Montgomery County, Maryland, holds a strong reputation for being a well-developed area with a thriving business environment. As such, it is quite common to see individuals or entities engage in the Assignment or Sale of Interest in Limited Liability Companies (LCS) within this jurisdiction. The process involves transferring ownership rights or disposing of interests in an LLC to another party. One type of Assignment or Sale of Interest in an LLC is an equity transfer. Equity transfers occur when an individual or entity transfers the ownership interest they hold in an LLC to another party. This can involve the sale of membership units or shares in the company, typically represented by a written agreement approved by both the assignor and the assignee. Another type of transfer is an asset assignment, wherein a member of an LLC transfers specific assets or intellectual property rights held by the LLC to another party. This type of assignment allows for the separation or sale of assets without the complete transfer of ownership in the LLC itself. When engaging in the Assignment or Sale of Interest in an LLC in Montgomery County, Maryland, it is crucial to ensure adherence to state-specific laws and regulations. Montgomery County operates under the Maryland Limited Liability Companies Act, providing a legal framework for conducting these transactions. To effectively execute the Assignment or Sale of Interest, parties involved should follow certain procedures. First, the assignor must identify their intention to sell or assign their interest in the LLC. The assignee, in turn, must express their willingness to assume such interest. This usually requires a written agreement outlining the terms and conditions of the transfer, such as the purchase price, effective date, and any required consents or approvals from other LLC members. To properly document the transaction, a Bill of Sale or an Assignment Agreement should be prepared. This legally binding document helps transfer the assignor's interest to the assignee, ensuring a smooth transition of ownership within the LLC. It may also include representations and warranties, indemnification provisions, and non-compete clauses, among other clauses specific to the transaction. It is essential for individuals participating in the Assignment or Sale of Interest in an LLC in Montgomery County, Maryland, to consult legal professionals experienced in business law and specifically familiar with the laws and regulations in the state. They can help navigate the complexities involved, draft comprehensive agreements, and ensure compliance with all necessary procedures. In conclusion, the Assignment or Sale of Interest in Limited Liability Companies (LCS) in Montgomery County, Maryland, encompasses various types, such as equity transfers and asset assignments. Following the Maryland Limited Liability Companies Act and consulting legal professionals will help facilitate these transactions smoothly, ensuring the protection of all parties' rights and compliance with relevant laws.

Montgomery Maryland Assignment or Sale of Interest in Limited Liability Company (LLC)

Description

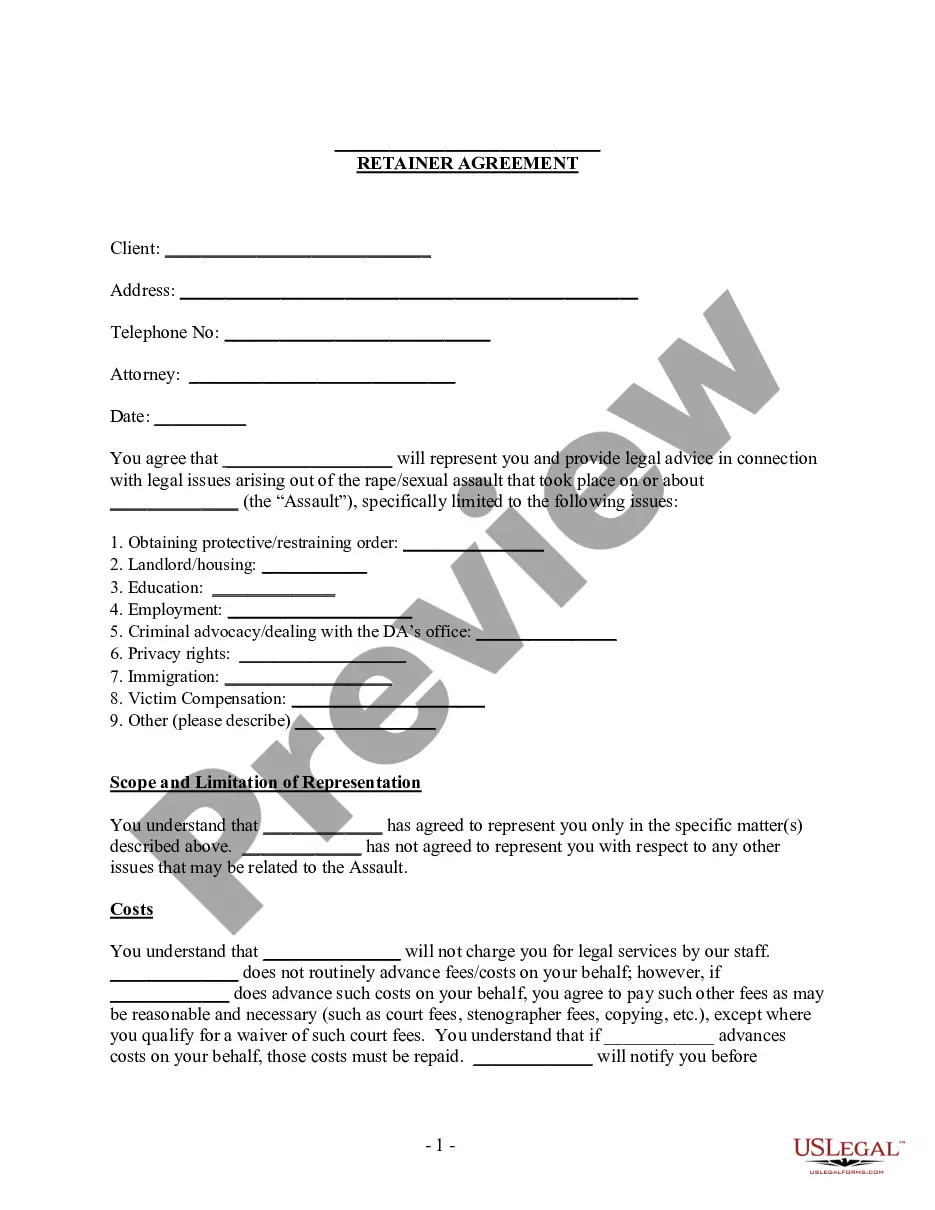

How to fill out Montgomery Maryland Assignment Or Sale Of Interest In Limited Liability Company (LLC)?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to seek qualified assistance to draft some of them from scratch, including Montgomery Assignment or Sale of Interest in Limited Liability Company (LLC), with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to choose from in different categories varying from living wills to real estate paperwork to divorce documents. All forms are arranged based on their valid state, making the searching process less overwhelming. You can also find information resources and tutorials on the website to make any tasks related to paperwork completion straightforward.

Here's how you can find and download Montgomery Assignment or Sale of Interest in Limited Liability Company (LLC).

- Go over the document's preview and outline (if provided) to get a basic idea of what you’ll get after downloading the document.

- Ensure that the template of your choice is specific to your state/county/area since state laws can affect the legality of some documents.

- Examine the similar document templates or start the search over to locate the correct document.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the option, then a suitable payment method, and buy Montgomery Assignment or Sale of Interest in Limited Liability Company (LLC).

- Select to save the form template in any offered file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Montgomery Assignment or Sale of Interest in Limited Liability Company (LLC), log in to your account, and download it. Needless to say, our website can’t replace a legal professional entirely. If you have to cope with an exceptionally difficult situation, we recommend using the services of a lawyer to examine your form before executing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of users. Join them today and purchase your state-specific documents effortlessly!