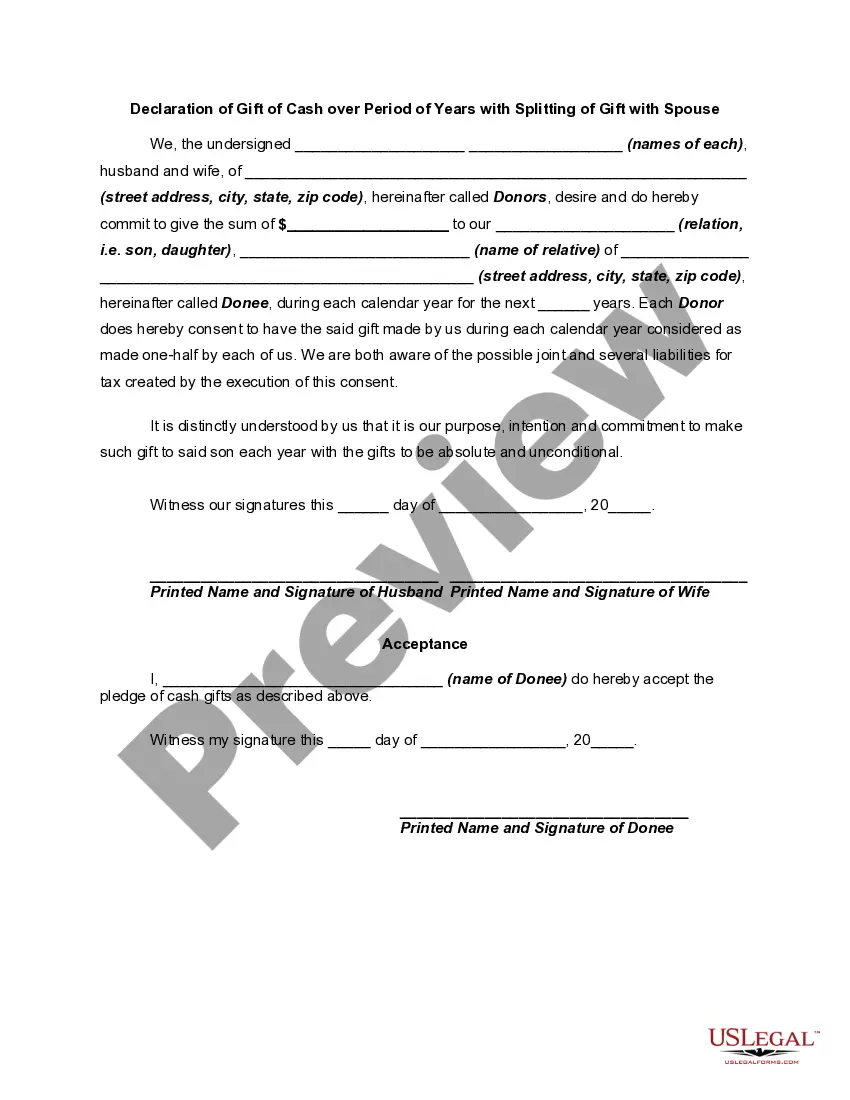

Gift taxes are taxes that supplement the Estate Tax. Gift taxes are placed on gifts given away to any person while you are still living, so that you may not avoid estate taxes by making gifts of your estate. You may give up to $12,000 a year in cash or assets to an unlimited number of people each year without incurring gift tax liability, but the gifts must have no conditions attached. Married couples can give, as a couple, a $24,000 gift per year to as many people as they want. Under federal tax law, gifts totaling more than $12,000 to one person in one year are considered a taxable gift and generate a potential gift tax. It does not matter if you give one $13,000 gift or 13 gifts of $1,000 each, or one gift of $12,000 and a "birthday gift" of $1,000.

Gifts beyond the $12,000 limit (there is an exception for gifts that are directly paid by the gift giver for tuition and medical expenses) are considered "taxable gifts." Taxable gifts create liability for a gift tax. But gift tax is not due to be paid until you give away over $1,000,000 in your lifetime.

Los Angeles, California Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse is a legal document used to outline the transfer of cash gifts over a specified period. This declaration allows individuals to gift a certain amount of cash to their spouse, splitting the gift between them in a fair and equitable manner. Here are a few types of Declarations of Gift of Cash over Period of Years with Splitting of Gift with Spouse that are commonly found in Los Angeles, California: 1. Yearly Declaration of Gift: This type of declaration involves the transfer of cash annually between spouses, dividing the gift evenly between them. It ensures equal distribution of assets over a specified period. 2. Lump-sum Declaration of Gift: In this type of declaration, a single, significant cash gift is split between spouses over a specific period. This method provides flexibility for individuals who may not wish to gift a fixed amount every year but still want to divide their assets with their spouse. 3. Graduated Declaration of Gift: A graduated declaration involves increasing the amount of the gift each year over the designated period. This option is suitable for individuals who anticipate an increase in their financial resources over time and want to gradually transfer more significant assets to their spouse. 4. Customized Declaration of Gift: This type of declaration allows individuals to personalize the terms and conditions of the gift, such as varying amounts, specific timeframes, or additional provisions. It provides flexibility to tailor the declaration according to the unique circumstances of the individuals involved. 5. Joint Declaration of Gift: In some cases, both spouses may want to contribute to a joint gift to be split between them. This declaration allows for joint ownership and distribution of the cash gift over the agreed-upon period. Regardless of the specific type of Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse, it is crucial to consult with a legal advisor or attorney familiar with the laws and regulations in Los Angeles, California, to ensure the document adheres to all applicable legal requirements and accurately reflects the intentions of the gifting individuals.Los Angeles, California Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse is a legal document used to outline the transfer of cash gifts over a specified period. This declaration allows individuals to gift a certain amount of cash to their spouse, splitting the gift between them in a fair and equitable manner. Here are a few types of Declarations of Gift of Cash over Period of Years with Splitting of Gift with Spouse that are commonly found in Los Angeles, California: 1. Yearly Declaration of Gift: This type of declaration involves the transfer of cash annually between spouses, dividing the gift evenly between them. It ensures equal distribution of assets over a specified period. 2. Lump-sum Declaration of Gift: In this type of declaration, a single, significant cash gift is split between spouses over a specific period. This method provides flexibility for individuals who may not wish to gift a fixed amount every year but still want to divide their assets with their spouse. 3. Graduated Declaration of Gift: A graduated declaration involves increasing the amount of the gift each year over the designated period. This option is suitable for individuals who anticipate an increase in their financial resources over time and want to gradually transfer more significant assets to their spouse. 4. Customized Declaration of Gift: This type of declaration allows individuals to personalize the terms and conditions of the gift, such as varying amounts, specific timeframes, or additional provisions. It provides flexibility to tailor the declaration according to the unique circumstances of the individuals involved. 5. Joint Declaration of Gift: In some cases, both spouses may want to contribute to a joint gift to be split between them. This declaration allows for joint ownership and distribution of the cash gift over the agreed-upon period. Regardless of the specific type of Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse, it is crucial to consult with a legal advisor or attorney familiar with the laws and regulations in Los Angeles, California, to ensure the document adheres to all applicable legal requirements and accurately reflects the intentions of the gifting individuals.