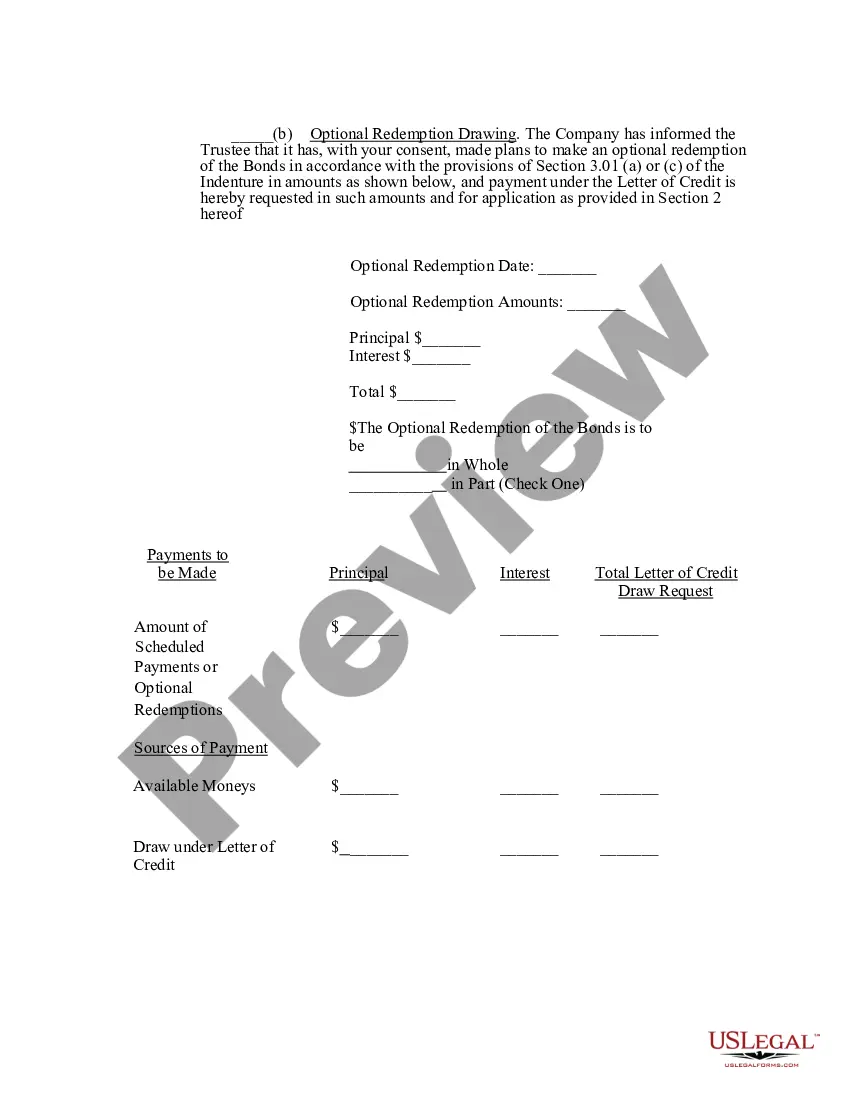

Fairfax, Virginia, is a city located in the northern region of the state. It is known for being a prominent area within the Washington, D.C. metropolitan area, offering a mix of suburban charm and urban convenience. One financial instrument commonly used in Fairfax, Virginia, is the Irrevocable Letter of Credit (LC). This document serves as a guarantee from a bank or financial institution to ensure payment to a beneficiary, provided that certain conditions are met. An Irrevocable Letter of Credit is a highly secure method of payment widely used in international trade, construction projects, and other contractual agreements. It offers assurance and reduces financial risk between the buyer and seller by acting as an intermediary. The LC assures the seller that payment will be made if they meet the stipulated terms of the agreement, and simultaneously protects the buyer by only releasing funds when the agreed-upon conditions are fulfilled. In Fairfax, Virginia, there are several types of Irrevocable Letters of Credit available to accommodate different business needs: 1. Commercial LC: This type of LC is commonly used for the purchase and sale of goods. It ensures that the seller will receive payment upon successful completion of the agreed-upon conditions, such as the delivery of goods or provision of services. 2. Standby LC: Unlike a Commercial LC, a Standby LC serves as a backup payment mechanism. It exists primarily to provide financial assurances to the beneficiary in case the applicant (usually the buyer) fails to fulfill their obligations stated in the contract. 3. Revolving LC: A Revolving LC is used when a buyer and seller have a long-term business relationship involving multiple transactions. It allows the buyer to make several draw downs against the LC within a specific time frame without the need for multiple LC applications. 4. Transferable LC: A Transferable LC permits either the beneficiary or the intermediary bank to transfer a part or the entire LC to a second beneficiary. This type of LC is useful when the primary beneficiary acts as a middleman or procures goods from multiple sources. 5. Back-to-Back LC: A Back-to-Back LC involves the issuance of two separate LC's. The first LC is obtained by the middleman in favor of the supplier, while the intermediary uses the second LC to secure payment from the buyer. This method is commonly used when the intermediary does not have sufficient funds or creditworthiness to execute the contract. Irrevocable Letters of Credit play a crucial role in facilitating international trade, promoting trust between parties, and mitigating potential financial risks. In Fairfax, Virginia, businesses frequently leverage these instruments to ensure smooth commercial transactions by taking advantage of the various types of LC's available to suit their specific requirements.

