Gift taxes are taxes that supplement the Estate Tax. Gift taxes are placed on gifts given away to any person while you are still living, so that you may not avoid estate taxes by making gifts of your estate. You may give up to $12,000 a year in cash or assets to an unlimited number of people each year without incurring gift tax liability, but the gifts must have no conditions attached. Married couples can give, as a couple, a $24,000 gift per year to as many people as they want. Under federal tax law, gifts totaling more than $12,000 to one person in one year are considered a taxable gift and generate a potential gift tax. It does not matter if you give one $13,000 gift or 13 gifts of $1,000 each, or one gift of $12,000 and a "birthday gift" of $1,000.

Gifts beyond the $12,000 limit (there is an exception for gifts that are directly paid by the gift giver for tuition and medical expenses) are considered "taxable gifts." Taxable gifts create liability for a gift tax. But gift tax is not due to be paid until you give away over $1,000,000 in your lifetime.

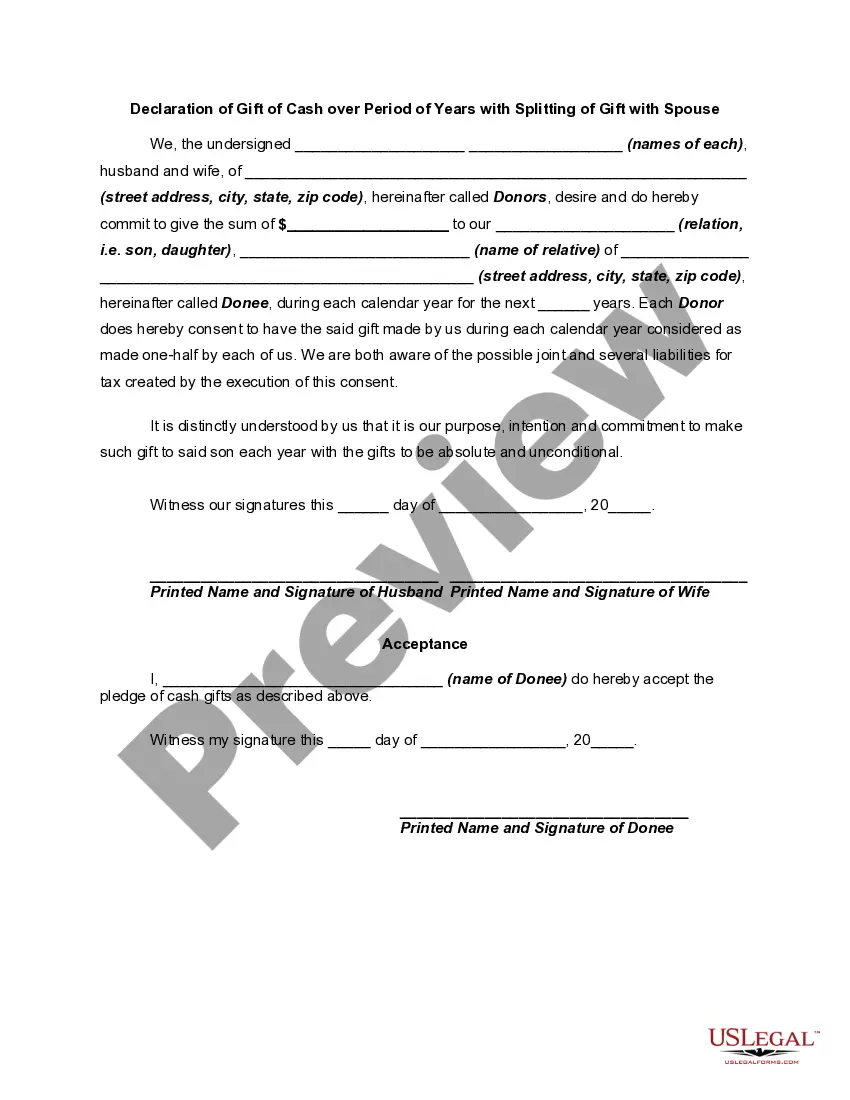

The Salt Lake Utah Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse is a legal document that outlines the terms and conditions for gifting cash to a recipient over a specific time frame while allowing for sharing of the gift with the spouse. This declaration is applicable in the state of Utah, specifically in Salt Lake City. Keywords: Salt Lake Utah Declaration of Gift, Cash, Period of Years, Splitting of Gift, Spouse Types of Salt Lake Utah Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse: 1. Fixed Amount Declaration: This type of declaration states a specific amount of cash that will be gifted to the recipient over a certain period of years. The splitting of the gift with the spouse can also be specified under this type. 2. Percentage of Income Declaration: Under this type, the declaration outlines a percentage of the donor's income that will be gifted to the recipient each year. The splitting of the gift with the spouse can be mentioned, defining how the percentage will be divided. 3. Lump Sum and Incremental Declaration: This declaration involves gifting a lump sum amount initially, followed by incremental cash gifts over a specified period. The splitting of the gift with the spouse can be mentioned for both the lump sum and incremental amounts. 4. Conditional Declaration: In this type of declaration, the gift of cash is subject to certain conditions or events. For example, the donor may state that the recipient will receive the gift only if they complete a specific educational degree or achieve a particular career milestone. The splitting of the gift with the spouse can also be specified based on the conditions being met. 5. Revocable or Irrevocable Declaration: This type of declaration specifies whether the gift of cash can be revoked or changed at any time by the donor or if it is a non-revocable commitment. The splitting of the gift with the spouse can be detailed according to the revocable or irrevocable nature of the declaration. Note: It's essential to consult with legal professionals or attorneys specialized in estate planning and gift declarations to draft and finalize the Salt Lake Utah Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse in adherence to the state's laws and regulations.The Salt Lake Utah Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse is a legal document that outlines the terms and conditions for gifting cash to a recipient over a specific time frame while allowing for sharing of the gift with the spouse. This declaration is applicable in the state of Utah, specifically in Salt Lake City. Keywords: Salt Lake Utah Declaration of Gift, Cash, Period of Years, Splitting of Gift, Spouse Types of Salt Lake Utah Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse: 1. Fixed Amount Declaration: This type of declaration states a specific amount of cash that will be gifted to the recipient over a certain period of years. The splitting of the gift with the spouse can also be specified under this type. 2. Percentage of Income Declaration: Under this type, the declaration outlines a percentage of the donor's income that will be gifted to the recipient each year. The splitting of the gift with the spouse can be mentioned, defining how the percentage will be divided. 3. Lump Sum and Incremental Declaration: This declaration involves gifting a lump sum amount initially, followed by incremental cash gifts over a specified period. The splitting of the gift with the spouse can be mentioned for both the lump sum and incremental amounts. 4. Conditional Declaration: In this type of declaration, the gift of cash is subject to certain conditions or events. For example, the donor may state that the recipient will receive the gift only if they complete a specific educational degree or achieve a particular career milestone. The splitting of the gift with the spouse can also be specified based on the conditions being met. 5. Revocable or Irrevocable Declaration: This type of declaration specifies whether the gift of cash can be revoked or changed at any time by the donor or if it is a non-revocable commitment. The splitting of the gift with the spouse can be detailed according to the revocable or irrevocable nature of the declaration. Note: It's essential to consult with legal professionals or attorneys specialized in estate planning and gift declarations to draft and finalize the Salt Lake Utah Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse in adherence to the state's laws and regulations.