Maricopa, Arizona is a city located in the southern part of the state. When it comes to real estate transactions in Maricopa, the Assignment of Deed of Trust plays a crucial role. This document, commonly used in property transfers, is essentially a legal instrument that transfers the rights and interests of the original lender (also known as the beneficiary) to another party. The Assignment of Deed of Trust is an important process in which the original lender transfers their rights to a new beneficiary. This can occur for various reasons, such as selling the loan, transferring the servicing rights, or as part of a loan securitization process. In Maricopa, Arizona, there are a few different types of Assignment of Deed of Trust, each serving a specific purpose: 1. Standard Assignment of Deed of Trust: This is the most common type, where the original lender assigns the mortgage loan to a new beneficiary. This could be an individual, an institutional investor, or even a mortgage-backed security trust. 2. Assignment of Deed of Trust with Substitution of Trustee: In certain situations, the lender might want to replace the trustee named in the original deed of trust. This type of assignment occurs when the beneficiary designates a new trustee to oversee the property in case of default or foreclosure. 3. Assignment of Deed of Trust in Case of Loan Modification: When a borrower faces financial difficulties and seeks a loan modification, the lender may change the original terms of the loan, including interest rates, payment schedules, or principal amounts. In such cases, an Assignment of Deed of Trust is often executed to reflect these modifications. 4. Collateral Assignment of Deed of Trust: In unique circumstances, the borrower might need to use their property as collateral for another loan, separate from the original mortgage. A collateral assignment occurs when the borrower assigns the deed of trust as collateral to secure a separate debt obligation. It is important to note that the specific terms and conditions for Assignment of Deed of Trust can vary depending on the parties involved, the loan agreement, and other factors. Additionally, the legal requirements for executing and recording these documents may differ between jurisdictions. For a comprehensive understanding of the Maricopa, Arizona Assignment of Deed of Trust, it is recommended to consult with a real estate attorney or relevant authorities.

