Resolution highlights the eligibility criteria for key employees who will be covered under the self-insured medical payment plan. This may include executives, managers, directors, and other individuals in strategic positions within the company. Clear guidelines defining who qualifies as a key employee are essential to ensure fairness and consistency in benefit administration. The resolution addresses the process of engaging a third-party administrator (TPA) or establishing an internal administrative system to handle various aspects of the self-insured medical payment plan. This includes claims processing, managing provider networks, negotiating pricing agreements, and offering support services to covered employees. Furthermore, the resolution may outline provisions for an annual review of the self-insured medical payment plan's financial performance to assess its effectiveness and make necessary adjustments. This regular evaluation ensures that the plan continues to meet the company's objectives and provides optimal healthcare coverage for key employees. Different types of Tarrant Texas Corporate Resolution Establishing a Self-insured Medical Payment Plans for Key Employees may vary depending on the specific needs and preferences of each corporation. Some may opt for a basic self-insured plan, covering essential medical services, while others might choose a more comprehensive plan encompassing higher-tier medical treatments, dental care, vision benefits, and prescription drug coverage. In conclusion, the Tarrant Texas Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees is a crucial document that allows companies in Tarrant, Texas, to tailor their employee benefits program to meet the unique needs of their key personnel. Through self-insurance, businesses gain greater control over costs while ensuring comprehensive healthcare coverage for their key employees.Tarrant Texas Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees In Tarrant, Texas, many corporations opt to establish a self-insured medical payment plan for key employees as a means to provide comprehensive healthcare coverage while maintaining control over costs. This corporate resolution is a strategic decision made by companies to tailor their benefit offerings to meet the unique needs of their valuable key employees. A self-insured medical payment plan offers businesses the flexibility to customize healthcare benefits, ensuring that key employees receive the highest quality medical care while minimizing expenses. By assuming the financial risk associated with healthcare claims, companies can better manage costs, avoid hefty insurance premiums, and gain greater control over their employee benefits program. The Tarrant Texas Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees involves several key components. Firstly, it outlines the intent of the corporation to switch from traditional insurance coverage to a self-insured model. This important decision is based on a thorough analysis of the company's financial stability, risk tolerance, and the unique needs of their key employees. The resolution also details the responsibilities and obligations of the corporation in implementing and maintaining the self-insured medical payment plan. This encompasses various elements such as funding the plan, creating reserves for claim payments, establishing administrative procedures, and adhering to applicable federal and state regulations. Moreover, the Tarrant Texas Corporate Resolution highlights the eligibility criteria for key employees who will be covered under the self-insured medical payment plan. This may include executives, managers, directors, and other individuals in strategic positions within the company. Clear guidelines defining who qualifies as a key employee are essential to ensure fairness and consistency in benefit administration. The resolution addresses the process of engaging a third-party administrator (TPA) or establishing an internal administrative system to handle various aspects of the self-insured medical payment plan. This includes claims processing, managing provider networks, negotiating pricing agreements, and offering support services to covered employees. Furthermore, the resolution may outline provisions for an annual review of the self-insured medical payment plan's financial performance to assess its effectiveness and make necessary adjustments. This regular evaluation ensures that the plan continues to meet the company's objectives and provides optimal healthcare coverage for key employees. Different types of Tarrant Texas Corporate Resolution Establishing a Self-insured Medical Payment Plans for Key Employees may vary depending on the specific needs and preferences of each corporation. Some may opt for a basic self-insured plan, covering essential medical services, while others might choose a more comprehensive plan encompassing higher-tier medical treatments, dental care, vision benefits, and prescription drug coverage. In conclusion, the Tarrant Texas Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees is a crucial document that allows companies in Tarrant, Texas, to tailor their employee benefits program to meet the unique needs of their key personnel. Through self-insurance, businesses gain greater control over costs while ensuring comprehensive healthcare coverage for their key employees.