Generally, a contract to employ a certified public accountant need not be in writing.

However, such contracts often call for services of a highly complex and technical nature, and hence they should be explicit in their terms, and they should be in writing. In particular, a written employment contract is necessary in order to avoid misunderstanding with the employer regarding the amount of the accountant's fee or compensation and the nature of its computation. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Collin Texas Contract with Accountant to Audit Corporation's Group Medical, Disability, and Life Insurance Program

Description

How to fill out Collin Texas Contract With Accountant To Audit Corporation's Group Medical, Disability, And Life Insurance Program?

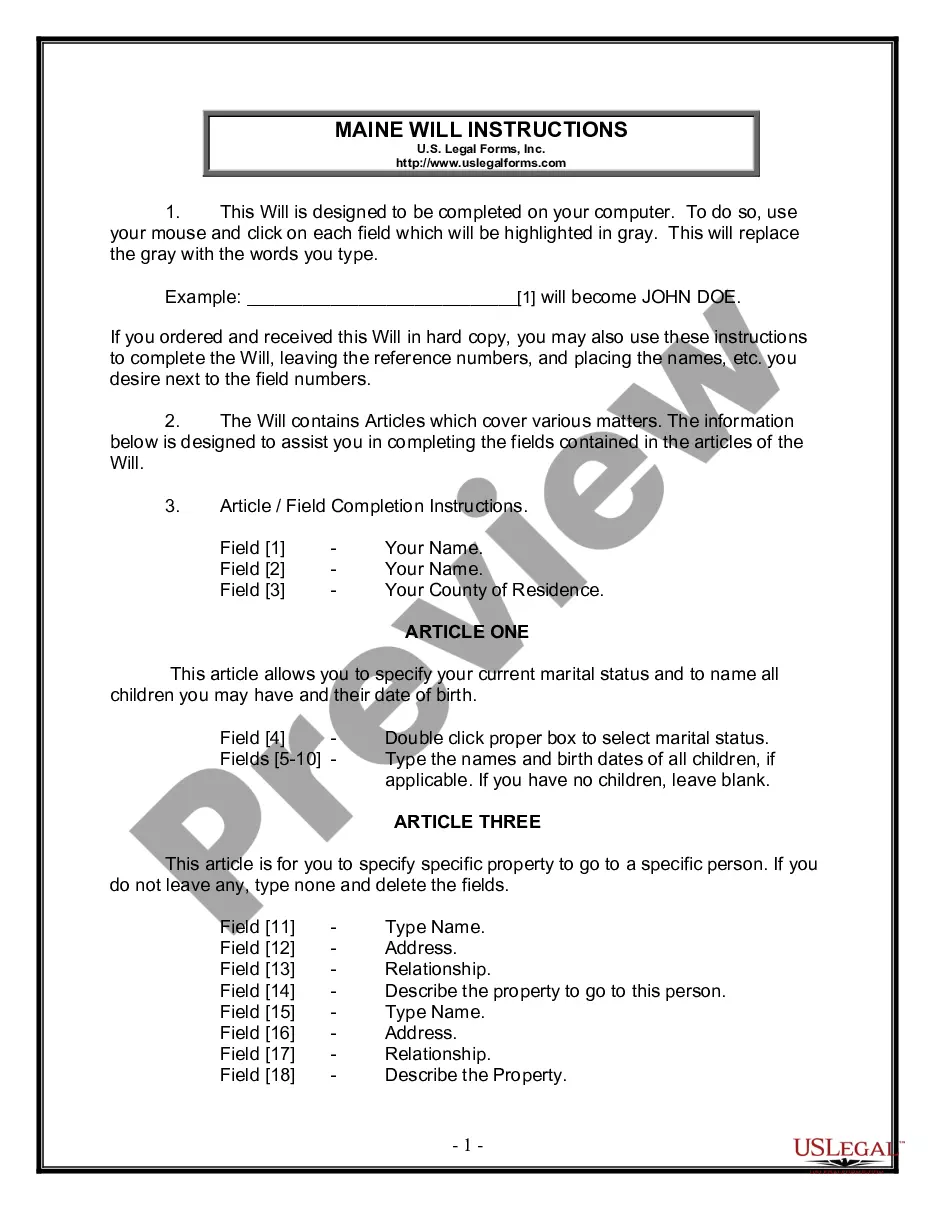

Creating documents, like Collin Contract with Accountant to Audit Corporation's Group Medical, Disability, and Life Insurance Program, to take care of your legal affairs is a challenging and time-consumming process. Many situations require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can acquire your legal matters into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal documents created for various cases and life circumstances. We ensure each document is in adherence with the laws of each state, so you don’t have to worry about potential legal issues associated with compliance.

If you're already aware of our website and have a subscription with US, you know how straightforward it is to get the Collin Contract with Accountant to Audit Corporation's Group Medical, Disability, and Life Insurance Program form. Simply log in to your account, download the template, and personalize it to your requirements. Have you lost your document? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is just as simple! Here’s what you need to do before getting Collin Contract with Accountant to Audit Corporation's Group Medical, Disability, and Life Insurance Program:

- Make sure that your template is specific to your state/county since the rules for writing legal paperwork may vary from one state another.

- Learn more about the form by previewing it or going through a brief description. If the Collin Contract with Accountant to Audit Corporation's Group Medical, Disability, and Life Insurance Program isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or create an account to start utilizing our website and download the form.

- Everything looks good on your side? Click the Buy now button and select the subscription plan.

- Pick the payment gateway and enter your payment details.

- Your form is good to go. You can go ahead and download it.

It’s easy to find and buy the appropriate template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!

Form popularity

FAQ

4 Things Every Accountant Needs at Their Desk Noise-Canceling Headphones. When it's time to buckle down and focus on your work, you need to be able to control your environment as much as possible.A Nice Keyboard and Mouse.Computer Glasses.Insulated Water Bottle.

Accountant and CPA insurance is insurance designed to protect accountants and CPAs from the risks they experience through the course of their work.

Professional liability insurance for tax preparers and bookkeepers is important coverage for your small business. If a client sues your company for a mistake in your services, this coverage can help pay your legal costs. Without it, you'll have to pay for claims of errors or omissions out of pocket.

As a CPA, you need 'Errors and Omissions' insurance to cover damages from an error committed by your firm in providing professional services; and to protect the assets of your firm and partners from the financial consequences of a claim.

Professional Indemnity Insurance is a type of liability insurance that provides cover for the financial consequences of neglect, error or omission by the professional or firm taking out the policy.

Any business that sells its expertise should consider professional liability insurance. Also known as errors and omissions (E&O) insurance, this coverage protects your company and your bottom line from customer claims of late, incomplete, or unsatisfactory work. Accusations like these can lead to costly lawsuits.

Professional Liability Insurance: Know by some as accountants professional liability malpractice or errors & omissions (E&O) insurance, this is easily the most important and vital type of insurance that all accounting firms will need to have.

Accountants professional liability insurance helps protect accounting professionals and small- and mid-sized accounting firms from the risks related to performing tax preparation, bookkeeping and other professional services.

What is CPA Life? CPA Life, issued by The Prudential Insurance Company of America (Prudential), is the most popular insurance plan offered by the AICPA and helps financially protect over 124,000 members and their families. It offers up to $2.5 million in coverage and flexible options to meet your needs.