A limited review of financial statements is an audit restricted to an examination either for a limited period or of a limited part of the records. A review does not contemplate obtaining an understanding of the entity's internal control; assessing fraud risk; tests of accounting records by obtaining sufficient appropriate audit evidence through inspection, observation, confirmation, or the examination of source documents (for example, cancelled checks or bank images); and other procedures ordinarily performed in an audit. Accordingly, a review does not provide assurance that we will become aware of all significant matters that would be disclosed in an audit. Therefore, a review provides only limited assurance that there are no material modifications that should be made to the financial statements in order for the statements to be in conformity with generally accepted accounting principles.

The definition of nonattest services is very inclusive. It includes, for example, preparation of the client's depreciation schedule and preparation of journal entries even if management has approved the journal entries. I have confirmed these examples directly with the AICPA ethics division. The definition of nonattest services includes preparation of tax returns.

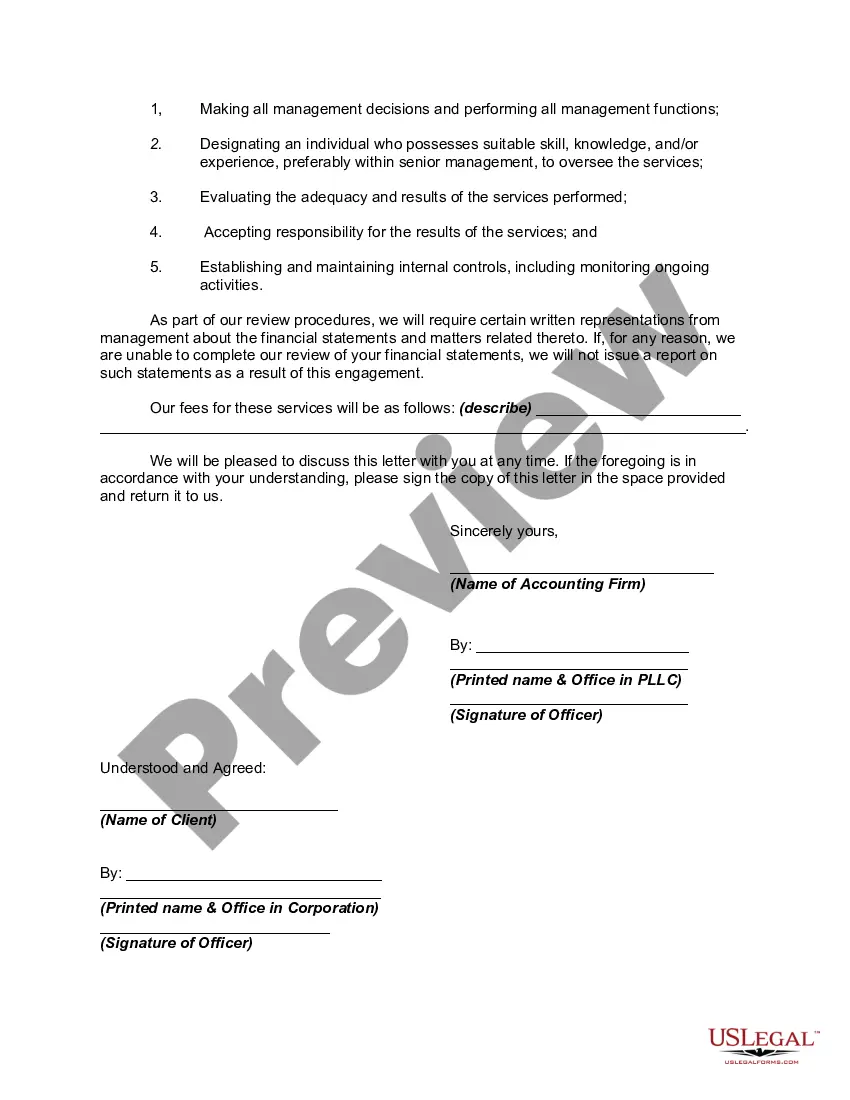

Fulton Georgia Engagement Letter for Review of Financial Statements by Accounting Firm serves as a formal agreement between an accounting firm and their client in Fulton, Georgia, whereby the firm will conduct a comprehensive review of the client's financial statements. This engagement letter outlines the scope of the review, the responsibilities of both parties, and the terms and conditions of the engagement. The purpose of the engagement letter is to establish a clear understanding between the accounting firm and the client regarding the services to be provided. It ensures that the client's financial statements will be reviewed with professional expertise and in compliance with applicable accounting principles and regulations. The engagement letter is a crucial document that facilitates transparency, builds trust, and sets the expectations for the review process. In Fulton, Georgia, there may be different types of engagement letters for the review of financial statements by accounting firms, depending on the specific needs of the client: 1. General Review Engagement Letter: This type of engagement letter outlines the overall scope of the review, including the timeframe, objectives, and deliverables. 2. Limited Scope Review Engagement Letter: In certain cases, clients may require a limited review of specific financial statements or accounts. This engagement letter will establish the boundaries and limitations of the review process. 3. Industry-Specific Engagement Letter: Some industries may have unique accounting practices and regulations. In such cases, an industry-specific engagement letter will address these specific requirements and ensure the review is conducted accordingly. 4. Compliance Review Engagement Letter: When the review is conducted to ensure compliance with specific legal or regulatory frameworks, a compliance review engagement letter is used. It explicitly states the purpose of the review in relation to the applicable laws or regulations. These various types of engagement letters allow accounting firms and their clients in Fulton, Georgia, to customize the review process to suit their specific needs. By clarifying the terms, expectations, and scope, an engagement letter helps establish a solid foundation for a successful review of financial statements, leading to accurate and reliable financial reporting.Fulton Georgia Engagement Letter for Review of Financial Statements by Accounting Firm serves as a formal agreement between an accounting firm and their client in Fulton, Georgia, whereby the firm will conduct a comprehensive review of the client's financial statements. This engagement letter outlines the scope of the review, the responsibilities of both parties, and the terms and conditions of the engagement. The purpose of the engagement letter is to establish a clear understanding between the accounting firm and the client regarding the services to be provided. It ensures that the client's financial statements will be reviewed with professional expertise and in compliance with applicable accounting principles and regulations. The engagement letter is a crucial document that facilitates transparency, builds trust, and sets the expectations for the review process. In Fulton, Georgia, there may be different types of engagement letters for the review of financial statements by accounting firms, depending on the specific needs of the client: 1. General Review Engagement Letter: This type of engagement letter outlines the overall scope of the review, including the timeframe, objectives, and deliverables. 2. Limited Scope Review Engagement Letter: In certain cases, clients may require a limited review of specific financial statements or accounts. This engagement letter will establish the boundaries and limitations of the review process. 3. Industry-Specific Engagement Letter: Some industries may have unique accounting practices and regulations. In such cases, an industry-specific engagement letter will address these specific requirements and ensure the review is conducted accordingly. 4. Compliance Review Engagement Letter: When the review is conducted to ensure compliance with specific legal or regulatory frameworks, a compliance review engagement letter is used. It explicitly states the purpose of the review in relation to the applicable laws or regulations. These various types of engagement letters allow accounting firms and their clients in Fulton, Georgia, to customize the review process to suit their specific needs. By clarifying the terms, expectations, and scope, an engagement letter helps establish a solid foundation for a successful review of financial statements, leading to accurate and reliable financial reporting.