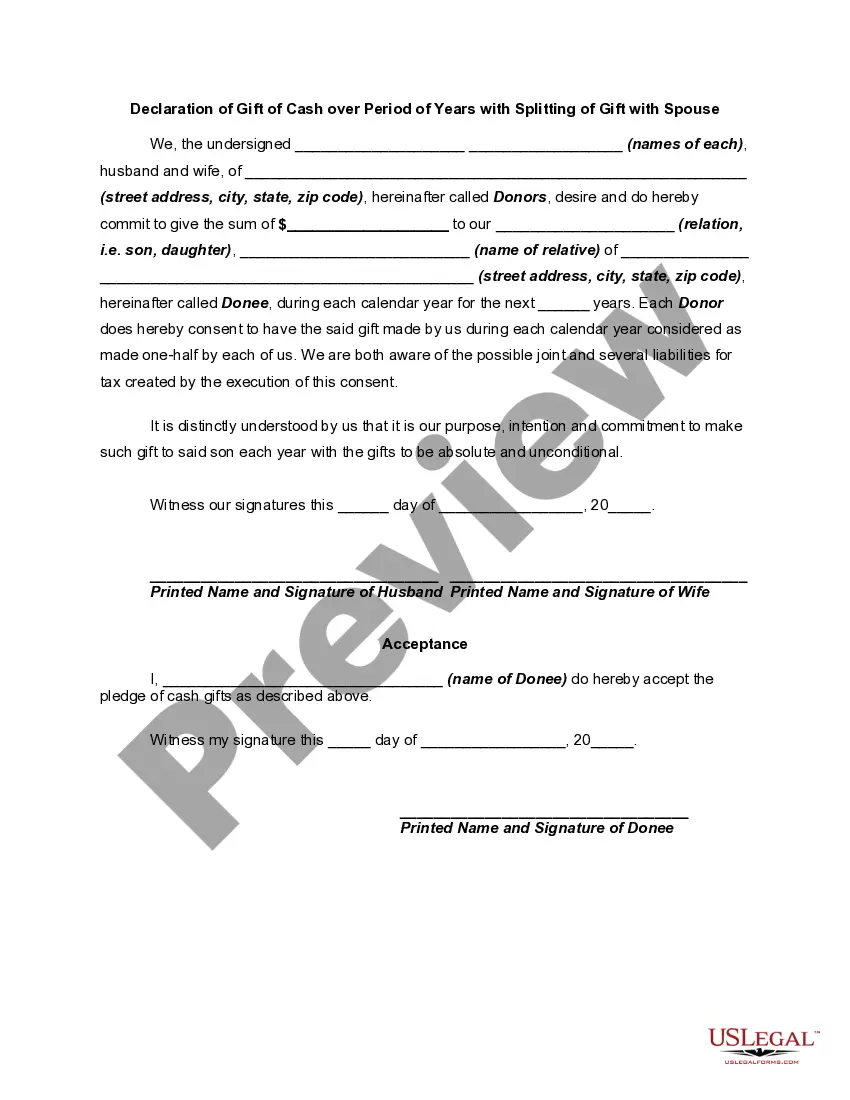

Gift taxes are taxes that supplement the Estate Tax. Gift taxes are placed on gifts given away to any person while you are still living, so that you may not avoid estate taxes by making gifts of your estate. You may give up to $12,000 a year in cash or assets to an unlimited number of people each year without incurring gift tax liability, but the gifts must have no conditions attached. Married couples can give, as a couple, a $24,000 gift per year to as many people as they want. Under federal tax law, gifts totaling more than $12,000 to one person in one year are considered a taxable gift and generate a potential gift tax. It does not matter if you give one $13,000 gift or 13 gifts of $1,000 each, or one gift of $12,000 and a "birthday gift" of $1,000.

Gifts beyond the $12,000 limit (there is an exception for gifts that are directly paid by the gift giver for tuition and medical expenses) are considered "taxable gifts." Taxable gifts create liability for a gift tax. But gift tax is not due to be paid until you give away over $1,000,000 in your lifetime.

In Philadelphia, Pennsylvania, the Declaration of Gift of Cash over a Period of Years with Splitting of Gift with a Spouse is a legal document that allows individuals to distribute their financial assets to beneficiaries over a specified time frame, while also including their spouse as a recipient of a portion of the gift. This declaration is often used as part of estate planning to ensure a smooth transfer of wealth and to provide financial support to loved ones. One type of Philadelphia, Pennsylvania Declaration of Gift of Cash over a Period of Years with Splitting of Gift with Spouse is the Testamentary Trust with Split-Gift Clause. This declaration is created within a person's will and is activated upon their death. This type of trust allows for the gradual distribution of cash gifts to beneficiaries over a set period of time, while also designating a portion of the gift to be received by the spouse. Another type is the Revocable Living Trust with Split-Gift Clause. In this case, the declaration is established during the individual's lifetime, allowing them to retain control over the assets while outlining the splitting of the gift with their spouse. This type of trust offers flexibility as it can be amended or revoked as per the granter's wishes. The Philadelphia, Pennsylvania Declaration of Gift of Cash over a Period of Years with Splitting of Gift with Spouse ensures that both the beneficiary and the spouse are taken care of and protects the assets from potential estate taxes. Some common keywords associated with this topic include estate planning, financial assets, beneficiaries, spouse, gradual distribution, testamentary trust, revocable living trust, and splitting of gifts. When creating such a declaration, it is important to consult with an experienced estate planning attorney in Philadelphia, Pennsylvania, who can provide personalized guidance tailored to individual circumstances. This legal professional can assist in drafting the document, ensuring it complies with relevant laws and regulations, and help navigate any tax implications associated with the gift and split-gift clause.In Philadelphia, Pennsylvania, the Declaration of Gift of Cash over a Period of Years with Splitting of Gift with a Spouse is a legal document that allows individuals to distribute their financial assets to beneficiaries over a specified time frame, while also including their spouse as a recipient of a portion of the gift. This declaration is often used as part of estate planning to ensure a smooth transfer of wealth and to provide financial support to loved ones. One type of Philadelphia, Pennsylvania Declaration of Gift of Cash over a Period of Years with Splitting of Gift with Spouse is the Testamentary Trust with Split-Gift Clause. This declaration is created within a person's will and is activated upon their death. This type of trust allows for the gradual distribution of cash gifts to beneficiaries over a set period of time, while also designating a portion of the gift to be received by the spouse. Another type is the Revocable Living Trust with Split-Gift Clause. In this case, the declaration is established during the individual's lifetime, allowing them to retain control over the assets while outlining the splitting of the gift with their spouse. This type of trust offers flexibility as it can be amended or revoked as per the granter's wishes. The Philadelphia, Pennsylvania Declaration of Gift of Cash over a Period of Years with Splitting of Gift with Spouse ensures that both the beneficiary and the spouse are taken care of and protects the assets from potential estate taxes. Some common keywords associated with this topic include estate planning, financial assets, beneficiaries, spouse, gradual distribution, testamentary trust, revocable living trust, and splitting of gifts. When creating such a declaration, it is important to consult with an experienced estate planning attorney in Philadelphia, Pennsylvania, who can provide personalized guidance tailored to individual circumstances. This legal professional can assist in drafting the document, ensuring it complies with relevant laws and regulations, and help navigate any tax implications associated with the gift and split-gift clause.