Queens, New York is known for its rich culture, diverse communities, and vibrant neighborhoods. Located on the easternmost part of New York City's five boroughs, Queens offers a unique blend of residential areas, commercial hubs, and recreational spaces. The Assignment or Sale of Interest in a Limited Liability Company (LLC) in Queens is a legal transaction that allows individuals or entities to transfer ownership rights or sell their shares in an LLC located within the borough. An LLC is a business structure that combines the liability protection of a corporation with the flexibility and tax advantages of a partnership. It is a popular choice for small businesses, startups, and real estate ventures operating in Queens. When an individual wishes to assign or sell their interest in an LLC, various types of transactions may take place, including: 1. Complete Assignment: In this type of transaction, an individual transfers their entire ownership interest in an LLC to another party. The new owner assumes all the rights, responsibilities, and liabilities associated with the LLC. 2. Partial Assignment: A partial assignment involves the transfer of a portion of an individual's ownership interest in an LLC. The assignee becomes a partial owner but may have limited decision-making power or financial obligations. 3. Sale of Membership Units: LCS often divide ownership interests into units, similar to shares in a corporation. The sale of membership units involves selling specific units to another party, allowing them to become a member of the LLC and benefit from its profits and losses. 4. Transfer without Consideration: In some cases, an individual may transfer their interest in an LLC without receiving any compensation in return. This type of transfer can occur through gifts, inheritance, or other non-monetary arrangements. When undertaking an Assignment or Sale of Interest in an LLC, it is crucial to follow proper legal procedures, including drafting and signing appropriate legal documents such as an Assignment Agreement or Membership Interest Transfer Agreement. These documents outline the terms and conditions of the transaction, ensuring a smooth transfer of ownership rights while minimizing potential disputes or legal complications. Whether you are buying or selling an interest in an LLC in Queens, it is advisable to seek professional advice from an attorney or business consultant who specializes in corporate law and transactions. They can guide you through the process, help negotiate terms, and ensure compliance with applicable laws and regulations. In conclusion, the Assignment or Sale of Interest in a Limited Liability Company (LLC) in Queens, New York involves transferring ownership rights in an LLC located within the borough. With various types of transactions possible, such as complete or partial assignments and the sale of membership units, it is essential to follow legal procedures and consult professionals for a successful and legally compliant transfer of ownership.

Queens New York Assignment or Sale of Interest in Limited Liability Company (LLC)

Description

How to fill out Queens New York Assignment Or Sale Of Interest In Limited Liability Company (LLC)?

Preparing papers for the business or individual demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to consider all federal and state regulations of the specific region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to draft Queens Assignment or Sale of Interest in Limited Liability Company (LLC) without professional help.

It's easy to avoid spending money on attorneys drafting your documentation and create a legally valid Queens Assignment or Sale of Interest in Limited Liability Company (LLC) by yourself, using the US Legal Forms online library. It is the most extensive online catalog of state-specific legal templates that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed form.

In case you still don't have a subscription, follow the step-by-step guideline below to get the Queens Assignment or Sale of Interest in Limited Liability Company (LLC):

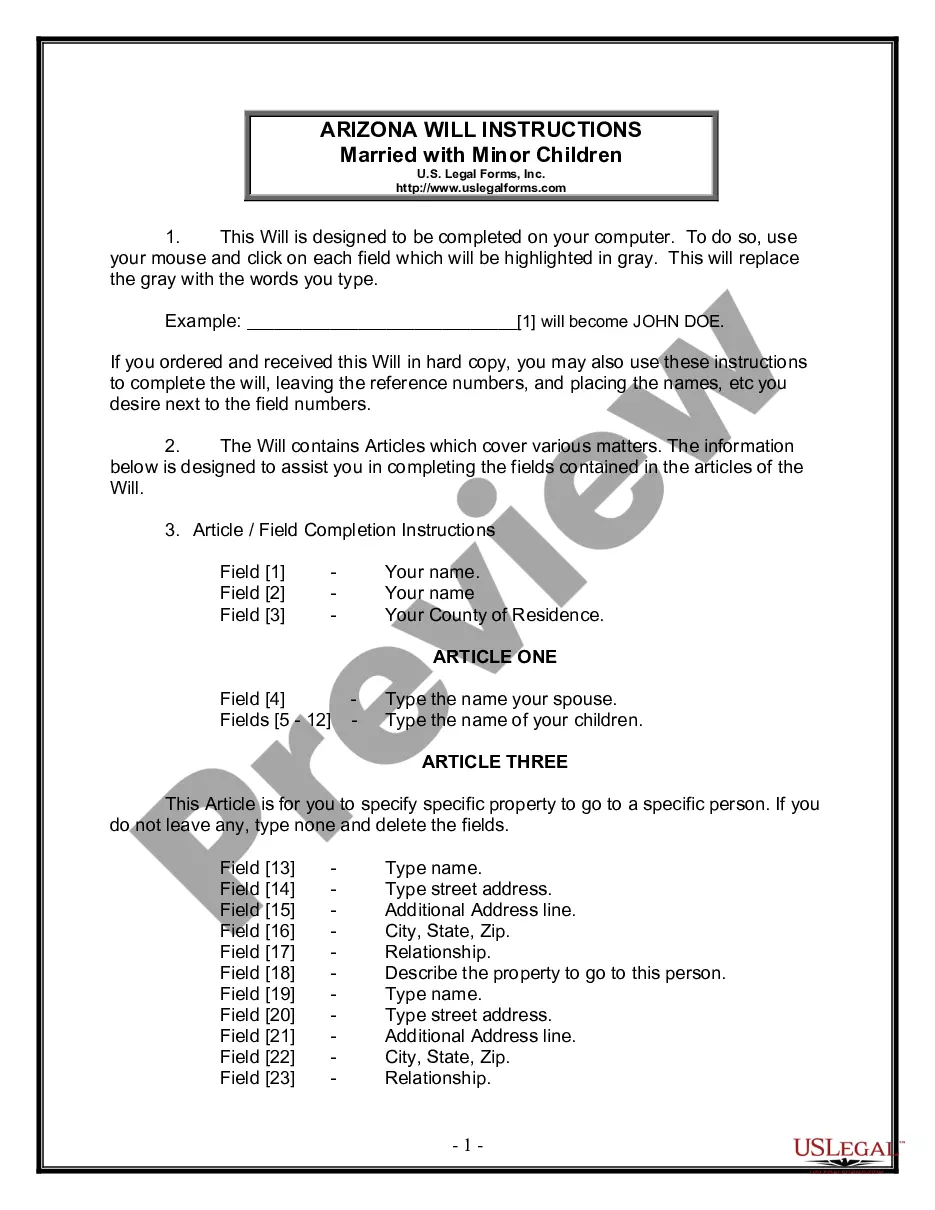

- Examine the page you've opened and check if it has the sample you require.

- To achieve this, use the form description and preview if these options are presented.

- To find the one that satisfies your requirements, utilize the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Select the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal templates for any scenario with just a couple of clicks!