Generally, a contract to employ a certified public accountant need not be in writing.

However, such contracts often call for services of a highly complex and technical nature, and hence they should be explicit in their terms, and they should be in writing. In particular, a written employment contract is necessary in order to avoid misunderstanding with the employer regarding the amount of the accountant's fee or compensation and the nature of its computation. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

San Jose California Contract with Accountant to Audit Corporation's Group Medical, Disability, and Life Insurance Program

Description

How to fill out Contract With Accountant To Audit Corporation's Group Medical, Disability, And Life Insurance Program?

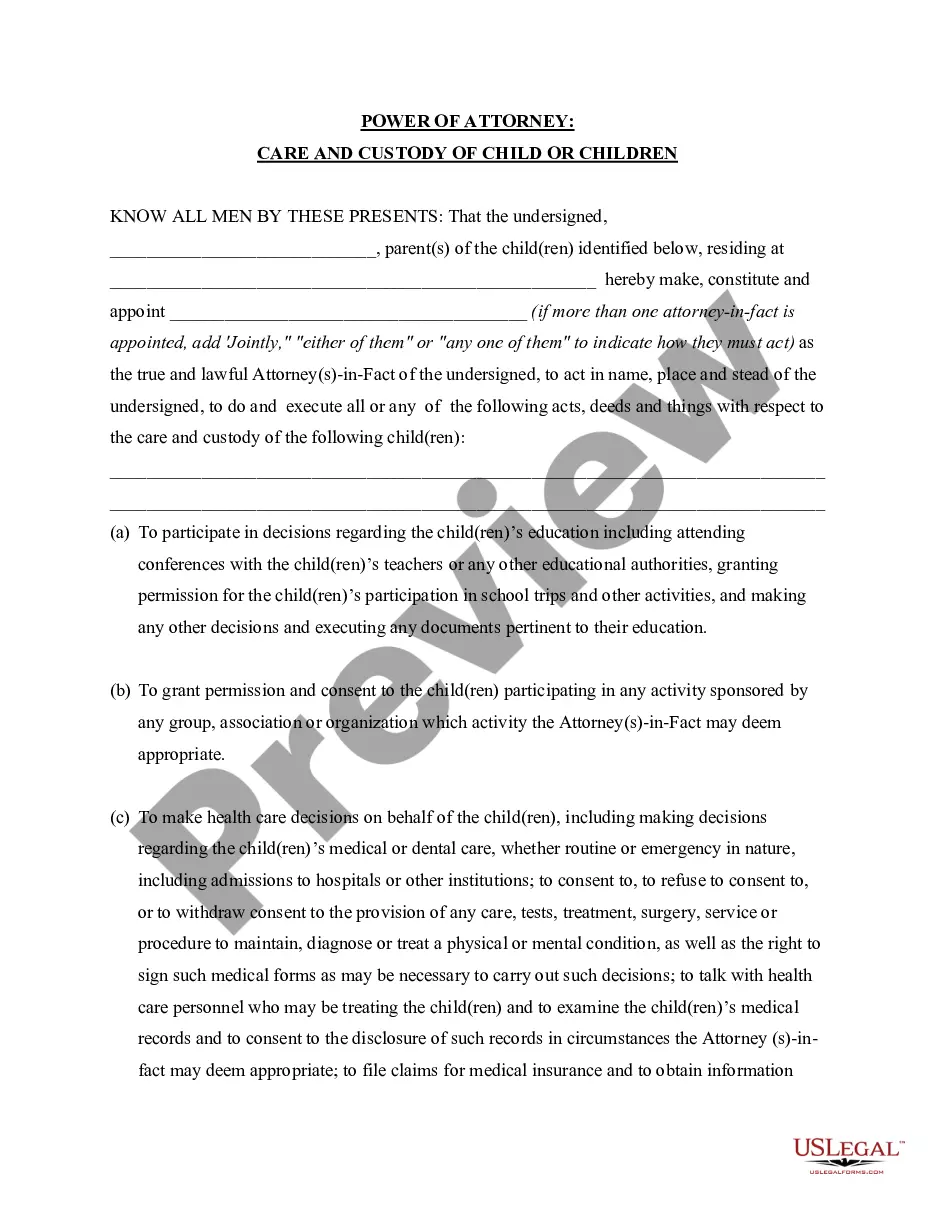

Whether you plan to launch your enterprise, engage in a transaction, submit your identification update, or address family-related legal matters, you need to prepare particular documentation that aligns with your local statutes and regulations.

Locating the appropriate papers can consume a significant amount of time and effort unless you take advantage of the US Legal Forms library.

The service offers individuals over 85,000 expertly prepared and verified legal documents for any personal or business situation. All documents are organized by state and area of use, making it quick and easy to choose a copy such as the San Jose Contract with Accountant to Audit Corporation's Group Medical, Disability, and Life Insurance Program.

Documents offered by our library are reusable. With an active subscription, you can access all of your previously acquired paperwork anytime in the My documents section of your profile. Stop spending time on a continuous quest for current formal documents. Register for the US Legal Forms platform and organize your paperwork with the most extensive online form collection!

- Ensure the template meets your personal requirements and state law criteria.

- Examine the form description and review the Preview if available on the site.

- Use the search bar indicating your state above to find another template.

- Click Buy Now to acquire the document once you've identified the correct one.

- Select the subscription plan that best fits your needs to continue.

- Log in to your account and pay the service using a credit card or PayPal.

- Download the San Jose Contract with Accountant to Audit Corporation's Group Medical, Disability, and Life Insurance Program in the file format you desire.

- Print the document or complete it and sign it electronically using an online editor to save time.

Form popularity

FAQ

Factors impairing the independence of auditors Factors impairing independenceType of threat created (i.e. result of factors)Gift and hospitalitySelf-interest and familiarity threatFamily and personal relationshipsSelf-interest threat, familiarity threat and intimidation threat5 more rows

Prohibited Auditor Activities bookkeeping or other services related to the accounting records or financial statements of the audit client; financial information systems design and implementation; appraisal or valuation services, fairness opinions, or contribution-in-kind reports; actuarial services;

Independence will be considered to be impaired if, during the period of a professional engagement, a member or his or her firm had any cooperative arrangement with the client that was material to the member's firm or to the client.

Under rule 102 ET section 102.01, a member must maintain objectivity and integrity in the performance of a professional service. In dealing with his or her employer's external accountant, a member must be candid and not knowingly misrepresent facts or knowingly fail to disclose material facts.

This study has identified four main factors which are perceived to affect auditor independence. They are audit fees, audit tenure, auditor market competition and non-audit services. This study aims to investigate the relationship between the four compromised factors and auditor independence.

Restricted entityAny attest (audit) client and its affiliates including nonclient affiliates of the attest client. Spousal equivalentRelationship is deemed to exist in any of the following case: A civil union in which the applicable law does not define the parties as spouses.

AICPA rules state that an accountant's independence will be impaired if the accountant: makes investment decisions on behalf of audit clients or otherwise has discretionary authority over an audit client's investments.

Specific Prohibited Non-audit Services Financial information systems design and implementation. Appraisal or valuation services, fairness opinions, or contribution-in-kind reports. Actuarial services. Internal audit outsourcing services.

One factor that complicates the issue of auditor independence is the auditor appointment process. In order to ensure independence from management, the auditor is expected to be appointed by the shareholders of the company.

A company's management has the responsibility for preparing the company's financial statements and related disclosures. The company's outside, independent auditor then subjects the financial statements and disclosures to an audit.