A limited review of financial statements is an audit restricted to an examination either for a limited period or of a limited part of the records. A review does not contemplate obtaining an understanding of the entity's internal control; assessing fraud risk; tests of accounting records by obtaining sufficient appropriate audit evidence through inspection, observation, confirmation, or the examination of source documents (for example, cancelled checks or bank images); and other procedures ordinarily performed in an audit. Accordingly, a review does not provide assurance that we will become aware of all significant matters that would be disclosed in an audit. Therefore, a review provides only limited assurance that there are no material modifications that should be made to the financial statements in order for the statements to be in conformity with generally accepted accounting principles.

The definition of nonattest services is very inclusive. It includes, for example, preparation of the client's depreciation schedule and preparation of journal entries even if management has approved the journal entries. I have confirmed these examples directly with the AICPA ethics division. The definition of nonattest services includes preparation of tax returns.

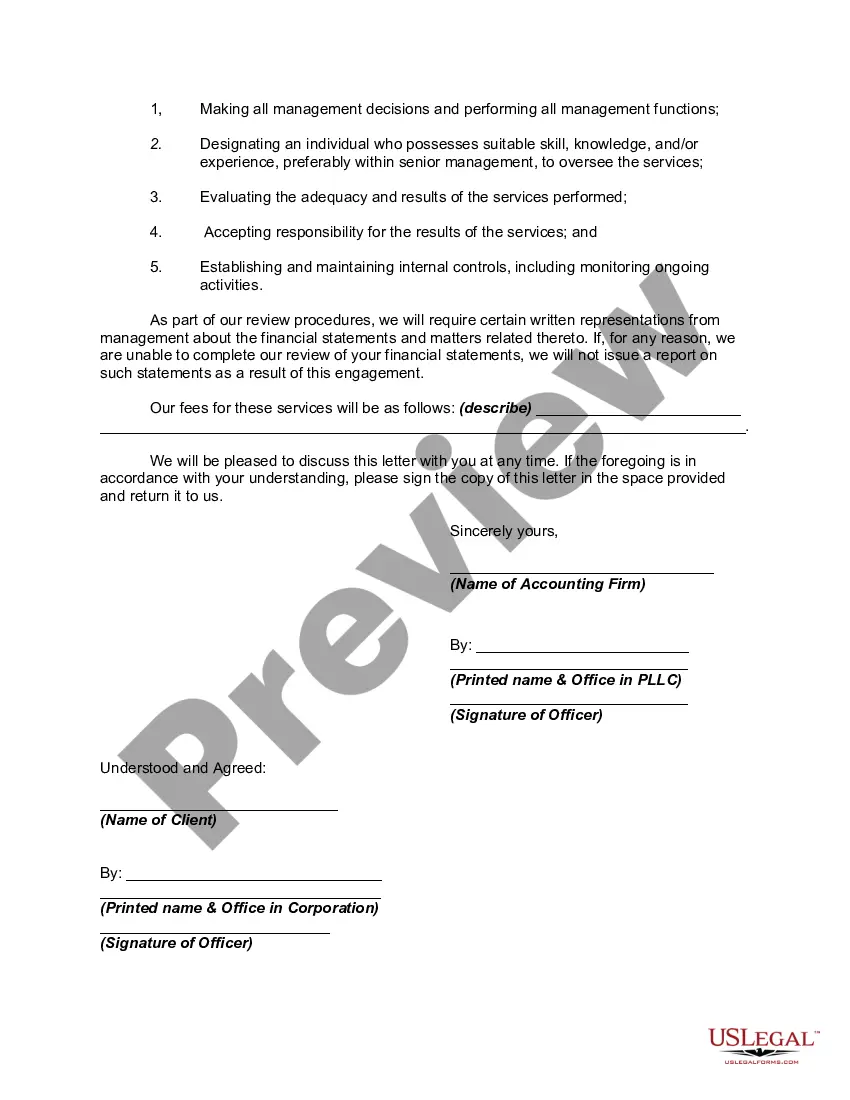

Los Angeles California Engagement Letter for Review of Financial Statements by Accounting Firm: A Comprehensive Guide Introduction: An engagement letter is a legal document drafted by an accounting firm to establish a professional relationship with a client in Los Angeles, California, seeking a review of their financial statements. This letter outlines the terms, conditions, and objectives of the engagement while ensuring mutual understanding between the accounting firm and the client. In Los Angeles, there are various types of engagement letters for different purposes, including review engagements, interim review engagements, and special review engagements. 1. Review Engagements: A review engagement letter in Los Angeles, California, is used when an accounting firm is engaged to perform a review of the financial statements prepared by the client. The purpose of a review engagement is to provide limited assurance that the financial statements are free from material misstatements. The letter specifies the period to be reviewed, the responsibilities of the accounting firm, and the client's management representation. 2. Interim Review Engagements: Interim review engagement letters are utilized when an accounting firm is engaged to review the financial statements of a client during a specific period within the fiscal year. This type of engagement letter in Los Angeles, California, helps ensure that the financial statements prepared for the interim period are reliable, accurate, and in compliance with accounting frameworks and regulatory requirements. 3. Special Review Engagements: Special review engagement letters are often used when a client in Los Angeles, California, requires a review of their financial statements for a specific purpose. These engagements may include reviewing financial statements for merger or acquisition activities, obtaining financing, regulatory compliance, or due diligence purposes. The engagement letter for such engagements explicitly outlines the scope, objectives, and procedures to be conducted by the accounting firm to meet the client's specific needs. Key Elements of a Los Angeles California Engagement Letter for Review of Financial Statements: a. Scope of Work: The letter should define the scope of the review engagement, including the specific financial statements to be reviewed, the accounting frameworks that will be used, and any limitations on the engagement. b. Responsibilities of the Accounting Firm: The letter should identify the responsibilities of the accounting firm, such as performing analytical procedures, making inquiries of management, obtaining management representations, and preparing the review report. c. Responsibilities of the Client: The letter should outline the client's responsibilities, including providing accurate and complete financial records, access to necessary personnel, and timely provision of all relevant information required for the review engagement. d. Assurance Level: The engagement letter should clarify that a review engagement provides limited assurance and does not guarantee the detection of all potential errors or fraud. e. Deadlines and Timing: The letter should specify the deadlines and timing of deliverables, including the expected completion date of the review engagement and the submission of the review report. f. Fees and Billing: The engagement letter should provide details regarding the fees charged by the accounting firm, including the