Kings New York Sample Letter concerning Free Port Tax Exemption

Description

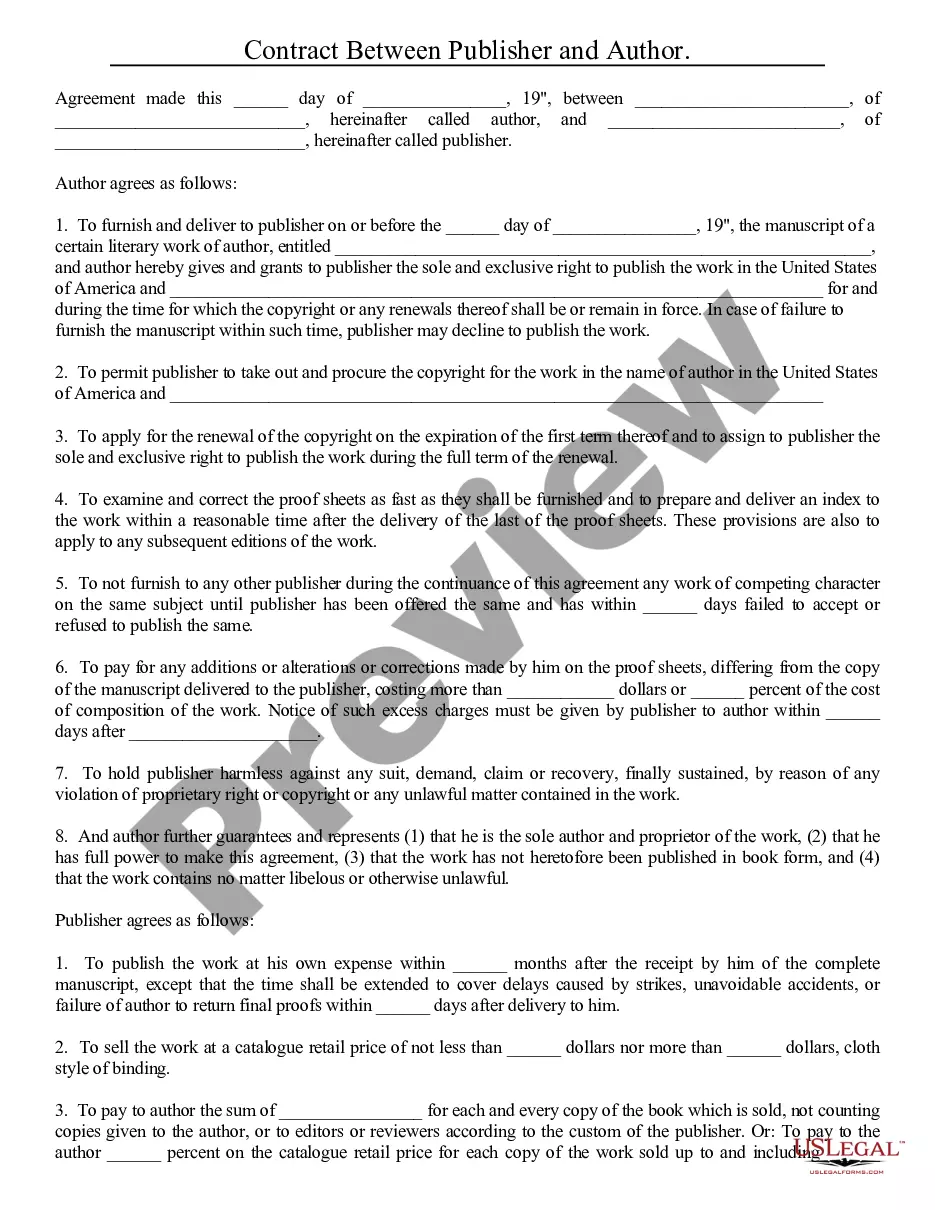

How to fill out Sample Letter Concerning Free Port Tax Exemption?

How much duration does it typically require for you to produce a legal document.

Since each state comes with its laws and regulations for every life situation, finding a Kings Sample Letter about Free Port Tax Exemption that meets all local standards can be draining, and obtaining it from a qualified attorney is frequently expensive.

Numerous online platforms provide the most sought-after state-specific templates for download, but utilizing the US Legal Forms library proves to be the most beneficial.

Establish an account on the platform or Log In to move on to payment procedures. Complete payment through PayPal or with your credit card. Alter the file format if necessary. Click Download to save the Kings Sample Letter concerning Free Port Tax Exemption. Print the document or use any chosen online editor to fill it out electronically. Regardless of how many times you need to utilize the acquired template, you can access all the files you’ve previously downloaded in your profile by visiting the My documents tab. Give it a try!

- US Legal Forms boasts the most comprehensive online collection of templates, organized by state and area of application.

- Alongside the Kings Sample Letter regarding Free Port Tax Exemption, you can discover any particular document needed to manage your business or personal matters while adhering to your county regulations.

- Professionals review all samples for their accuracy, ensuring you can confidently prepare your paperwork correctly.

- Using the service is quite simple.

- If you owe an account on the platform and your subscription is active, you merely need to Log In, select the desired sample, and download it.

- You can retrieve the file from your profile at any time later.

- On the other hand, if you are a newcomer to the website, there will be additional steps to follow before acquiring your Kings Sample Letter about Free Port Tax Exemption.

- Check the information on the page you’re on.

- Review the description of the sample or Preview it (if available).

- Look for another document using the relevant option in the header.

- Hit Buy Now once you’re confident in your selected file.

- Choose the subscription plan that fits you best.

Form popularity

FAQ

These Homestead Exemptions apply to the Fulton County portion of your property taxes anywhere in Fulton county, with no income or age limits. Fulton Schools Basic Exemption $2,000 Plus 3% Floating Homestead.

The benefit is estimated to be a $293 tax reduction. Enhanced STAR is for homeowners 65 and older whose total household income for all owners and spouses who live with them is $92,000 or less. The benefit is estimated to be a $650 tax reduction.

You need to download and complete Form RP-425-IVR to receive the exemption. Senior citizens can elect to have the assessor's office automatically verify their income and avoid filing the enhanced form every year.

The Freeport Inventory Tax Exemption exempts companies from paying state and local property taxes on qualifying inventory held in their factories and warehouses. Georgia's Sales Tax and Use Tax Exemptions allows businesses to purchase various goods and services tax free.

To apply for the Enhanced STAR exemption, submit the following to your assessor: Form RP-425-IVP, Supplement to Form RP-425-E , and. Form RP-425-E, Application for Enhanced STAR Exemption (include the Social Security numbers of all owners of the property and any of their spouses who reside at the property).

To be eligible for Basic STAR your income must be $250,000 or less. You currently receive Basic STAR and would like to apply for Enhanced STAR. You may be eligible for Enhanced STAR if you will be 65 or older in the calendar year in which you apply.

The Freeport Exemption is a business personal property tax exemption on inventory that is in Texas for a short period of time (175 days or less) and will be transported outside of the State of Texas.

Also, some localities have special exemptions. For example, states like Georgia and Oklahoma offer the Freeport Exemption, which exempts certain types of inventory from taxation.

Under Section 11.43 of the Texas Property Tax Code, a person must file an exemption application form between January 1 and April 30 and furnish the information required by the form each year the person claims entitlement to the exemption.

The average property tax rate in Texas is 1.80%. This is currently the seventh-highest rate in the United States. Breaking this out in dollars, if your home is valued at $200,000, your personal property taxes at the average rate of 1.80% would be $3,600 for the year.