Gift taxes are taxes that supplement the Estate Tax. Gift taxes are placed on gifts given away to any person while you are still living, so that you may not avoid estate taxes by making gifts of your estate. You may give up to $12,000 a year in cash or assets to an unlimited number of people each year without incurring gift tax liability, but the gifts must have no conditions attached. Married couples can give, as a couple, a $24,000 gift per year to as many people as they want. Under federal tax law, gifts totaling more than $12,000 to one person in one year are considered a taxable gift and generate a potential gift tax. It does not matter if you give one $13,000 gift or 13 gifts of $1,000 each, or one gift of $12,000 and a "birthday gift" of $1,000.

Gifts beyond the $12,000 limit (there is an exception for gifts that are directly paid by the gift giver for tuition and medical expenses) are considered "taxable gifts." Taxable gifts create liability for a gift tax. But gift tax is not due to be paid until you give away over $1,000,000 in your lifetime.

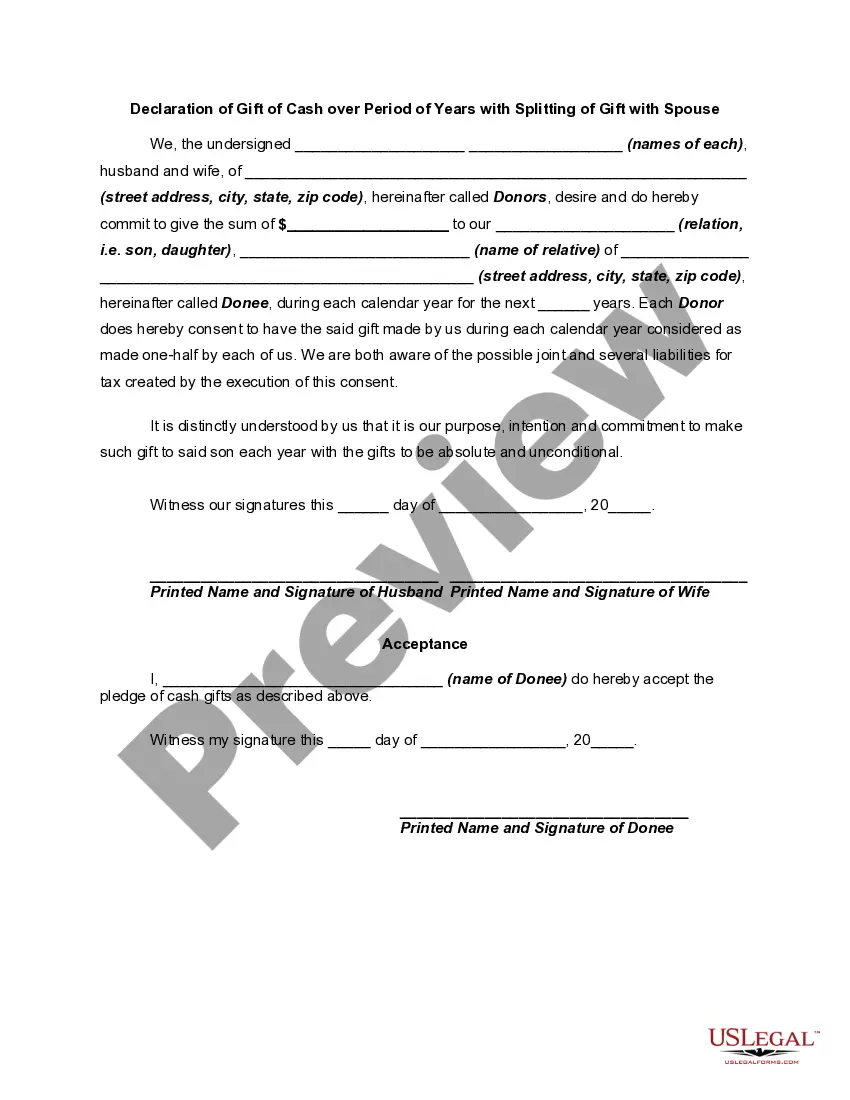

The Franklin Ohio Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse is a legal document that allows an individual residing in Franklin, Ohio to make a generous contribution of money to a chosen recipient(s) over a specific period of time while involving their spouse in the process. This declaration ensures clarity, transparency, and legal compliance throughout the gifting process. There are two main types of the Franklin Ohio Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse: 1. Comprehensive Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse: This type of declaration outlines the details of the gift, including the amount and frequency of cash contributions, the duration of the gifting period, and the designated recipient(s). It also specifies how the gift will be split between the individual making the gift and their spouse. This comprehensive declaration serves as a formal agreement between the parties involved, ensuring a clear understanding of each party's rights and responsibilities. 2. Modified Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse: This type of declaration allows for some flexibility in the gifting process. It may involve adjustments to the amount, frequency, or duration of the cash contributions, depending on the circumstances or preferences of the parties involved. The modified declaration ensures that any changes made are legally recognized and documented, providing a secure framework for the gifting arrangement. Keywords: Franklin Ohio, Declaration of Gift of Cash, Period of Years, Splitting of Gift with Spouse, legal document, recipient, contribution, gifting process, clarity, transparency, legal compliance, comprehensive declaration, formal agreement, rights and responsibilities, modified declaration, flexibility, adjustments, cash contributions, duration, gifting arrangement.The Franklin Ohio Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse is a legal document that allows an individual residing in Franklin, Ohio to make a generous contribution of money to a chosen recipient(s) over a specific period of time while involving their spouse in the process. This declaration ensures clarity, transparency, and legal compliance throughout the gifting process. There are two main types of the Franklin Ohio Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse: 1. Comprehensive Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse: This type of declaration outlines the details of the gift, including the amount and frequency of cash contributions, the duration of the gifting period, and the designated recipient(s). It also specifies how the gift will be split between the individual making the gift and their spouse. This comprehensive declaration serves as a formal agreement between the parties involved, ensuring a clear understanding of each party's rights and responsibilities. 2. Modified Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse: This type of declaration allows for some flexibility in the gifting process. It may involve adjustments to the amount, frequency, or duration of the cash contributions, depending on the circumstances or preferences of the parties involved. The modified declaration ensures that any changes made are legally recognized and documented, providing a secure framework for the gifting arrangement. Keywords: Franklin Ohio, Declaration of Gift of Cash, Period of Years, Splitting of Gift with Spouse, legal document, recipient, contribution, gifting process, clarity, transparency, legal compliance, comprehensive declaration, formal agreement, rights and responsibilities, modified declaration, flexibility, adjustments, cash contributions, duration, gifting arrangement.