Fairfax Virginia Irrevocable Letter of Credit

Description

How to fill out Fairfax Virginia Irrevocable Letter Of Credit?

Laws and regulations in every sphere differ throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid costly legal assistance when preparing the Fairfax Irrevocable Letter of Credit, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals searching for do-it-yourself templates for different life and business scenarios. All the documents can be used multiple times: once you pick a sample, it remains accessible in your profile for future use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Fairfax Irrevocable Letter of Credit from the My Forms tab.

For new users, it's necessary to make several more steps to get the Fairfax Irrevocable Letter of Credit:

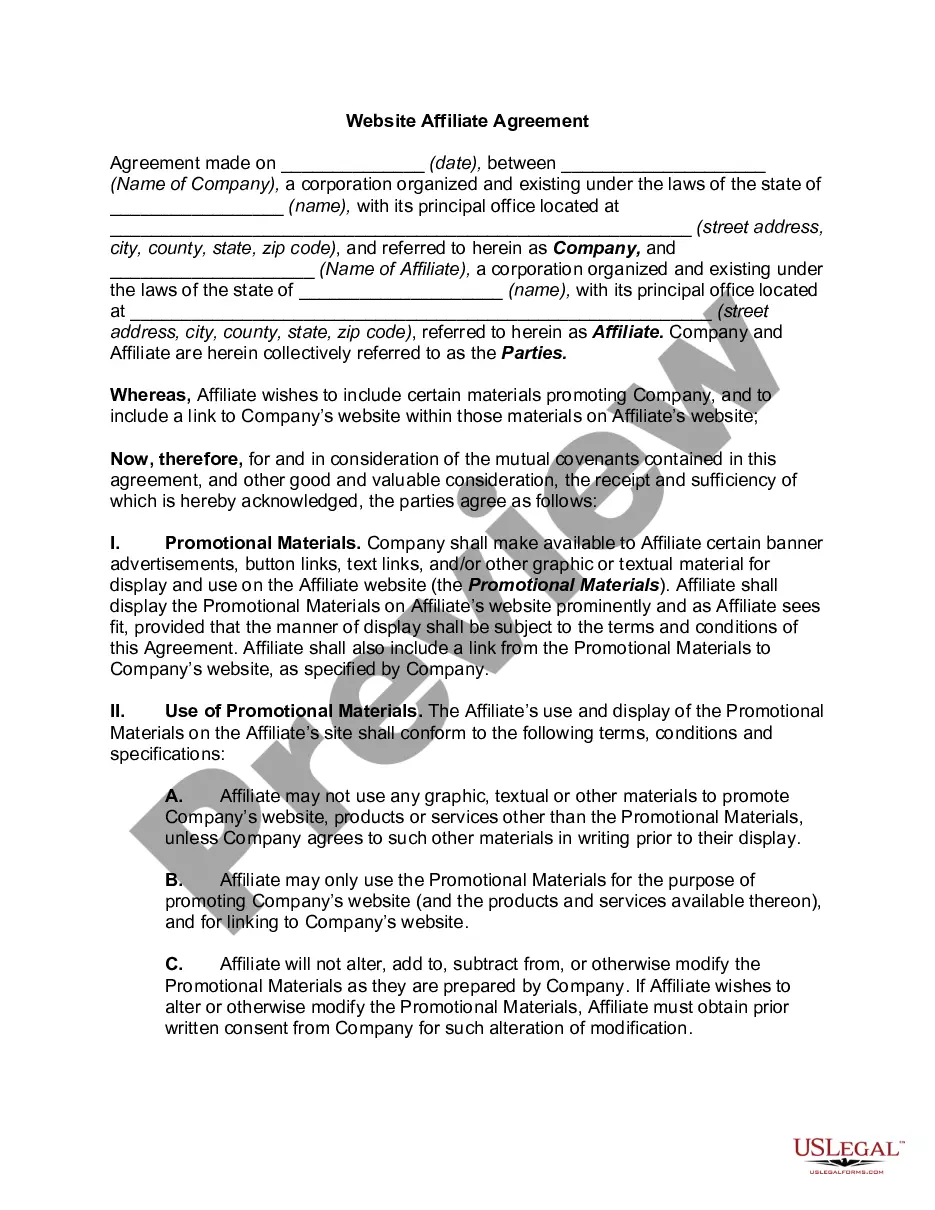

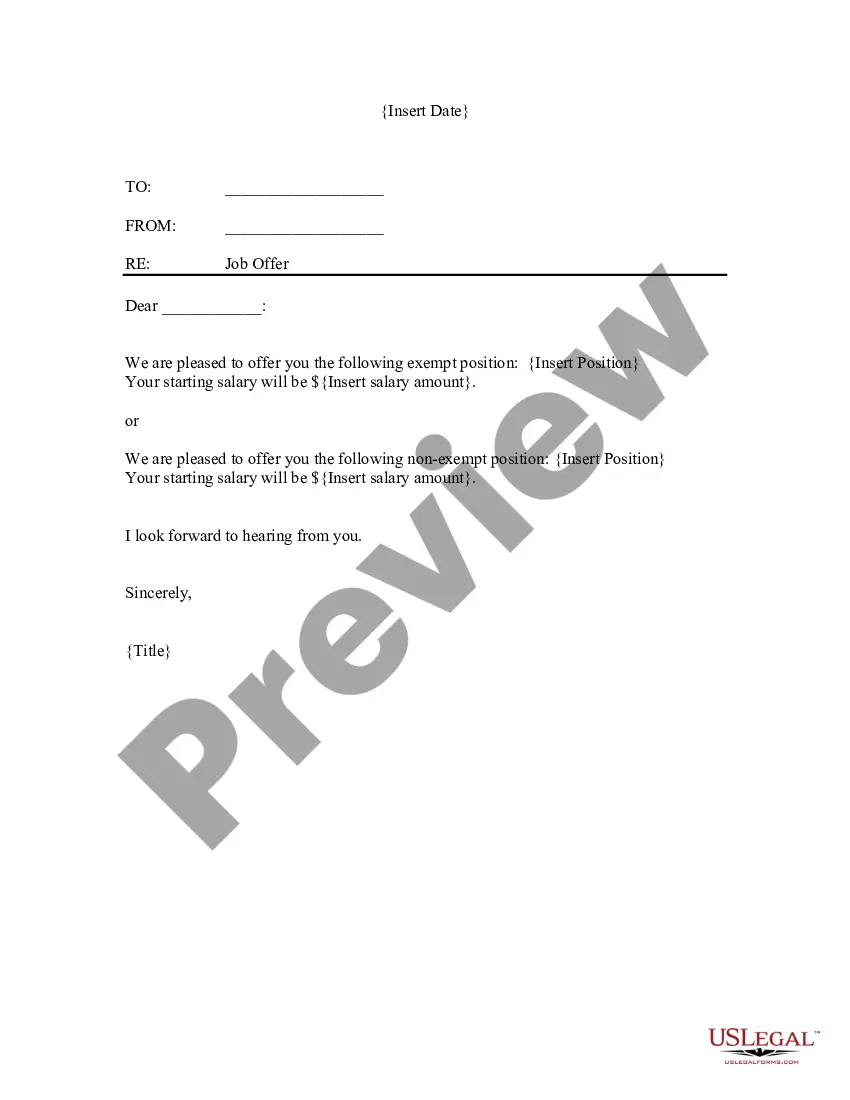

- Analyze the page content to ensure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the document once you find the appropriate one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!