Gift taxes are taxes that supplement the Estate Tax. Gift taxes are placed on gifts given away to any person while you are still living, so that you may not avoid estate taxes by making gifts of your estate. You may give up to $12,000 a year in cash or assets to an unlimited number of people each year without incurring gift tax liability, but the gifts must have no conditions attached. Married couples can give, as a couple, a $24,000 gift per year to as many people as they want. Under federal tax law, gifts totaling more than $12,000 to one person in one year are considered a taxable gift and generate a potential gift tax. It does not matter if you give one $13,000 gift or 13 gifts of $1,000 each, or one gift of $12,000 and a "birthday gift" of $1,000.

Gifts beyond the $12,000 limit (there is an exception for gifts that are directly paid by the gift giver for tuition and medical expenses) are considered "taxable gifts." Taxable gifts create liability for a gift tax. But gift tax is not due to be paid until you give away over $1,000,000 in your lifetime.

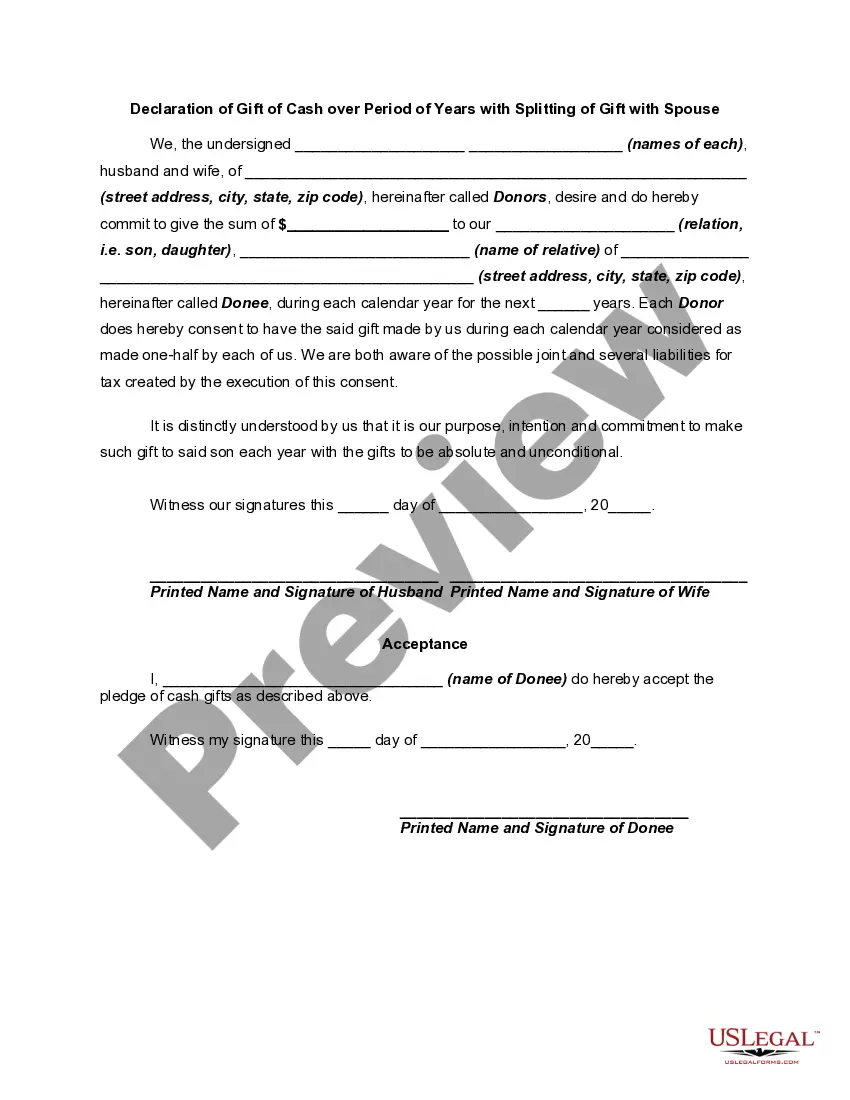

Hillsborough Florida Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse is a legal document that allows individuals residing in Hillsborough County, Florida to make a gift of cash to another person or entity over a specified period of time, while also sharing a portion of the gift with their spouse. This declaration serves as a legally binding agreement between the donor and the recipient, outlining the terms and conditions of the gift, including the amount, timelines, and any restrictions or conditions attached to the gift. By splitting the gift with their spouse, individuals can ensure that both parties are recognized as joint contributors to the gift, providing an opportunity for tax planning and optimizing financial benefits. Different types of Hillsborough Florida Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse may include: 1. Annual Cash Gifting with Splitting: This type involves making yearly cash gifts to a designated recipient while allocating a portion of the gift to the spouse. This arrangement allows for tax benefits by utilizing the annual gift tax exclusion limit for both the donor and the spouse. 2. Monthly Cash Gifting with Splitting: In this type, the donor makes monthly cash gifts to the recipient, and a portion of the gift is shared with the spouse. This arrangement provides a systematic approach to gift-giving and can be suitable for individuals with a steady income source. 3. Lump Sum Cash Gifting with Splitting: This variation involves making a one-time lump-sum cash gift to the recipient, while also splitting a portion with the spouse. It is often used in situations where individuals may have a specific financial event, such as a windfall, where they wish to distribute the funds over time while enjoying the tax benefits associated with splitting the gift. When drafting a Hillsborough Florida Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse, it is crucial to consult with a qualified attorney or legal professional to ensure compliance with state laws and regulations. Additionally, it is advisable to consider the financial implications and tax consequences of such arrangements to ensure the best outcome for all parties involved.Hillsborough Florida Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse is a legal document that allows individuals residing in Hillsborough County, Florida to make a gift of cash to another person or entity over a specified period of time, while also sharing a portion of the gift with their spouse. This declaration serves as a legally binding agreement between the donor and the recipient, outlining the terms and conditions of the gift, including the amount, timelines, and any restrictions or conditions attached to the gift. By splitting the gift with their spouse, individuals can ensure that both parties are recognized as joint contributors to the gift, providing an opportunity for tax planning and optimizing financial benefits. Different types of Hillsborough Florida Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse may include: 1. Annual Cash Gifting with Splitting: This type involves making yearly cash gifts to a designated recipient while allocating a portion of the gift to the spouse. This arrangement allows for tax benefits by utilizing the annual gift tax exclusion limit for both the donor and the spouse. 2. Monthly Cash Gifting with Splitting: In this type, the donor makes monthly cash gifts to the recipient, and a portion of the gift is shared with the spouse. This arrangement provides a systematic approach to gift-giving and can be suitable for individuals with a steady income source. 3. Lump Sum Cash Gifting with Splitting: This variation involves making a one-time lump-sum cash gift to the recipient, while also splitting a portion with the spouse. It is often used in situations where individuals may have a specific financial event, such as a windfall, where they wish to distribute the funds over time while enjoying the tax benefits associated with splitting the gift. When drafting a Hillsborough Florida Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse, it is crucial to consult with a qualified attorney or legal professional to ensure compliance with state laws and regulations. Additionally, it is advisable to consider the financial implications and tax consequences of such arrangements to ensure the best outcome for all parties involved.