A limited review of financial statements is an audit restricted to an examination either for a limited period or of a limited part of the records. A review does not contemplate obtaining an understanding of the entity's internal control; assessing fraud risk; tests of accounting records by obtaining sufficient appropriate audit evidence through inspection, observation, confirmation, or the examination of source documents (for example, cancelled checks or bank images); and other procedures ordinarily performed in an audit. Accordingly, a review does not provide assurance that we will become aware of all significant matters that would be disclosed in an audit. Therefore, a review provides only limited assurance that there are no material modifications that should be made to the financial statements in order for the statements to be in conformity with generally accepted accounting principles.

The definition of nonattest services is very inclusive. It includes, for example, preparation of the client's depreciation schedule and preparation of journal entries even if management has approved the journal entries. I have confirmed these examples directly with the AICPA ethics division. The definition of nonattest services includes preparation of tax returns.

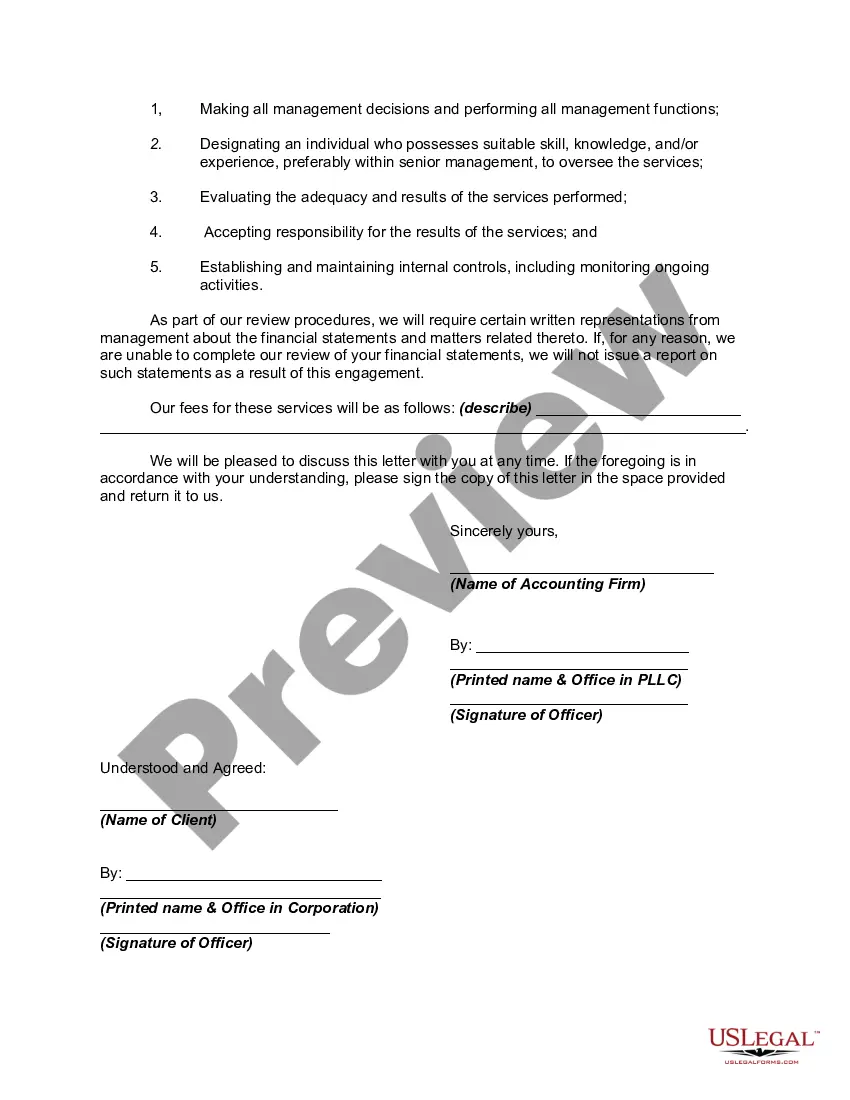

Chicago, Illinois Engagement Letter for Review of Financial Statements by Accounting Firm An engagement letter is a crucial document that outlines the terms and conditions of a professional agreement between a client and an accounting firm, specifically relating to the review of financial statements. In the city of Chicago, Illinois, various types of engagement letters are commonly used by accounting firms to conduct comprehensive reviews and provide assurance on the accuracy and reliability of financial statements for their clients. These engagement letters ensure transparency, establish mutual responsibilities, and maintain the standards of the accounting profession. One type of engagement letter used in Chicago, Illinois is the Standard Engagement Letter for Review of Financial Statements. This document specifies the scope of work, timing, and fee arrangements for the review engagement. It provides clear details on the objectives of the review, the type of report to be issued, and the general responsibilities of both the accounting firm and the client. This type of engagement letter is suitable for businesses looking for a comprehensive review of their financial statements to ensure their compliance with accounting principles and regulations. Another commonly used engagement letter is the Limited-Scope Engagement Letter for Review of Financial Statements. This type of engagement letter is tailored for clients who require a review of specific elements or accounts within their financial statements, rather than a full review. It focuses on the particular areas of concern identified by the client and specifies the limitations and exclusions of the review engagement. This type of engagement letter is ideal for clients who want to address specific financial issues or focus on certain aspects of their financial statements. Moreover, a tailored Engagement Letter for Review of Financial Statements may be used in Chicago, Illinois. This type of engagement letter is customized to meet the unique needs and circumstances of individual clients. It takes into account the specific industry, size of the business, and any specific regulatory requirements that the client needs to adhere to in terms of the review engagement. This engagement letter may include additional clauses and considerations that are not covered in the standard templates to ensure a thorough and specialized review of financial statements. In conclusion, Chicago, Illinois