A limited review of financial statements is an audit restricted to an examination either for a limited period or of a limited part of the records. A review does not contemplate obtaining an understanding of the entity's internal control; assessing fraud risk; tests of accounting records by obtaining sufficient appropriate audit evidence through inspection, observation, confirmation, or the examination of source documents (for example, cancelled checks or bank images); and other procedures ordinarily performed in an audit. Accordingly, a review does not provide assurance that we will become aware of all significant matters that would be disclosed in an audit. Therefore, a review provides only limited assurance that there are no material modifications that should be made to the financial statements in order for the statements to be in conformity with generally accepted accounting principles.

The definition of nonattest services is very inclusive. It includes, for example, preparation of the client's depreciation schedule and preparation of journal entries even if management has approved the journal entries. I have confirmed these examples directly with the AICPA ethics division. The definition of nonattest services includes preparation of tax returns.

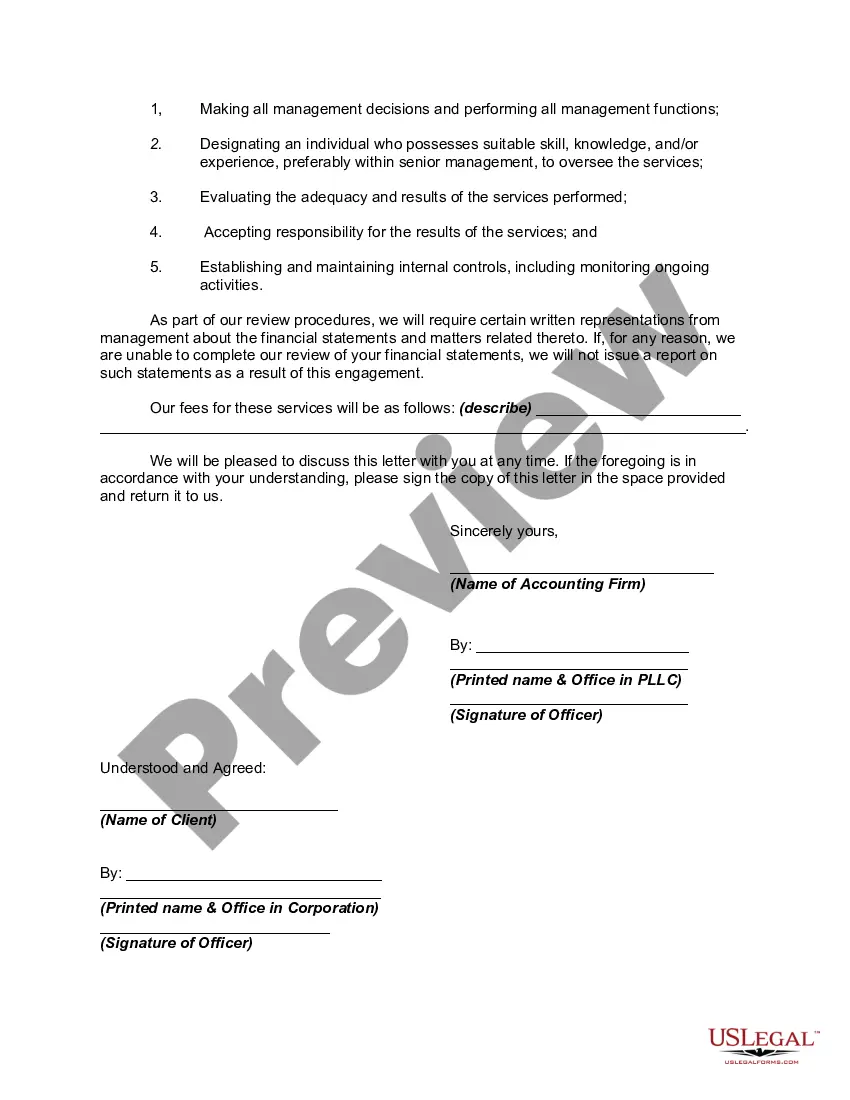

San Diego California Engagement Letter for Review of Financial Statements by Accounting Firm An Engagement Letter for Review of Financial Statements is a crucial document that establishes an agreement between a client and an accounting firm in San Diego, California. This letter outlines the scope of work, responsibilities, and objectives of the financial review process undertaken by the accounting firm on behalf of the client. The San Diego California Engagement Letter for Review of Financial Statements typically includes the following key elements: 1. Introduction: The letter begins with an introduction that outlines the names and addresses of both the client and the accounting firm involved in the engagement. It also specifies the effective date of the engagement. 2. Objective: This section describes the specific objective of the financial statement review. The objective is typically to provide limited assurance that there are no material modifications needed for the financial statements to comply with the applicable accounting standards. 3. Scope of Work: The engagement letter clearly defines the scope of work for the review, including the period covered by the review and any specific financial statements to be reviewed (e.g., balance sheet, income statement, etc.). It also mentions the accounting standards that will be applied during the review process. 4. Responsibilities: The responsibilities section outlines the responsibilities of both the client and the accounting firm. The client is responsible for providing accurate and complete information, maintaining internal controls, and ensuring compliance with relevant laws and regulations. The accounting firm is responsible for performing the review in accordance with applicable professional standards, maintaining professional independence, and expressing an unbiased opinion. 5. Communication: The engagement letter establishes the communication protocol between the client and the accounting firm. It specifies the point of contact for both parties and how information and findings will be communicated throughout the engagement. 6. Fees and Terms of Payment: The engagement letter usually includes details regarding the fees charged by the accounting firm for their services. It outlines the payment terms, due dates, and any additional expenses that may be incurred during the review process. Types of Engagement Letters for Review of Financial Statements by Accounting Firm in San Diego, California: 1. General Engagement Letter for Review of Financial Statements: This type of engagement letter covers the review of financial statements for businesses of various sizes and industries. It is commonly used for privately held companies and nonprofit organizations. 