Gift taxes are taxes that supplement the Estate Tax. Gift taxes are placed on gifts given away to any person while you are still living, so that you may not avoid estate taxes by making gifts of your estate. You may give up to $12,000 a year in cash or assets to an unlimited number of people each year without incurring gift tax liability, but the gifts must have no conditions attached. Married couples can give, as a couple, a $24,000 gift per year to as many people as they want. Under federal tax law, gifts totaling more than $12,000 to one person in one year are considered a taxable gift and generate a potential gift tax. It does not matter if you give one $13,000 gift or 13 gifts of $1,000 each, or one gift of $12,000 and a "birthday gift" of $1,000.

Gifts beyond the $12,000 limit (there is an exception for gifts that are directly paid by the gift giver for tuition and medical expenses) are considered "taxable gifts." Taxable gifts create liability for a gift tax. But gift tax is not due to be paid until you give away over $1,000,000 in your lifetime.

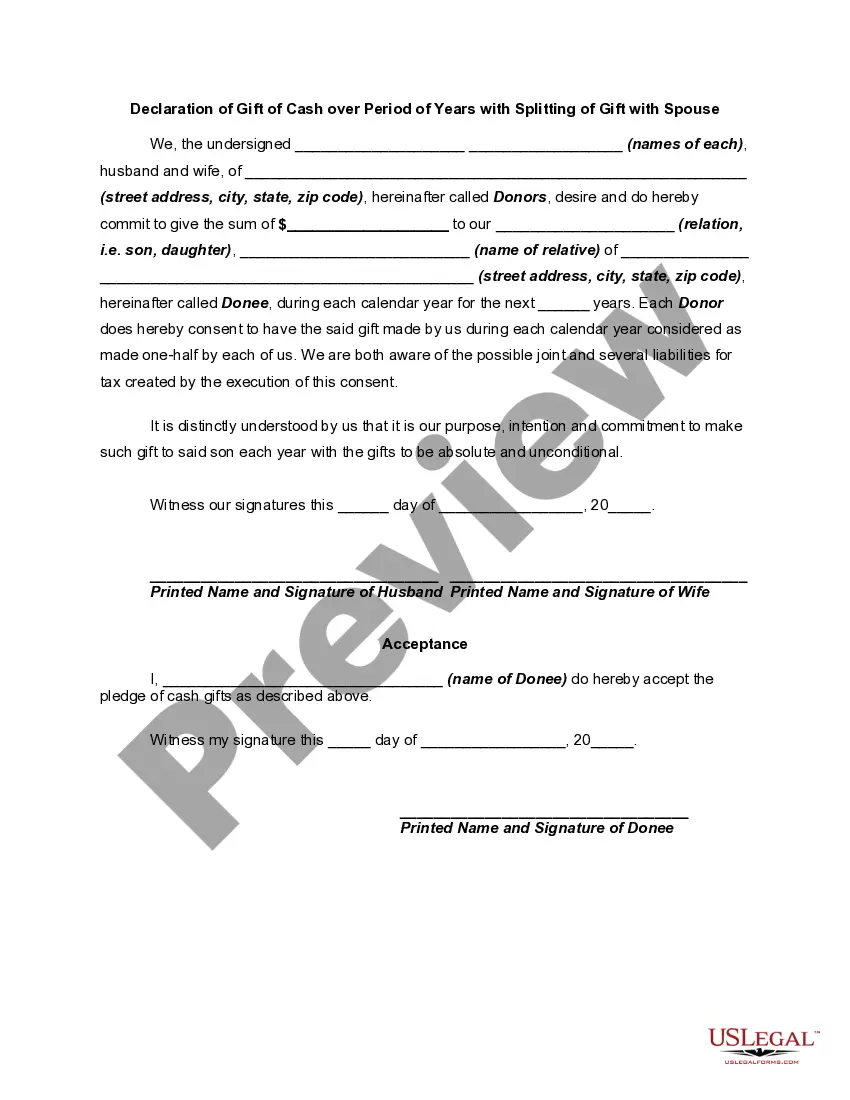

Title: Understanding the Suffolk New York Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse Keywords: Suffolk New York Declaration, Gift of Cash, Splitting of Gift, Spouse, Period of Years Introduction: The Suffolk New York Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse is a legal document that allows individuals in Suffolk County, New York, to gift cash over a specified period of time while opting to split the gift with their spouse. This declaration is crucial for ensuring that financial gifts are transparent, well-documented, and compliant with tax regulations. Let's explore the key aspects and types of the Suffolk New York Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse. Key Points: 1. Purpose of the Declaration: The Suffolk New York Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse serves two main objectives. Firstly, it enables individuals to gift cash to their desired recipients, such as family members, friends, or charitable organizations, over a predetermined period. Secondly, it allows the individual to divide the gift with their spouse, providing an option for equal sharing of the financial responsibility. 2. Engaging in Gift Splitting: Gift splitting is a vital provision within the Suffolk New York Declaration that enables married individuals filing joint tax returns to effectively utilize both spouses' gift tax exclusions when making substantial cash gifts. This practice can reduce the potential tax burden associated with gift giving, ensuring that the fighters can maximize their tax benefits. 3. Types of Suffolk New York Declarations: a) Single-Year Declaration of Gift of Cash: This type of declaration allows individuals to gift a specific amount of cash to their desired recipients in one calendar year, while ensuring gift splitting with their spouse if necessary. b) Multi-Year Declaration of Gift of Cash: With this type of declaration, individuals can plan a systematic gifting strategy over a span of multiple years to minimize tax liabilities. The gift amount, payment intervals, and gift splitting options are clearly specified within this declaration. 