engagement letters for the review of financial statements by accounting firms play a vital role in establishing a clear professional agreement between clients and accounting firms. The various types of engagement letters, including the Standard Engagement Letter for Review of Financial Statements, Limited-Scope Engagement Letter for Review of Financial Statements, and Tailored Engagement Letter for Review of Financial Statements, cater to the specific needs and requirements of different clients. These engagement letters ensure transparency, clarity, and accountability, setting the foundation for a successful financial review engagement process.Chicago, Illinois Engagement Letter for Review of Financial Statements by Accounting Firm An engagement letter is a crucial document that outlines the terms and conditions of a professional agreement between a client and an accounting firm, specifically relating to the review of financial statements. In the city of Chicago, Illinois, various types of engagement letters are commonly used by accounting firms to conduct comprehensive reviews and provide assurance on the accuracy and reliability of financial statements for their clients. These engagement letters ensure transparency, establish mutual responsibilities, and maintain the standards of the accounting profession. One type of engagement letter used in Chicago, Illinois is the Standard Engagement Letter for Review of Financial Statements. This document specifies the scope of work, timing, and fee arrangements for the review engagement. It provides clear details on the objectives of the review, the type of report to be issued, and the general responsibilities of both the accounting firm and the client. This type of engagement letter is suitable for businesses looking for a comprehensive review of their financial statements to ensure their compliance with accounting principles and regulations. Another commonly used engagement letter is the Limited-Scope Engagement Letter for Review of Financial Statements. This type of engagement letter is tailored for clients who require a review of specific elements or accounts within their financial statements, rather than a full review. It focuses on the particular areas of concern identified by the client and specifies the limitations and exclusions of the review engagement. This type of engagement letter is ideal for clients who want to address specific financial issues or focus on certain aspects of their financial statements. Moreover, a tailored Engagement Letter for Review of Financial Statements may be used in Chicago, Illinois. This type of engagement letter is customized to meet the unique needs and circumstances of individual clients. It takes into account the specific industry, size of the business, and any specific regulatory requirements that the client needs to adhere to in terms of the review engagement. This engagement letter may include additional clauses and considerations that are not covered in the standard templates to ensure a thorough and specialized review of financial statements. In conclusion, Chicago, Illinois engagement letters for the review of financial statements by accounting firms play a vital role in establishing a clear professional agreement between clients and accounting firms. The various types of engagement letters, including the Standard Engagement Letter for Review of Financial Statements, Limited-Scope Engagement Letter for Review of Financial Statements, and Tailored Engagement Letter for Review of Financial Statements, cater to the specific needs and requirements of different clients. These engagement letters ensure transparency, clarity, and accountability, setting the foundation for a successful financial review engagement process.