A Suffolk New York Irrevocable Letter of Credit is a financial instrument issued by a bank or financial institution in Suffolk County, New York. It guarantees payment to a beneficiary under specific conditions that are outlined in the letter of credit. This type of letter of credit cannot be amended or canceled without the explicit consent of all parties involved. The Suffolk New York Irrevocable Letter of Credit is widely used in various industries and transactions, including international trade, real estate, construction projects, and other contractual agreements. It offers a level of financial security and assurance to both the parties involved in a transaction. There are different types of Suffolk New York Irrevocable Letters of Credit, categorized based on their purpose and terms: 1. Commercial Letter of Credit: This type of letter of credit is usually used in international trade transactions. It guarantees payment to the exporter once they fulfill the specified terms and conditions, such as providing the necessary documents or completing the delivery. 2. Standby Letter of Credit: A standby letter of credit acts as a backup or guarantee if the primary payment method fails. It serves as a form of financial security for the beneficiary, assuring them that they will receive the payment if certain predefined events occur. 3. Performance Letter of Credit: In construction or service contracts, a performance letter of credit ensures that the party responsible for fulfilling the obligations under the contract will carry them out satisfactorily. If there is a breach of contract or failure to perform, the beneficiary can draw on this letter of credit. 4. Financial Letter of Credit: This type of letter of credit is mainly used in financial transactions, such as loans or credit extensions. It guarantees payment to the lender if the borrower fails to meet their financial obligations. Overall, the Suffolk New York Irrevocable Letter of Credit provides a contractual safeguard and promotes trust between parties engaged in various business transactions. It offers financial security and mitigates risk for both the applicant and the beneficiary when conducting business in Suffolk County, New York.

