A limited review of financial statements is an audit restricted to an examination either for a limited period or of a limited part of the records. A review does not contemplate obtaining an understanding of the entity's internal control; assessing fraud risk; tests of accounting records by obtaining sufficient appropriate audit evidence through inspection, observation, confirmation, or the examination of source documents (for example, cancelled checks or bank images); and other procedures ordinarily performed in an audit. Accordingly, a review does not provide assurance that we will become aware of all significant matters that would be disclosed in an audit. Therefore, a review provides only limited assurance that there are no material modifications that should be made to the financial statements in order for the statements to be in conformity with generally accepted accounting principles.

The definition of nonattest services is very inclusive. It includes, for example, preparation of the client's depreciation schedule and preparation of journal entries even if management has approved the journal entries. I have confirmed these examples directly with the AICPA ethics division. The definition of nonattest services includes preparation of tax returns.

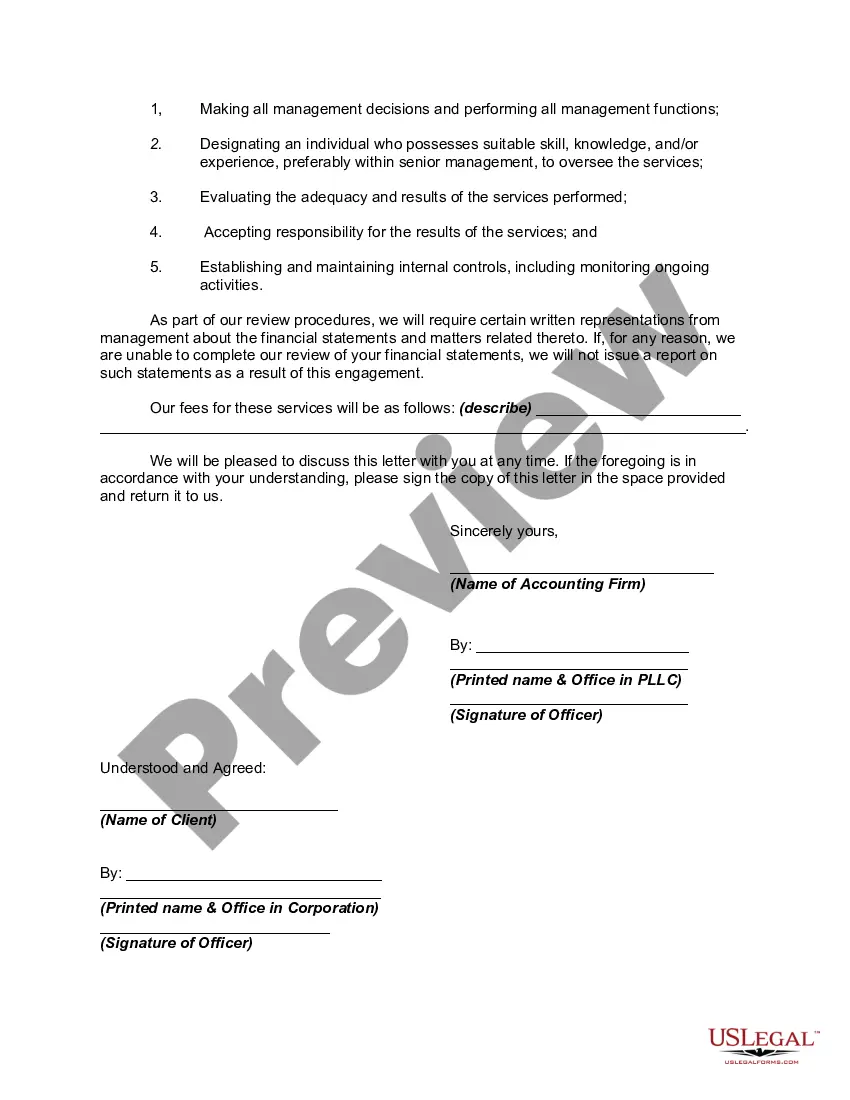

Lima, Arizona Engagement Letter for Review of Financial Statements by an Accounting Firm An engagement letter is a crucial component of any professional agreement between a client and an accounting firm. In the case of a review of financial statements, the engagement letter sets the stage for a comprehensive understanding of the scope, objectives, and responsibilities associated with the review. Lima, Arizona, being a hub of commercial activities, relies on accounting firms to provide accurate and trustworthy financial information to various stakeholders. The Lima, Arizona Engagement Letter for Review of Financial Statements by an Accounting Firm outlines the terms and conditions that will govern the review process. It details the services to be provided, the extent of the review, and the timeframe in which the accounting firm intends to complete its work. The engagement letter is typically prepared by the accounting firm and approved by the client before commencing the review process. The Lima, Arizona Engagement Letter for Review of Financial Statements can be tailored to different scenarios and client needs. There might be variations in the engagement letters depending on the nature of the organization, such as: 1. Lima, Arizona Engagement Letter for Review of Financial Statements for Non-Profit Organizations: This engagement letter is specifically designed for non-profit organizations operating in Lima, Arizona. It may address unique reporting requirements, compliance with regulations specific to non-profits, and considerations regarding fund accounting and transparency. 2. Lima, Arizona Engagement Letter for Review of Financial Statements for Small Businesses: This engagement letter caters to small businesses in Lima, Arizona, which may have distinct financial reporting needs and considerations. It may focus on addressing issues that are typically faced by smaller entities, such as limited resources, the need for streamlined financial reporting, and compliance with local tax regulations. 3. Lima, Arizona Engagement Letter for Review of Financial Statements for Government Entities: This engagement letter caters to government entities, such as municipal organizations, government-funded agencies, or public institutions in Lima, Arizona. It may cover specific requirements related to governmental accounting standards, compliance with budgetary regulations, and adherence to rules set by oversight bodies. Regardless of the type of engagement letter, certain fundamental sections are typically included. These may comprise: a) Objective and Scope: This section outlines the purpose of the review and the extent to which the financial statements will be examined. It clarifies that a review does not provide an assurance as strong as an audit, but rather, it consists of inquiries, analytical procedures, and discussions with management. b) Responsibilities of the Accounting Firm: This section defines the responsibilities of the accounting firm in conducting the review, the level of expertise and independence expected, and adherence to professional standards. c) Responsibilities of the Client: This section highlights the client's obligation to provide access to relevant financial records and internal controls, disclose all necessary information, and ensure the accuracy of the financial statements. d) Deliverables: This section specifies the expected output of the review, which typically includes