2. Industry-Specific Engagement Letter: San Diego's diverse economic landscape often requires specialized knowledge and considerations in the review of financial statements. Industry-specific engagement letters cater to businesses in sectors such as healthcare, technology, real estate, hospitality, and more. 3. Nonprofit Engagement Letter: Nonprofit organizations require specialized attention due to their unique reporting and compliance requirements. Nonprofit engagement letters address the specific needs and challenges faced by these organizations in ensuring accurate financial reporting. In conclusion, the San Diego California Engagement Letter for Review of Financial Statements by an Accounting Firm is a comprehensive document that establishes the framework for the financial review process. It outlines the responsibilities, scope, objectives, and communication protocols between the client and the accounting firm. Various types of engagement letters exist to cater to the diverse needs of businesses, including general, industry-specific, and nonprofit engagement letters.San Diego California Engagement Letter for Review of Financial Statements by Accounting Firm An Engagement Letter for Review of Financial Statements is a crucial document that establishes an agreement between a client and an accounting firm in San Diego, California. This letter outlines the scope of work, responsibilities, and objectives of the financial review process undertaken by the accounting firm on behalf of the client. The San Diego California Engagement Letter for Review of Financial Statements typically includes the following key elements: 1. Introduction: The letter begins with an introduction that outlines the names and addresses of both the client and the accounting firm involved in the engagement. It also specifies the effective date of the engagement. 2. Objective: This section describes the specific objective of the financial statement review. The objective is typically to provide limited assurance that there are no material modifications needed for the financial statements to comply with the applicable accounting standards. 3. Scope of Work: The engagement letter clearly defines the scope of work for the review, including the period covered by the review and any specific financial statements to be reviewed (e.g., balance sheet, income statement, etc.). It also mentions the accounting standards that will be applied during the review process. 4. Responsibilities: The responsibilities section outlines the responsibilities of both the client and the accounting firm. The client is responsible for providing accurate and complete information, maintaining internal controls, and ensuring compliance with relevant laws and regulations. The accounting firm is responsible for performing the review in accordance with applicable professional standards, maintaining professional independence, and expressing an unbiased opinion. 5. Communication: The engagement letter establishes the communication protocol between the client and the accounting firm. It specifies the point of contact for both parties and how information and findings will be communicated throughout the engagement. 6. Fees and Terms of Payment: The engagement letter usually includes details regarding the fees charged by the accounting firm for their services. It outlines the payment terms, due dates, and any additional expenses that may be incurred during the review process. Types of Engagement Letters for Review of Financial Statements by Accounting Firm in San Diego, California: 1. General Engagement Letter for Review of Financial Statements: This type of engagement letter covers the review of financial statements for businesses of various sizes and industries. It is commonly used for privately held companies and nonprofit organizations. 2. Industry-Specific Engagement Letter: San Diego's diverse economic landscape often requires specialized knowledge and considerations in the review of financial statements. Industry-specific engagement letters cater to businesses in sectors such as healthcare, technology, real estate, hospitality, and more. 3. Nonprofit Engagement Letter: Nonprofit organizations require specialized attention due to their unique reporting and compliance requirements. Nonprofit engagement letters address the specific needs and challenges faced by these organizations in ensuring accurate financial reporting. In conclusion, the San Diego California Engagement Letter for Review of Financial Statements by an Accounting Firm is a comprehensive document that establishes the framework for the financial review process. It outlines the responsibilities, scope, objectives, and communication protocols between the client and the accounting firm. Various types of engagement letters exist to cater to the diverse needs of businesses, including general, industry-specific, and nonprofit engagement letters.