Maricopa Arizona Assignment of Deed of Trust

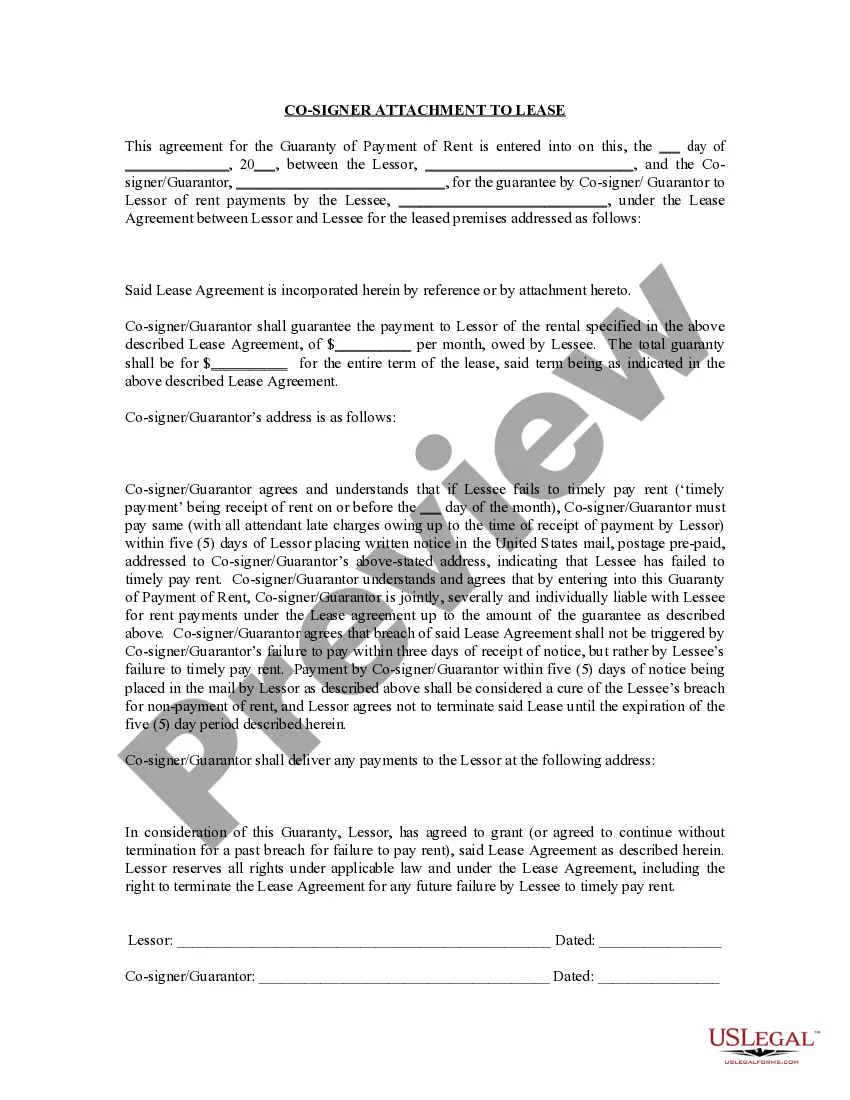

Description

How to fill out Maricopa Arizona Assignment Of Deed Of Trust?

