Gift taxes are taxes that supplement the Estate Tax. Gift taxes are placed on gifts given away to any person while you are still living, so that you may not avoid estate taxes by making gifts of your estate. You may give up to $12,000 a year in cash or assets to an unlimited number of people each year without incurring gift tax liability, but the gifts must have no conditions attached. Married couples can give, as a couple, a $24,000 gift per year to as many people as they want. Under federal tax law, gifts totaling more than $12,000 to one person in one year are considered a taxable gift and generate a potential gift tax. It does not matter if you give one $13,000 gift or 13 gifts of $1,000 each, or one gift of $12,000 and a "birthday gift" of $1,000.

Gifts beyond the $12,000 limit (there is an exception for gifts that are directly paid by the gift giver for tuition and medical expenses) are considered "taxable gifts." Taxable gifts create liability for a gift tax. But gift tax is not due to be paid until you give away over $1,000,000 in your lifetime.

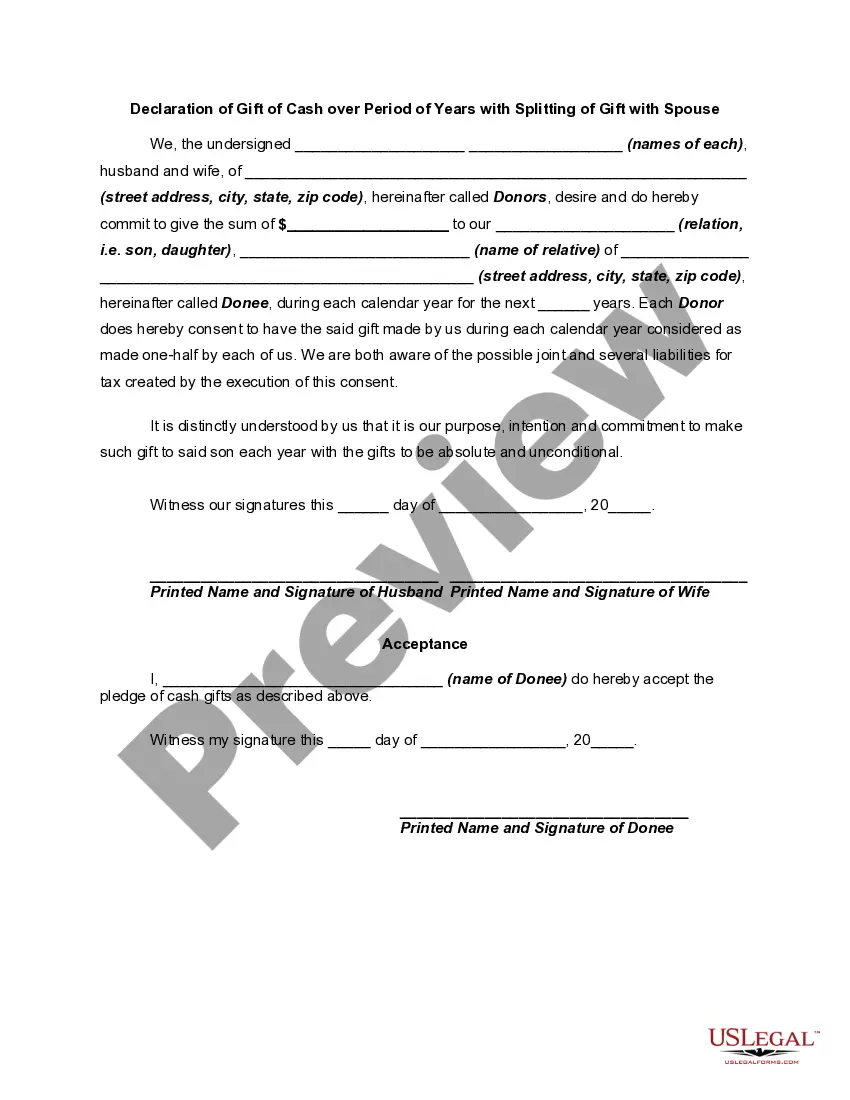

The Contra Costa California Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse is a legal document that allows individuals to make charitable donations over a specified period of time while also involving their spouse in the gifting process. This declaration can have several variations depending on the specific circumstances and preferences of the individuals involved. One type of Contra Costa California Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse is the Joint Declaration. This type involves both spouses contributing to the charitable donation, with an agreed-upon split of the gift amount over the designated period. This ensures that both spouses are actively involved and connected in the gifting process while supporting the chosen cause or organization. Another type is the Spousal Agreement Declaration, where one spouse takes the lead in making the charitable donations, but the other spouse consents to the splitting of the gift. This type allows for one spouse to have primary control in deciding the amount and timing of the donations while ensuring that both spouses are formally committed to the charitable endeavor. The Contra Costa California Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse typically outlines specific terms and conditions, including the identification of the charitable organization or cause, the total amount to be donated, the duration of the donation period, the method of gifting (such as monthly or yearly installments), and the agreed-upon splitting arrangement between the spouses. By involving both spouses in the charitable donation process, this declaration promotes collaboration, shared values, and joint commitment towards enriching the community. It allows couples to support causes that are meaningful to them while reinforcing their bond through philanthropy. This legal document serves as a testament to the couple's dedication to making a positive impact and can provide certain tax benefits as well. Keywords: Contra Costa, California, Declaration of Gift of Cash, Splitting of Gift with Spouse, charitable donations, Joint Declaration, Spousal Agreement Declaration, terms and conditions, philanthropy, community, tax benefits.The Contra Costa California Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse is a legal document that allows individuals to make charitable donations over a specified period of time while also involving their spouse in the gifting process. This declaration can have several variations depending on the specific circumstances and preferences of the individuals involved. One type of Contra Costa California Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse is the Joint Declaration. This type involves both spouses contributing to the charitable donation, with an agreed-upon split of the gift amount over the designated period. This ensures that both spouses are actively involved and connected in the gifting process while supporting the chosen cause or organization. Another type is the Spousal Agreement Declaration, where one spouse takes the lead in making the charitable donations, but the other spouse consents to the splitting of the gift. This type allows for one spouse to have primary control in deciding the amount and timing of the donations while ensuring that both spouses are formally committed to the charitable endeavor. The Contra Costa California Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse typically outlines specific terms and conditions, including the identification of the charitable organization or cause, the total amount to be donated, the duration of the donation period, the method of gifting (such as monthly or yearly installments), and the agreed-upon splitting arrangement between the spouses. By involving both spouses in the charitable donation process, this declaration promotes collaboration, shared values, and joint commitment towards enriching the community. It allows couples to support causes that are meaningful to them while reinforcing their bond through philanthropy. This legal document serves as a testament to the couple's dedication to making a positive impact and can provide certain tax benefits as well. Keywords: Contra Costa, California, Declaration of Gift of Cash, Splitting of Gift with Spouse, charitable donations, Joint Declaration, Spousal Agreement Declaration, terms and conditions, philanthropy, community, tax benefits.