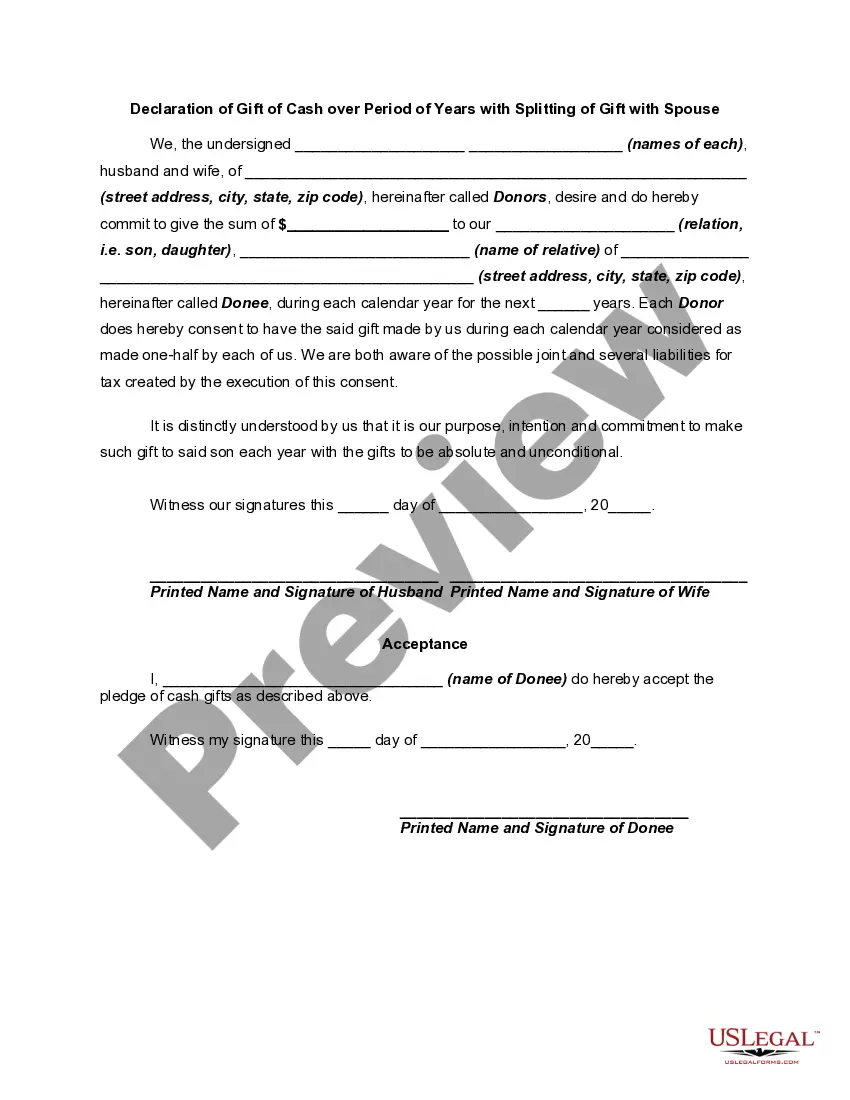

Gift taxes are taxes that supplement the Estate Tax. Gift taxes are placed on gifts given away to any person while you are still living, so that you may not avoid estate taxes by making gifts of your estate. You may give up to $12,000 a year in cash or assets to an unlimited number of people each year without incurring gift tax liability, but the gifts must have no conditions attached. Married couples can give, as a couple, a $24,000 gift per year to as many people as they want. Under federal tax law, gifts totaling more than $12,000 to one person in one year are considered a taxable gift and generate a potential gift tax. It does not matter if you give one $13,000 gift or 13 gifts of $1,000 each, or one gift of $12,000 and a "birthday gift" of $1,000.

Gifts beyond the $12,000 limit (there is an exception for gifts that are directly paid by the gift giver for tuition and medical expenses) are considered "taxable gifts." Taxable gifts create liability for a gift tax. But gift tax is not due to be paid until you give away over $1,000,000 in your lifetime.

Riverside California Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse is a legal document that enables individuals to gift a specific amount of money over a designated period to a beneficiary, with the option to split the gift with their spouse. This declaration is relevant to estate planning, tax management, and ensuring financial security for loved ones. Keywords: Riverside California, Declaration of Gift of Cash, Period of Years, Splitting of Gift, Spouse, legal document, estate planning, tax management, financial security, beneficiary. Different Types of Riverside California Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse: 1. Basic Gift Splitting Declaration: This type involves a simple declaration of gifting cash over a specified period, with the option to split the gift with a spouse if desired. 2. Gift Splitting Declaration with Tax Planning: This type incorporates strategic tax planning techniques to optimize the gift splitting process and minimize tax liabilities for both the donor and the beneficiary. 3. Conditional Gift Splitting Declaration: This type includes specific conditions or requirements that must be met by the beneficiary or the spouse before the gift splitting can occur, providing an added layer of control and protection for the donor. 4. Irrevocable Gift Splitting Declaration: In this type, the declaration becomes irrevocable once signed, meaning that the donor cannot change their mind or revoke the gift after it has been made. This can be useful in certain estate planning scenarios. 5. Gift Splitting Declaration for Charitable Contributions: This specific type focuses on gifting cash to charitable organizations over a period of years, with the option to split the gift with a spouse to maximize the impact of the donation while maintaining tax benefits. These different types of Riverside California Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse cater to varying needs and objectives, ensuring individuals have the flexibility to customize their gifting strategies while considering legal and financial aspects. Consulting with a legal professional is advised to understand the specific requirements and implications of each declaration type.Riverside California Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse is a legal document that enables individuals to gift a specific amount of money over a designated period to a beneficiary, with the option to split the gift with their spouse. This declaration is relevant to estate planning, tax management, and ensuring financial security for loved ones. Keywords: Riverside California, Declaration of Gift of Cash, Period of Years, Splitting of Gift, Spouse, legal document, estate planning, tax management, financial security, beneficiary. Different Types of Riverside California Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse: 1. Basic Gift Splitting Declaration: This type involves a simple declaration of gifting cash over a specified period, with the option to split the gift with a spouse if desired. 2. Gift Splitting Declaration with Tax Planning: This type incorporates strategic tax planning techniques to optimize the gift splitting process and minimize tax liabilities for both the donor and the beneficiary. 3. Conditional Gift Splitting Declaration: This type includes specific conditions or requirements that must be met by the beneficiary or the spouse before the gift splitting can occur, providing an added layer of control and protection for the donor. 4. Irrevocable Gift Splitting Declaration: In this type, the declaration becomes irrevocable once signed, meaning that the donor cannot change their mind or revoke the gift after it has been made. This can be useful in certain estate planning scenarios. 5. Gift Splitting Declaration for Charitable Contributions: This specific type focuses on gifting cash to charitable organizations over a period of years, with the option to split the gift with a spouse to maximize the impact of the donation while maintaining tax benefits. These different types of Riverside California Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse cater to varying needs and objectives, ensuring individuals have the flexibility to customize their gifting strategies while considering legal and financial aspects. Consulting with a legal professional is advised to understand the specific requirements and implications of each declaration type.