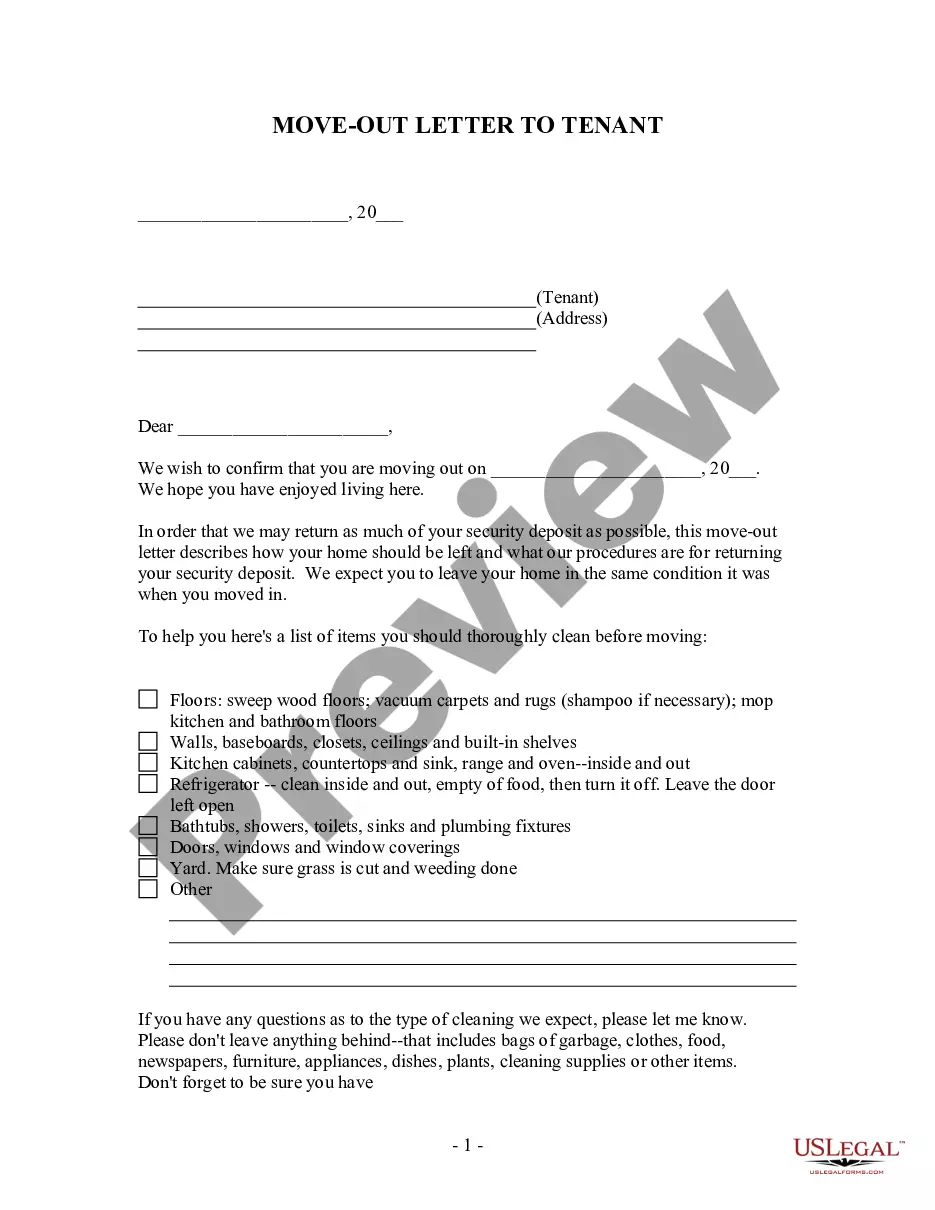

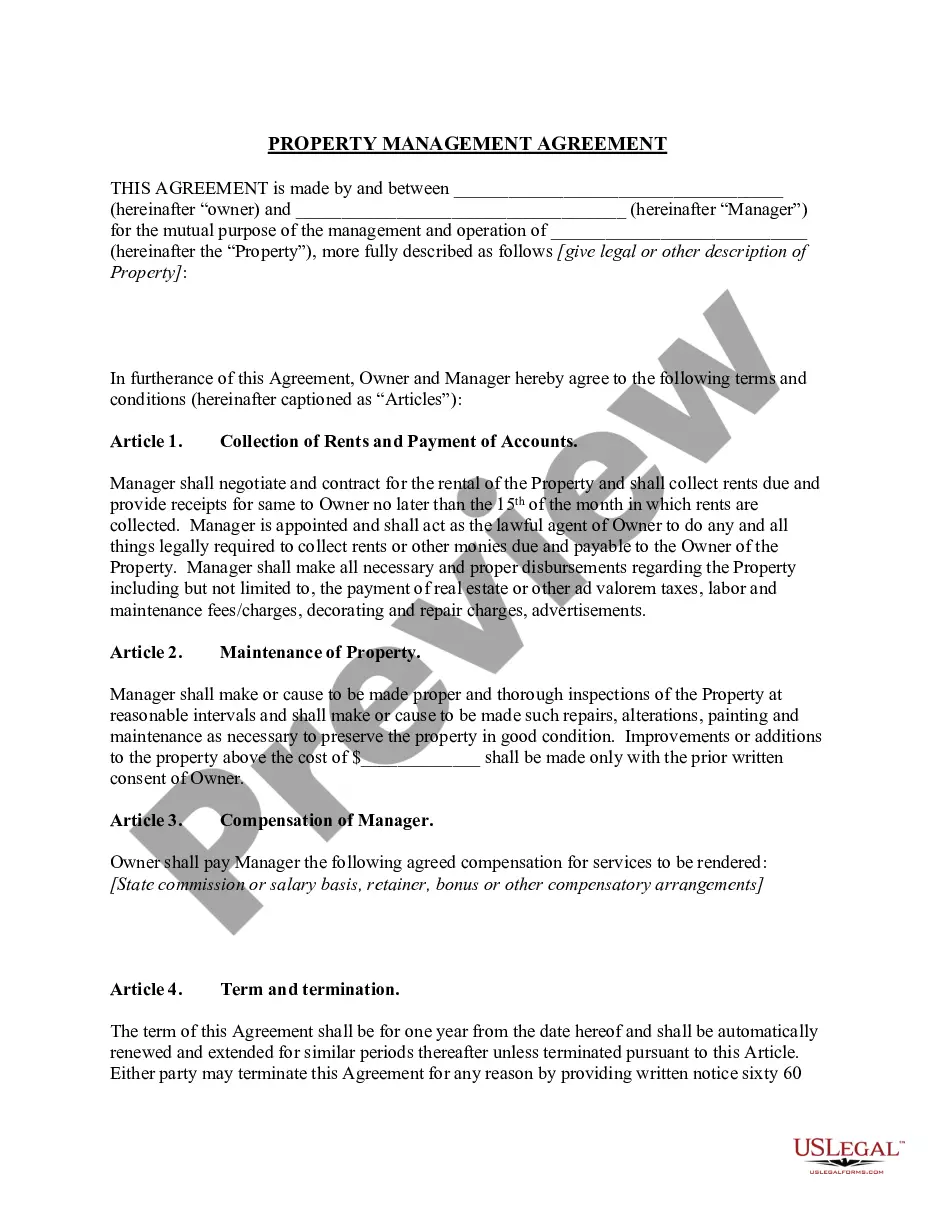

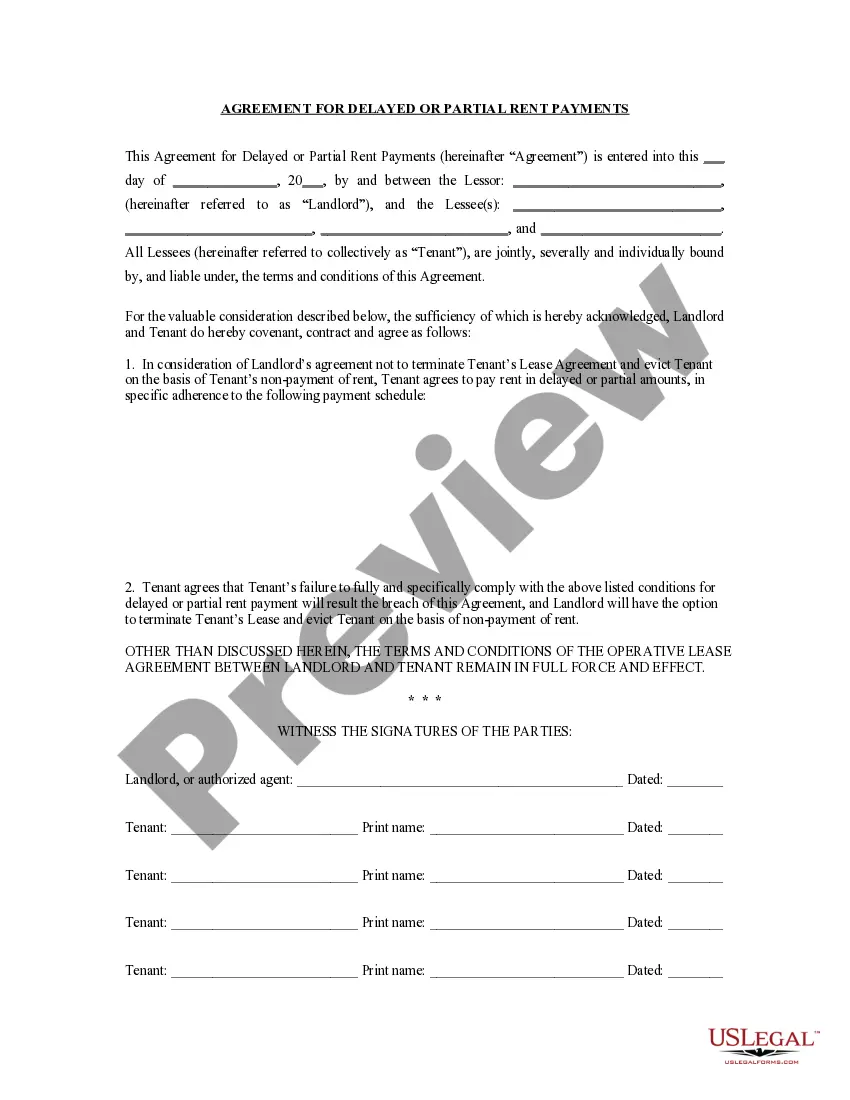

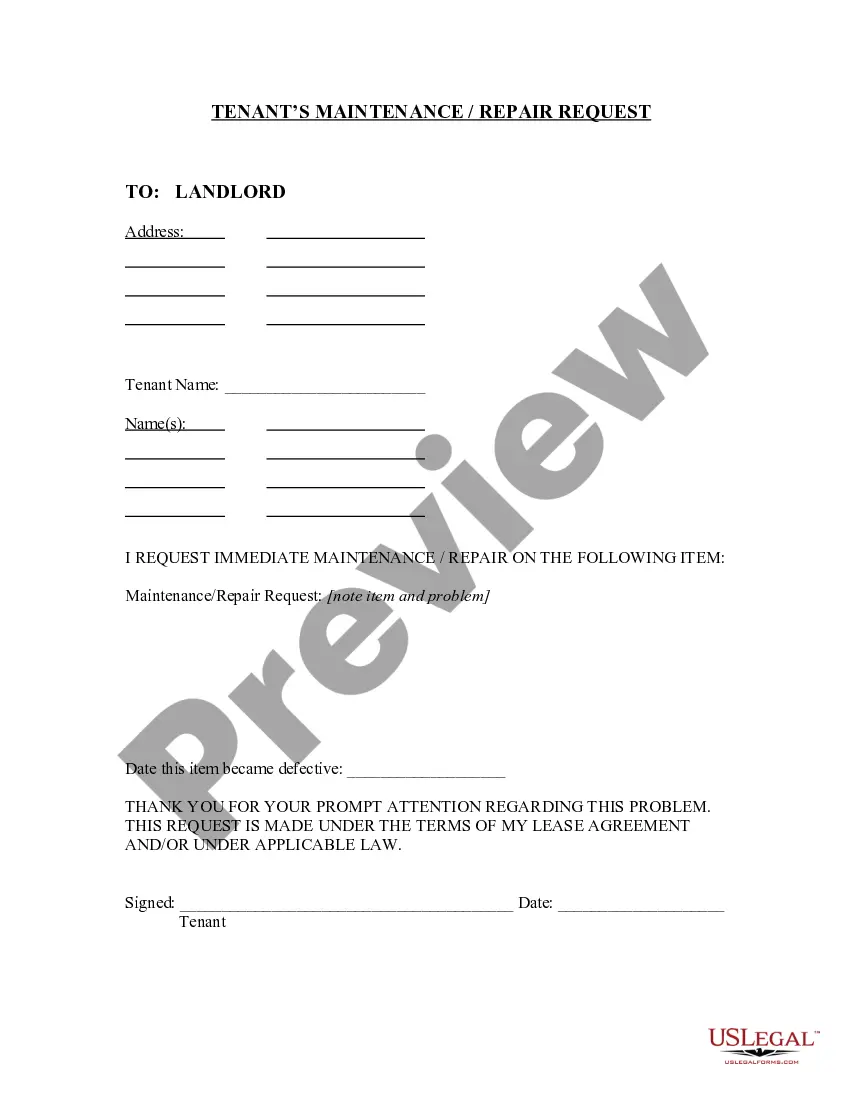

Whether you plan to start your company, enter into a deal, apply for your ID update, or resolve family-related legal issues, you need to prepare certain paperwork meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal templates for any individual or business occasion. All files are grouped by state and area of use, so picking a copy like Maricopa Assignment of Deed of Trust is quick and easy.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few more steps to obtain the Maricopa Assignment of Deed of Trust. Adhere to the guidelines below:

- Make certain the sample meets your individual needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Make use of the search tab providing your state above to find another template.

- Click Buy Now to get the sample once you find the proper one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Maricopa Assignment of Deed of Trust in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you are able to access all of your previously acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!