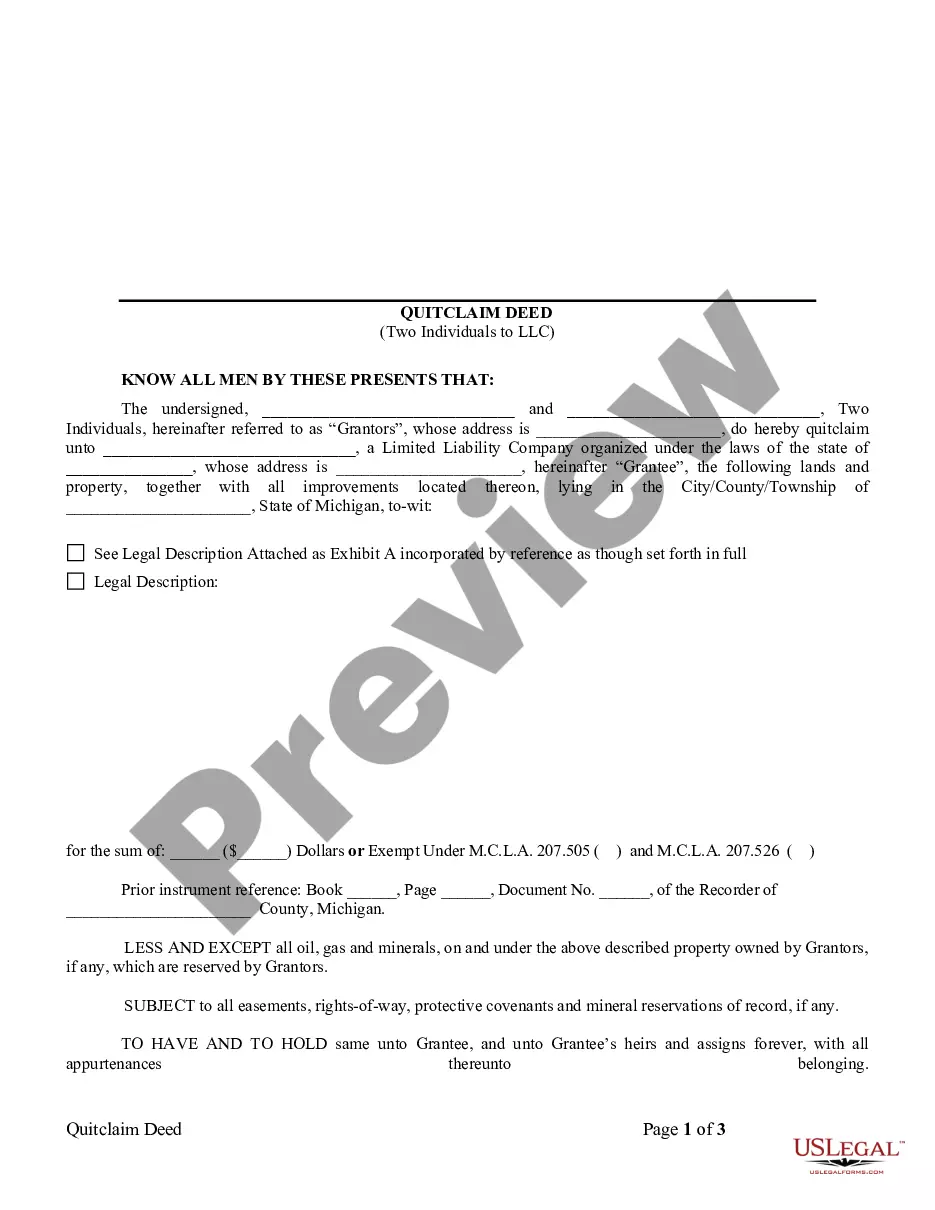

A Limited Liability Company (LLC) is a separate legal entity that can conduct business just like a corporation with many of the advantages of a partnership. It is taxed as a partnership. Its owners are called members and receive income from the LLC just as a partner would. There is no tax on the LLC entity itself. The members are not personally liable for the debts and obligations of the entity like partners would be. Basically, an LLC combines the tax advantages of a partnership with the limited liability feature of a corporation.

An LLC is formed by filing articles of organization with the secretary of state in the same type manner that articles of incorporation are filed. The articles must contain the name, purpose, duration, registered agent, and principle office of the LLC. The name of the LLC must contain the words Limited Liability Company or LLC. An LLC is a separate legal entity like a corporation.

Management of an LLC is vested in its members. An operating agreement is executed by the members and operates much the same way a partnership agreement operates. Profits and losses are shared according to the terms of the operating agreement.

The Suffolk New York Operating Agreement is a legal document that outlines the internal operations and management structure of a limited liability company (LLC) in Suffolk County, New York. This document is designed specifically for LCS operating in states that have adopted the Uniform Limited Liability Company Act (UCLA) or the Revised Uniform Limited Liability Company Act (SULLA). It serves as a binding contract between the LLC members, defining their rights, responsibilities, and investment interests in the company. Keywords: Suffolk New York, operating agreement, limited liability company, LLC, UCLA, SULLA, internal operations, management structure, members, rights, responsibilities, investment interests. Different types of Suffolk New York Operating Agreements for States who have Adopted the Uniform Limited Liability Act and the Revised Uniform Limited Liability Act may include: 1. Member-Managed Operating Agreement: This type of operating agreement specifies that all members of the LLC have equal decision-making powers and responsibilities in the company's operations. Each member has the authority to bind the LLC in contractual agreements. 2. Manager-Managed Operating Agreement: In this type of operating agreement, the LLC designates one or more managers to handle the daily operations and decision-making of the company. The managers may be appointed from among the members or hired externally. 3. Single-Member Operating Agreement: This operating agreement is used when an LLC has only one member or owner. It is designed to provide structure and define the rights and responsibilities of the single member, similar to how a multi-member operating agreement would function. 4. Multi class Membership Operating Agreement: Some LCS may have multiple classes of membership, each with different rights and privileges. This type of operating agreement outlines the specific rights, responsibilities, and distributions associated with each class of membership within the LLC. 5. Special Purpose Entity Operating Agreement: A special purpose entity (SPE) is an LLC formed for a specific purpose or project. This type of operating agreement is tailored to address the unique needs, goals, and restrictions of the SPE. It may include specific provisions related to project funding, profit sharing, and dissolution procedures. Overall, the Suffolk New York Operating Agreement ensures compliance with the applicable state laws while providing a comprehensive framework for LLC operations, governance, and member relationships. Keywords: Suffolk New York, operating agreement, limited liability company, LLC, UCLA, SULLA, member-managed, manager-managed, single-member, multi class membership, special purpose entity, compliance, state laws, operations, governance, member relationships.