a review report providing limited assurance on the financial statements. e) Limitations and Disclaimers: This section explicitly outlines the limitations of a review engagement, clarifies that it does not guarantee the detection of all errors or fraud, and disclaims responsibility for misstatements. The Lima, Arizona Engagement Letter for Review of Financial Statements serves as an essential communication tool and a legal agreement between the accounting firm and the client. Its precise content and structure will depend on the specific requirements of the engagement, ensuring a transparent and collaborative relationship throughout the review process.Lima, Arizona Engagement Letter for Review of Financial Statements by an Accounting Firm An engagement letter is a crucial component of any professional agreement between a client and an accounting firm. In the case of a review of financial statements, the engagement letter sets the stage for a comprehensive understanding of the scope, objectives, and responsibilities associated with the review. Lima, Arizona, being a hub of commercial activities, relies on accounting firms to provide accurate and trustworthy financial information to various stakeholders. The Lima, Arizona Engagement Letter for Review of Financial Statements by an Accounting Firm outlines the terms and conditions that will govern the review process. It details the services to be provided, the extent of the review, and the timeframe in which the accounting firm intends to complete its work. The engagement letter is typically prepared by the accounting firm and approved by the client before commencing the review process. The Lima, Arizona Engagement Letter for Review of Financial Statements can be tailored to different scenarios and client needs. There might be variations in the engagement letters depending on the nature of the organization, such as: 1. Lima, Arizona Engagement Letter for Review of Financial Statements for Non-Profit Organizations: This engagement letter is specifically designed for non-profit organizations operating in Lima, Arizona. It may address unique reporting requirements, compliance with regulations specific to non-profits, and considerations regarding fund accounting and transparency. 2. Lima, Arizona Engagement Letter for Review of Financial Statements for Small Businesses: This engagement letter caters to small businesses in Lima, Arizona, which may have distinct financial reporting needs and considerations. It may focus on addressing issues that are typically faced by smaller entities, such as limited resources, the need for streamlined financial reporting, and compliance with local tax regulations. 3. Lima, Arizona Engagement Letter for Review of Financial Statements for Government Entities: This engagement letter caters to government entities, such as municipal organizations, government-funded agencies, or public institutions in Lima, Arizona. It may cover specific requirements related to governmental accounting standards, compliance with budgetary regulations, and adherence to rules set by oversight bodies. Regardless of the type of engagement letter, certain fundamental sections are typically included. These may comprise: a) Objective and Scope: This section outlines the purpose of the review and the extent to which the financial statements will be examined. It clarifies that a review does not provide an assurance as strong as an audit, but rather, it consists of inquiries, analytical procedures, and discussions with management. b) Responsibilities of the Accounting Firm: This section defines the responsibilities of the accounting firm in conducting the review, the level of expertise and independence expected, and adherence to professional standards. c) Responsibilities of the Client: This section highlights the client's obligation to provide access to relevant financial records and internal controls, disclose all necessary information, and ensure the accuracy of the financial statements. d) Deliverables: This section specifies the expected output of the review, which typically includes a review report providing limited assurance on the financial statements. e) Limitations and Disclaimers: This section explicitly outlines the limitations of a review engagement, clarifies that it does not guarantee the detection of all errors or fraud, and disclaims responsibility for misstatements. The Lima, Arizona Engagement Letter for Review of Financial Statements serves as an essential communication tool and a legal agreement between the accounting firm and the client. Its precise content and structure will depend on the specific requirements of the engagement, ensuring a transparent and collaborative relationship throughout the review process.