basis of billing (hourly, fixed, etc.), payment terms, and any additional costs or expenses. Conclusion: In Los Angeles, California, engaging an accounting firm to review the financial statements requires a comprehensive engagement letter that clearly defines the scope, responsibilities, and expectations of both parties. Review engagements, interim review engagements, and special review engagements cater to different requirements depending on the client's unique needs. Such engagement letters are crucial to maintain transparency, establish appropriate fees, and ensure efficient and effective communication between the accounting firm and the client.Los Angeles California Engagement Letter for Review of Financial Statements by Accounting Firm: A Comprehensive Guide Introduction: An engagement letter is a legal document drafted by an accounting firm to establish a professional relationship with a client in Los Angeles, California, seeking a review of their financial statements. This letter outlines the terms, conditions, and objectives of the engagement while ensuring mutual understanding between the accounting firm and the client. In Los Angeles, there are various types of engagement letters for different purposes, including review engagements, interim review engagements, and special review engagements. 1. Review Engagements: A review engagement letter in Los Angeles, California, is used when an accounting firm is engaged to perform a review of the financial statements prepared by the client. The purpose of a review engagement is to provide limited assurance that the financial statements are free from material misstatements. The letter specifies the period to be reviewed, the responsibilities of the accounting firm, and the client's management representation. 2. Interim Review Engagements: Interim review engagement letters are utilized when an accounting firm is engaged to review the financial statements of a client during a specific period within the fiscal year. This type of engagement letter in Los Angeles, California, helps ensure that the financial statements prepared for the interim period are reliable, accurate, and in compliance with accounting frameworks and regulatory requirements. 3. Special Review Engagements: Special review engagement letters are often used when a client in Los Angeles, California, requires a review of their financial statements for a specific purpose. These engagements may include reviewing financial statements for merger or acquisition activities, obtaining financing, regulatory compliance, or due diligence purposes. The engagement letter for such engagements explicitly outlines the scope, objectives, and procedures to be conducted by the accounting firm to meet the client's specific needs. Key Elements of a Los Angeles California Engagement Letter for Review of Financial Statements: a. Scope of Work: The letter should define the scope of the review engagement, including the specific financial statements to be reviewed, the accounting frameworks that will be used, and any limitations on the engagement. b. Responsibilities of the Accounting Firm: The letter should identify the responsibilities of the accounting firm, such as performing analytical procedures, making inquiries of management, obtaining management representations, and preparing the review report. c. Responsibilities of the Client: The letter should outline the client's responsibilities, including providing accurate and complete financial records, access to necessary personnel, and timely provision of all relevant information required for the review engagement. d. Assurance Level: The engagement letter should clarify that a review engagement provides limited assurance and does not guarantee the detection of all potential errors or fraud. e. Deadlines and Timing: The letter should specify the deadlines and timing of deliverables, including the expected completion date of the review engagement and the submission of the review report. f. Fees and Billing: The engagement letter should provide details regarding the fees charged by the accounting firm, including the basis of billing (hourly, fixed, etc.), payment terms, and any additional costs or expenses. Conclusion: In Los Angeles, California, engaging an accounting firm to review the financial statements requires a comprehensive engagement letter that clearly defines the scope, responsibilities, and expectations of both parties. Review engagements, interim review engagements, and special review engagements cater to different requirements depending on the client's unique needs. Such engagement letters are crucial to maintain transparency, establish appropriate fees, and ensure efficient and effective communication between the accounting firm and the client.