Suffolk New York Irrevocable Letter of Credit

Description

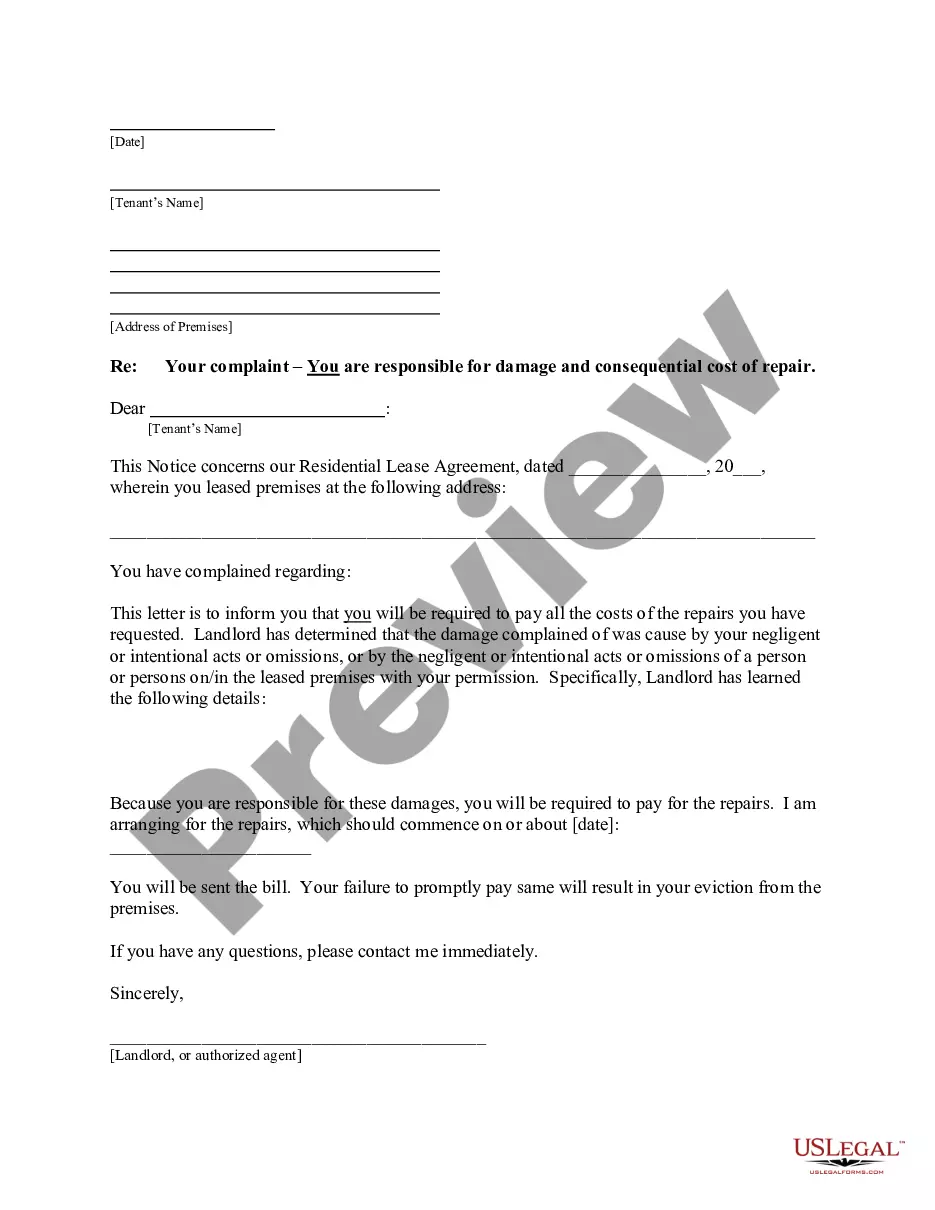

How to fill out Suffolk New York Irrevocable Letter Of Credit?

Drafting documents for the business or personal needs is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws and regulations of the particular area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to draft Suffolk Irrevocable Letter of Credit without expert assistance.

It's possible to avoid spending money on lawyers drafting your documentation and create a legally valid Suffolk Irrevocable Letter of Credit by yourself, using the US Legal Forms online library. It is the biggest online collection of state-specific legal documents that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary document.

In case you still don't have a subscription, adhere to the step-by-step guide below to get the Suffolk Irrevocable Letter of Credit:

- Examine the page you've opened and verify if it has the sample you need.

- To achieve this, use the form description and preview if these options are presented.

- To find the one that satisfies your needs, use the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal forms for any situation with just a couple of clicks!

Form popularity

FAQ

An irrevocable letter of credit cannot be canceled, nor in any way modified, except with the explicit agreement of all parties involved: the buyer, the seller, and the issuing bank. For example, the issuing bank does not have the authority by itself to change any of the terms of an ILOC once it is issued.

An irrevocable letter of credit should always be obtained from a commercial bank and not drafted by the importer or exporter.

First, a Letter of Credit costs more than you think: For a typical commercial lease, a bank charges about 2% annually for a letter of credit, but the actual costs to the tenant are much higher.

A Revocable letter of credit can be edited or annulled without prior notice to the receiver/ sellers. On the other hand, an irrevocable letter of credit cannot be amended in any way or be cancelled unless explicitly agreed upon by all the parties involved in the agreement.

The standard cost of a letter of credit is around 0.75% of the total purchase cost. For letters that are in the 6 figures (typically around $250,000), these fees can add up and benefit the bank.

An irrevocable letter of credit (ILOC) is a guarantee for payment issued by a bank for goods and services purchased, which cannot be cancelled during some specified time period. ILOCs are most commonly used to facilitate international trade.

You can approach your bank to open a Letter of credit. The concerned officer at bank helps you in filling up necessary application to open an LC. Since the LC is opened on the basis of your purchase contract, a copy purchase order / export contract has to be produced with along with other required documents.

An irrevocable letter of credit (ILOC) is an official correspondence from a bank that guarantees payment for goods or services being purchased by the individual or entity, referred to as the applicant, that requests the letter of credit from an issuing bank.

According to the latest letter of credit rules (UCP 600) all credits are irrevocable. Letter of credit is a conditional payment obligation of the issuing bank and the beneficiary always has to make a complying presentation in order to receive the payment.

How To Get a Letter of Credit. To get a letter of credit, contact your bank. You'll most likely need to work with an international trade department or commercial division. Not every institution offers letters of credit, but small banks and credit unions can often refer you to somebody who can accommodate your needs.