4. Required Information: A comprehensive Suffolk New York Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse includes vital information, such as the name and contact details of the gift or, the spouse's information, recipient(s) of the gift, desired gift splitting percentages, gift amount, payment schedule, and the duration of the gifting period. Additionally, it is important to include any conditions or limitations attached to the gift. Conclusion: The Suffolk New York Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse is an essential legal instrument that allows individuals in Suffolk County to gift cash to their chosen recipients over a defined period while considering gift splitting options with their spouse. By adhering to the regulations outlined in this declaration, individuals can ensure transparency, tax efficiency, and proper documentation of their gifting strategies. Remember to consult legal professionals or tax advisors when preparing and executing the Suffolk New York Declaration, as it involves intricate financial and legal considerations.Title: Understanding the Suffolk New York Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse Keywords: Suffolk New York Declaration, Gift of Cash, Splitting of Gift, Spouse, Period of Years Introduction: The Suffolk New York Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse is a legal document that allows individuals in Suffolk County, New York, to gift cash over a specified period of time while opting to split the gift with their spouse. This declaration is crucial for ensuring that financial gifts are transparent, well-documented, and compliant with tax regulations. Let's explore the key aspects and types of the Suffolk New York Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse. Key Points: 1. Purpose of the Declaration: The Suffolk New York Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse serves two main objectives. Firstly, it enables individuals to gift cash to their desired recipients, such as family members, friends, or charitable organizations, over a predetermined period. Secondly, it allows the individual to divide the gift with their spouse, providing an option for equal sharing of the financial responsibility. 2. Engaging in Gift Splitting: Gift splitting is a vital provision within the Suffolk New York Declaration that enables married individuals filing joint tax returns to effectively utilize both spouses' gift tax exclusions when making substantial cash gifts. This practice can reduce the potential tax burden associated with gift giving, ensuring that the fighters can maximize their tax benefits. 3. Types of Suffolk New York Declarations: a) Single-Year Declaration of Gift of Cash: This type of declaration allows individuals to gift a specific amount of cash to their desired recipients in one calendar year, while ensuring gift splitting with their spouse if necessary. b) Multi-Year Declaration of Gift of Cash: With this type of declaration, individuals can plan a systematic gifting strategy over a span of multiple years to minimize tax liabilities. The gift amount, payment intervals, and gift splitting options are clearly specified within this declaration. 4. Required Information: A comprehensive Suffolk New York Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse includes vital information, such as the name and contact details of the gift or, the spouse's information, recipient(s) of the gift, desired gift splitting percentages, gift amount, payment schedule, and the duration of the gifting period. Additionally, it is important to include any conditions or limitations attached to the gift. Conclusion: The Suffolk New York Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse is an essential legal instrument that allows individuals in Suffolk County to gift cash to their chosen recipients over a defined period while considering gift splitting options with their spouse. By adhering to the regulations outlined in this declaration, individuals can ensure transparency, tax efficiency, and proper documentation of their gifting strategies. Remember to consult legal professionals or tax advisors when preparing and executing the Suffolk New York Declaration, as it involves intricate financial and legal considerations.